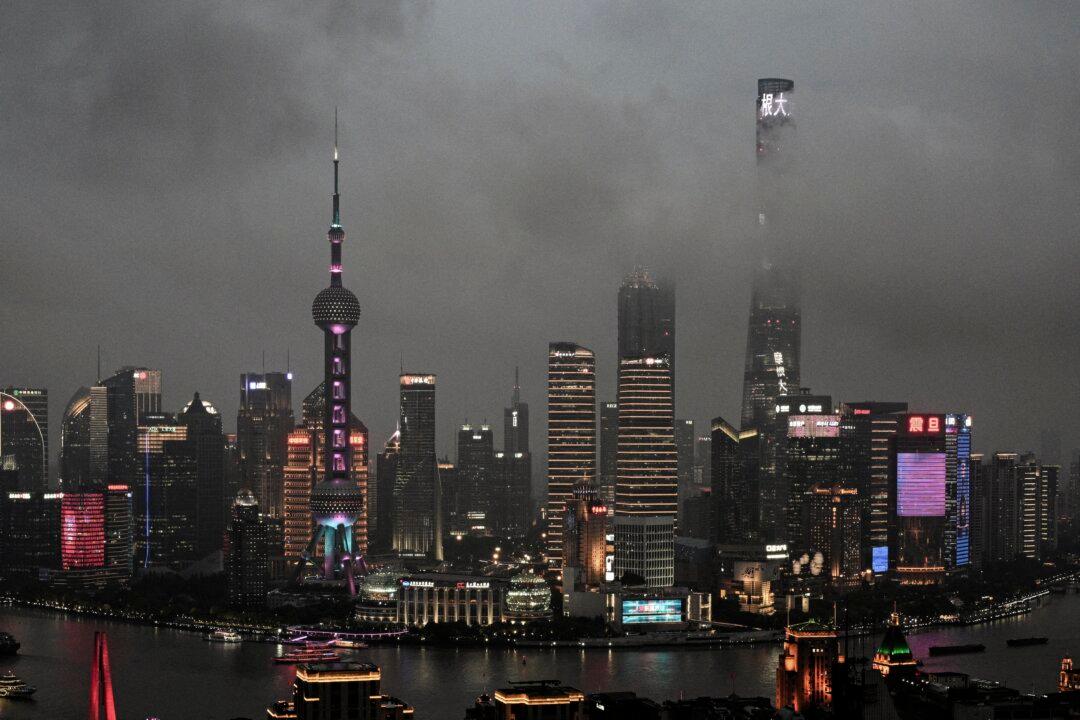

Four in 10 European companies operating in China want to move their production out of the world’s No. 2 economy because of supply chain concerns, according to a recent survey from the European Central Bank (ECB).

Forty-two percent of European companies want to relocate to politically closer countries, or “friend-shoring,” in the next five years, according to the survey, which was published on Nov. 6. Friend-shoring involves relocating production to politically or economically favored countries to minimize geopolitical risk.