For those not familiar with blockchain technology, bitcoin is just bits and bytes being traded for real dollars. However, a new development will make the most popular cryptocurrency more and more mainstream.

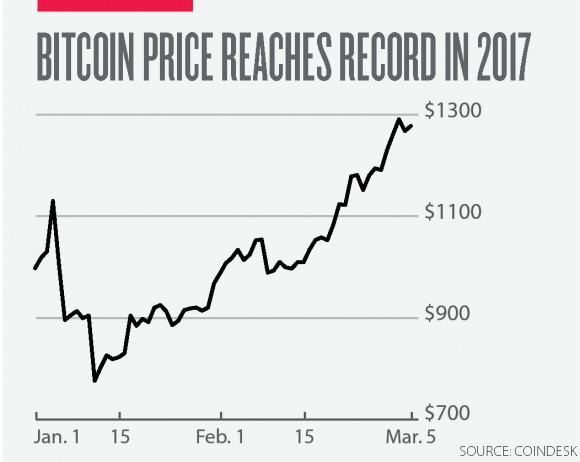

The cryptocurrency is up more than 30 percent since the beginning of the year.