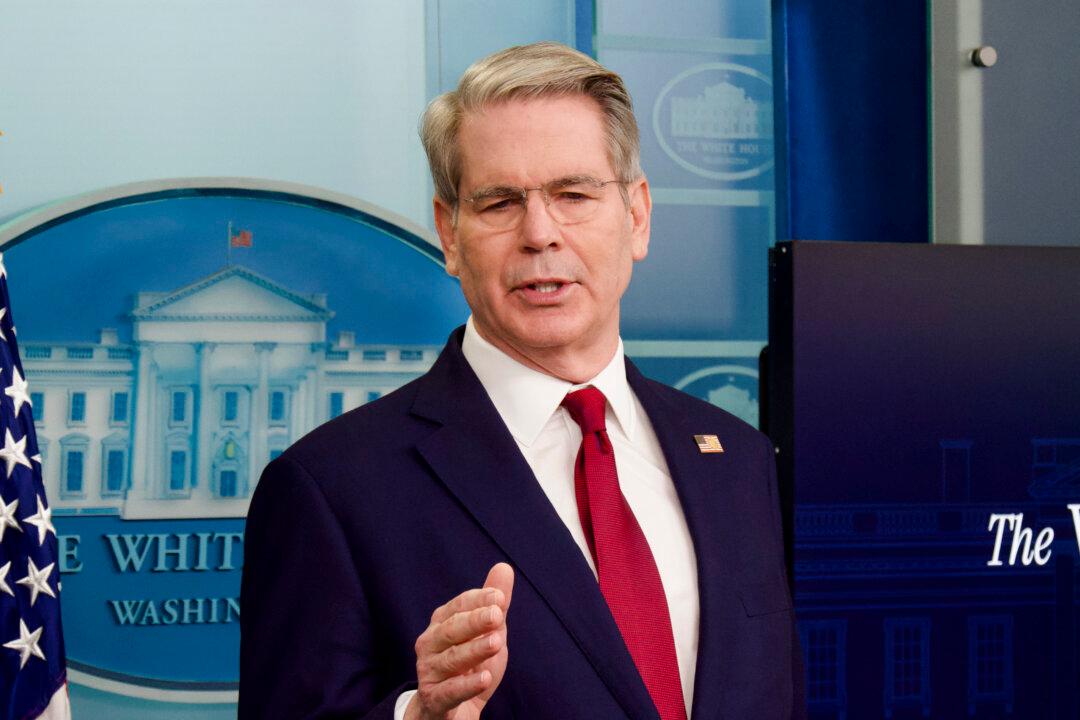

The federal government is likely to exceed its statutory debt limit in August, when Congress is slated for a recess, according to Treasury Secretary Scott Bessent.

The timing of the so-called X date is likely to place added pressure on Congress to pass a much-anticipated sweeping policy bill within the next few weeks, which is expected to provide an increase in the borrowing limit and advance key parts of President Donald Trump’s agenda, including tax cut, border, and energy measures.