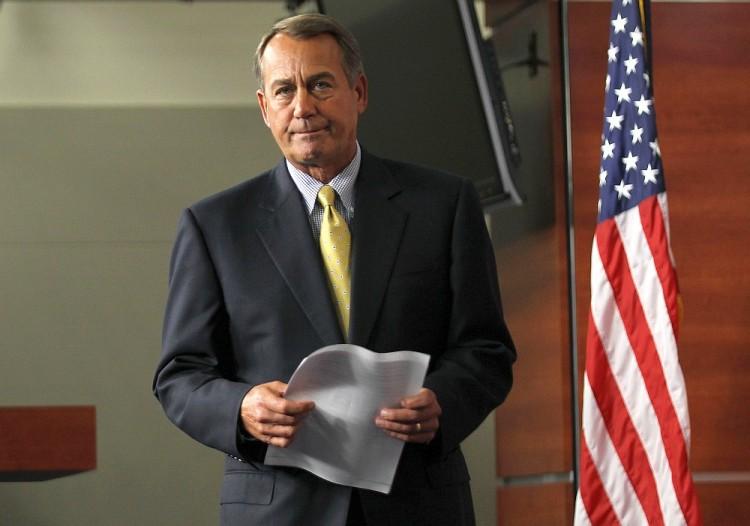

Boehner Offers Two-Stage Solution After Debt Talks Collapse

Boehner seemed increasingly pessimistic that President Barack Obama’s dream of a “grand bargain” deal could be achieved and passed by both houses of Congress.

U.S. Speaker of the House Rep. John Boehner (R-OH). (Alex Wong/Getty Images))

|Updated: