Commentary

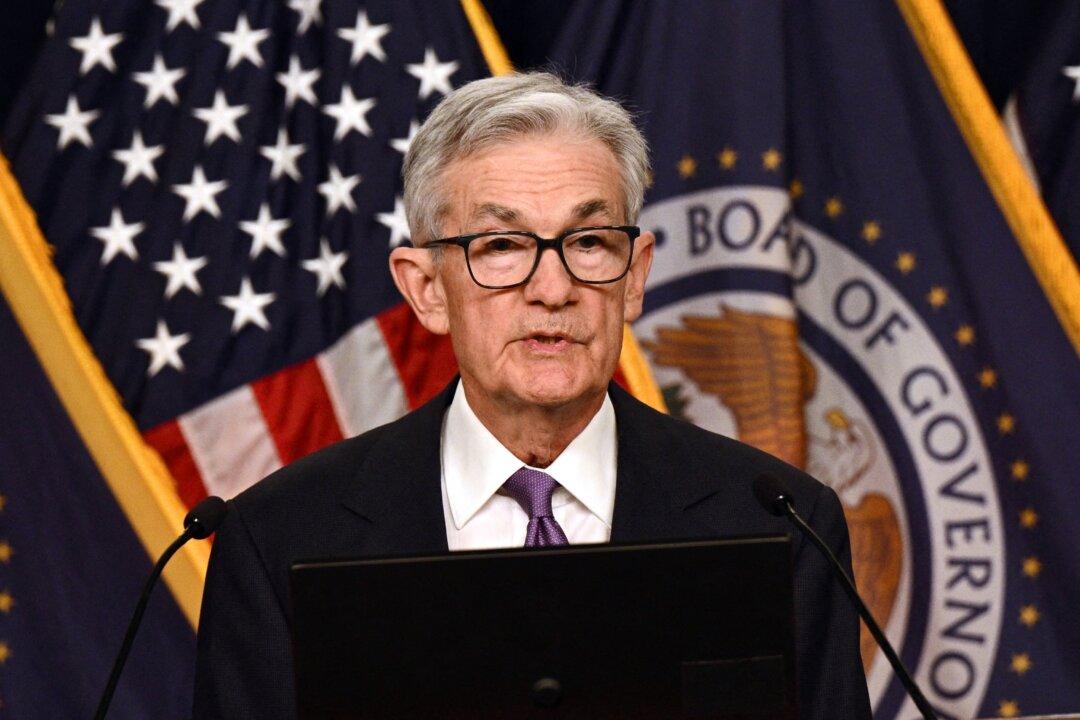

As the Federal Open Market Committee (FOMC) met last week for the first time in 2024, they weighed all the economic data and decided to make it clear they would most likely not cut interest rates in March.

As the Federal Open Market Committee (FOMC) met last week for the first time in 2024, they weighed all the economic data and decided to make it clear they would most likely not cut interest rates in March.