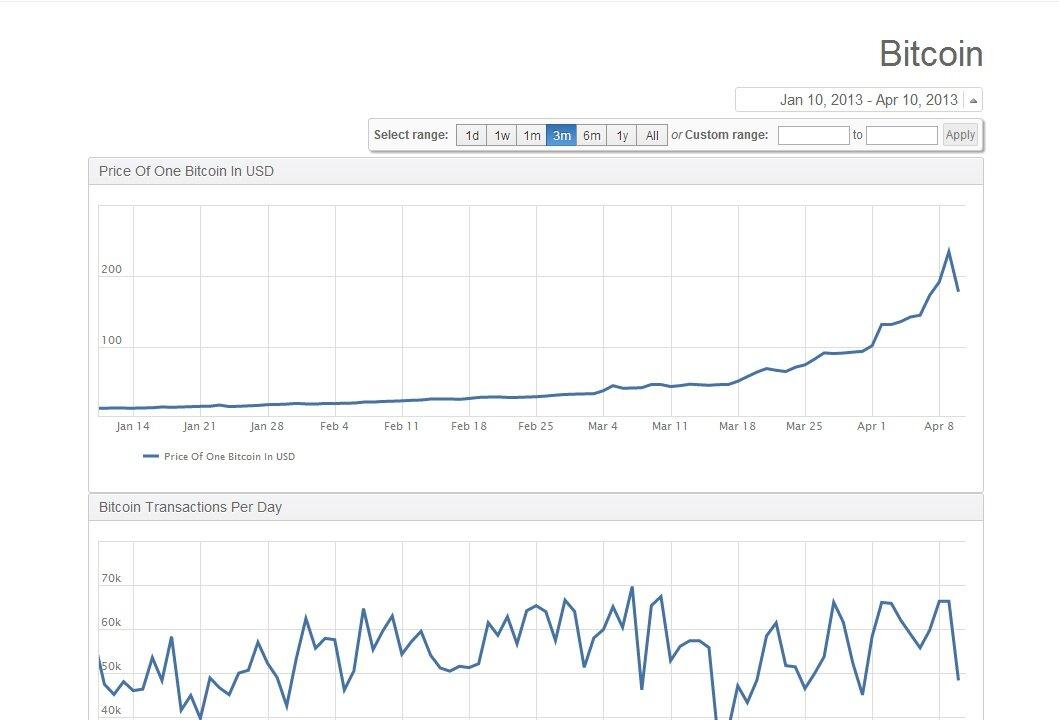

As virtual currency Bitcoin briefly spiked above $250 on Wednesday, up seven-fold since the beginning of March, questions arise. How does it work, is it a bubble and could it replace fiat money in the future?

The Bitcoin virtual currency is both simple and complex at the same time. Launched in 2009 by a programmer using the pseudonym Satoshi Nakamoto, a Bitcoin is basically money, a medium of exchange.

Unlike bank deposits, however, which are also electronic, it does not depend on a counterparty, e.g. a bank. It is the equivalent of a paper dollar bill in electronic form, freely transferable for goods and services and exchangeable for other currencies.

The tricky part is how Bitcoin (essentially a piece of encrypted data) achieves to become this kind of electronic money. The initial programmers only included a few fixed rules: The total number of Bitcoins will reach an absolutely limited number of 21 million by 2140. The current supply stands at 11 million, which are worth around $2 billion, and the schedule of new issuance was also fixed over time.

The programmers set up the system so it would self-regulate in a decentralized way. At this moment, 25 Bitcoins are created automatically by the peer-to-peer system every ten minutes. It is how these Bitcoins are distributed that creates the automatically self-regulating system.

Mining Both Produces and Regulates Bitcoins

In order to verify that a Bitcoin was transferred correctly from one electronic wallet to another and has not been spent twice, extensive computer calculations are needed. Special servers and their users, called “miners,” carry out this verification work and receive Bitcoins in exchange.

Any computer with open-source software installed can connect to the Bitcoin network making the system decentralized. It merely has to follow the calculation specifications set by the original programmers. As transactions are posted, miners start the verification process.

The output is a complete transaction log called “blockchain” which follows a chronological order. For processing ten minutes worth of transactions, the miners who carried out the proof-work will get the 25 Bitcoins.

In practice, many miners have pooled their servers together to save costs, as single computers often have to wait a long time before they can verify a block of transactions, which consumes too much electricity.

The more common way of obtaining Bitcoins, however, is by exchanging it for dollars, euros or yen on one of the different Bitcoin exchanges, such as Mt. Gox. It can then be spent with different merchants or can be used for private party transactions. According to American Banker, more than 1,000 merchants signed up to accept Bitcoins as payment in 2012 alone.

Transactions Not Anonymous

Contrary to popular opinion, however, Bitcoin transactions are not anonymous. In fact, every transaction is posted on the public ledger. This is necessary, so the servers can carry out the verification work. If the users IP address is known, law enforcement agencies can verify identities through the Internet Service Provider (ISP).

“When they claim that Bitcoins are anonymous or untraceable, in fact the opposite is true,” Jeff Garzick, founder of Bitcoin Watch told CBS.

On the flip-side, customers’ names will be protected until a prosecutor requests the ISP to connect an IP address to an identity. This guarantees a fair amount of privacy, as normal users will only see the IP address on the public ledger.

Is it a Bubble?

Bitcoin started its parabolic rise just as depositors in Cyprus found out in March that parts of their deposits would be confiscated to fund a bank bailout. Bitcoin seems to provide a solution to this dilemma by providing a currency that is transferable electronically, but doesn’t depend on a bank or any other institution.

Like gold and cash, the bearer can exchange it for goods and services with whoever is willing to accept it as a form of payment, meaning that no bank is necessary.

However, Patrick Korda writes on Mises.org that this is also its biggest weakness: “[Austrian school Economist] Carl Menger made the point that money, a general medium of exchange, has always tended to be the most ’saleable' (i.e., ‘marketable’ or ‘liquid’) commodity of the time.”

According to him, a lot has to change for Bitcoin to be the most salable good: “Until the majority of the 7 billion or so people that inhabit this planet have either a smart phone or frequent access to the internet, a digital currency is out of the question.”

Since Bitcoin is inherently dependent on technology, it cannot—at least not for the foreseeable future—replace cash and gold, which are accepted worldwide, irrespective of a connection to the Internet. Taking a $100 bill or an ounce of gold to New York City as well as sub-Saharan Africa requires no power, no internet and yet both can be exchanged for goods and services.

In addition, Bitcoin is a very illiquid market, trading only $7 million on average per day during the last month. Until the world is ready to completely let go of fiat currencies and gold, or if the technology is widely available, there will necessarily be corrections, such as the 93 percent drop the currency suffered in late 2011 or the 60 percent intra-day drop suffered April 10.

It is very likely that the recent situation in Cyprus and the subsequent media hype pushed a lot of buyers into the market, merely following the trend. “There is … a reflexive pattern of people buying because prices are rising, and prices rising because people are buying. The myopic are extrapolating the price trend of the past four months, which they deem is normal, and in so doing they exacerbate it to the upside, thus attracting even greater fools,” Patrick Korda writes.

This does not mean, however, that the Bitcoin phenomenon cannot grow as an alternative to bank deposits and fiat cash. Its unique attributes of being 100 percent electronic, independent from banks and central banks, reasonably private, limited in supply as well as decentralized will support its growth in technologically developed economies.