The European Commission has this week, under EU state aid rules, approved the restructuring plan of Bank of Ireland (BOI), following the banks state recapitalisation last year.

In a statement released from Brussels late last week, the European Commission said that it is satisfied that the plan is in line with its communication on the restructuring of banks during the economic crisis.

The Commission was pleased to see that BOI will pay a “significant proportion of the restructuring costs”, and that in doing so the bank will limit any distortion to competition. It was the Commissions opinion that the proposed plan would also “ensure a sustainable future for the bank without continued state support.”

Commission Vice President in charge of Competition Policy Joaquin Almunia said: “I am confident that this plan will ensure a stable future for Bank of Ireland and contribute to financial stability in Ireland without unduly distorting competition. The good collaboration with the Irish authorities and the bank allowed us to achieve measures that will further open the banking market and facilitate entry and growth of market challengers.”

The recapitalisation of Bank of Ireland in March 2009 was only temporarily approved by the Commission as emergency aid pending the submission of a restructuring plan, which has now been approved.

Some of the measures outlined in BOI’s restructuring plan relate to a reduction of BOI’s presence in certain market segments through transfer or winding down of assets. The bank will significantly reduce its presence in the UK corporate lending market. In Ireland, it will sell its New Ireland Assurance Company plc, its mortgage brokering business ICS Building Society and the banks stake in the Irish Credit Bureau. Job cuts of up to 750 are also expected.

Job Losses

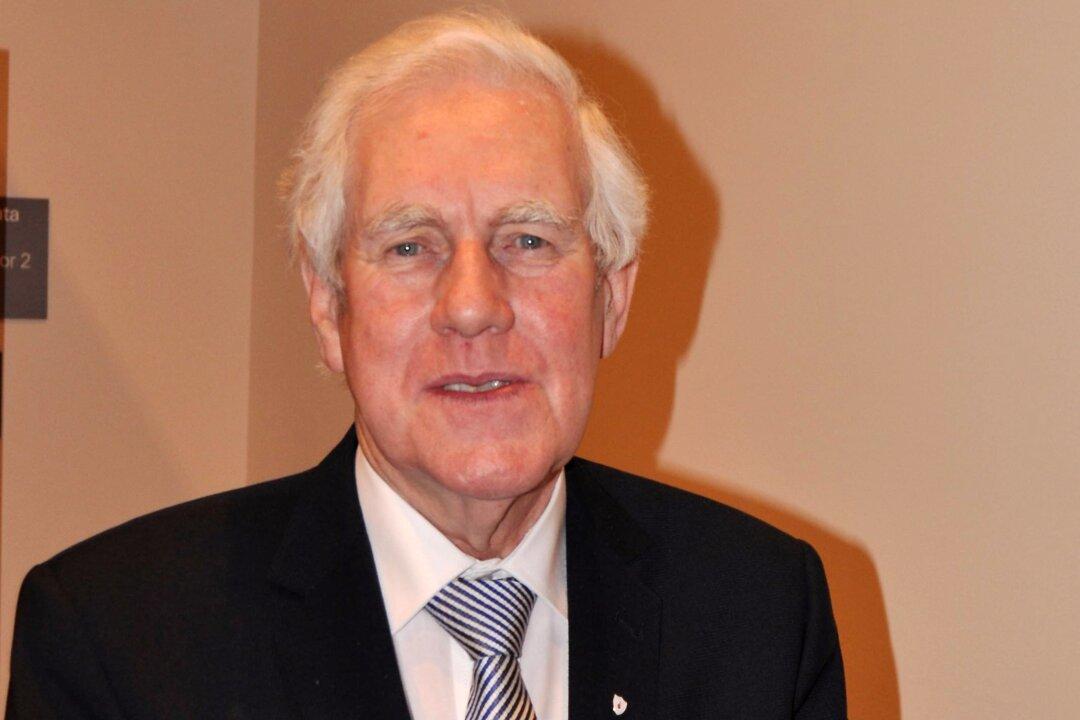

Irish Bank Officials’ Association (IBOA) General Secretary, Larry Broderick, said that despite the fact that the EU Commission has endorsed the BOI’s restructuring plan, many have overlooked the fact that BOI’s program makes provision for up to 750 additional job losses over a two-year period.

“Against this disturbing backdrop, it is timely that the independent mediator, Mr Mark Connaughton SC, has recommended that any job reductions in Bank of Ireland should be implemented on a voluntary basis and in line with existing agreements between IBOA and the bank on terms for voluntary severance,” said the IBOA General Secretary, who also added that staff in BOI were paying a high price for the mismanagement of the Bank.

“While the prospects for Bank of Ireland look better now than they have for some time, this will be a false dawn unless there is a restoration of traditional banking values such as prudence and integrity - which underpins an approach to customers which places a premium on consistent service rather than short-term profit,” concluded Mr Broderick.

The IBOA’s Bank of Ireland Executive Committee will meet next week to review the EU Commission report together with the mediator’s recommendation - in preparation for further engagement with the Bank’s senior management.

A statement from BOI acknowledged contact with IBOA: “Following extensive discussions between the Bank and the IBOA, we welcome the proposals regarding pay and job security that have been recommended by Senior Counsel, Mark Connaughton.”

Recommendations relating to BOI staff

“The existing pay restraints are to continue with reviews to take place in April and December 2011. As the Bank achieves its objectives to continue to become more focussed and efficient, regrettably, this will mean a reduction of 750 in the overall number of people employed.”

“The Bank anticipates that the reduction can be achieved over a period of two years in areas affected by business change across the Group in the Republic of Ireland, Northern Ireland and Great Britain.”

“Reductions in the number of people employed will be on a voluntary basis, and Bank of Ireland is strongly committed to engagement and consultation with staff and their representatives throughout the process.”