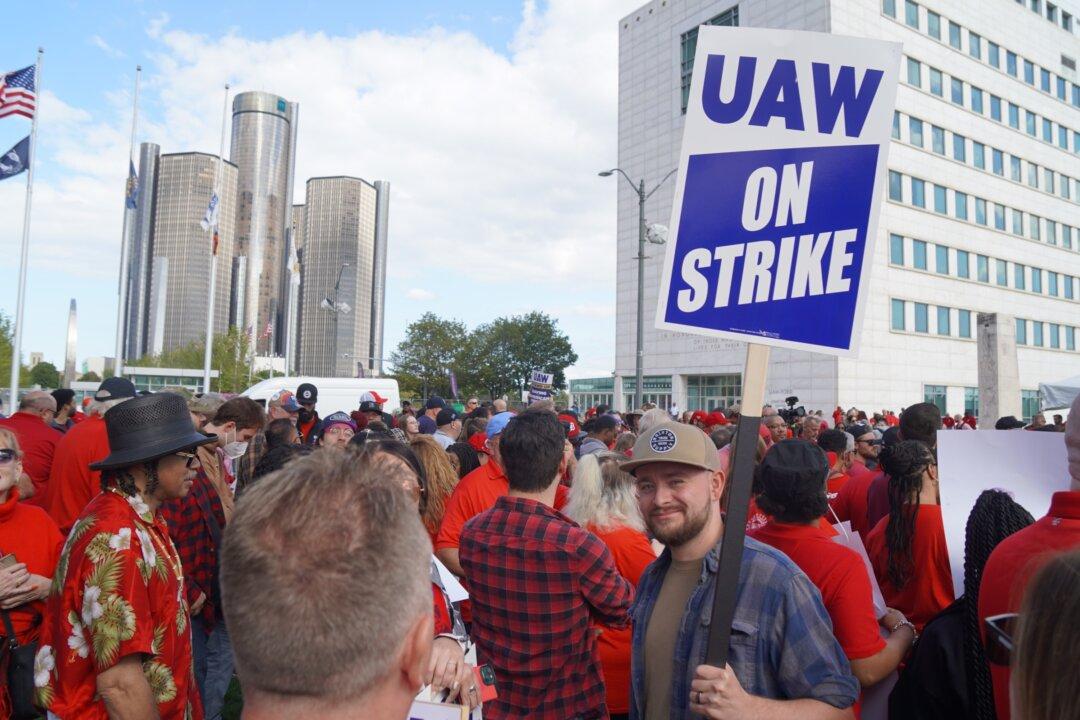

General Motors said it has lost $800 million in operating profits since the United Auto Workers (UAW) union strike began some 40 days ago, leading the automaker to withdraw its full-year earnings guidance and say it’s being forced to slow down its electric vehicle strategy.

GM Chief Financial Officer Paul Jacobson revealed the financial hit on a call with reporters on Oct. 24, adding that the company estimates it will keep losing roughly $200 million a week if the strike continues in its current scope.