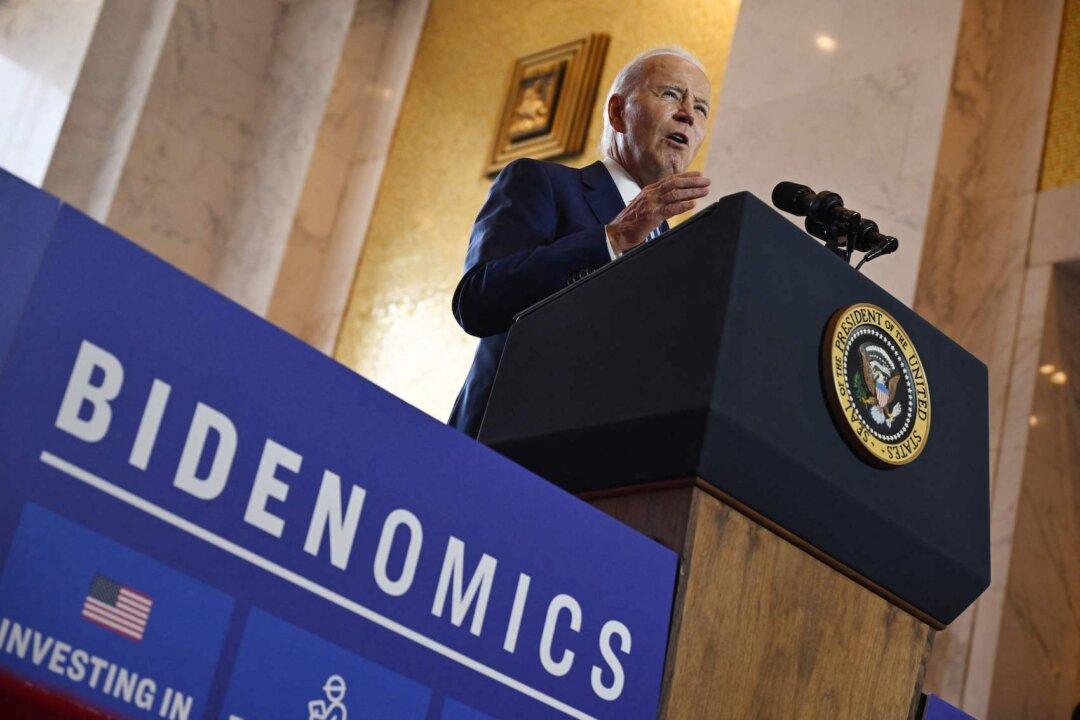

Following the Supreme Court’s recent ruling to block the current administration’s student loan forgiveness proposal, President Joe Biden announced that his administration would pursue different avenues to offer relief to millions of borrowers.

“I’m not going to stop fighting to deliver borrowers what they need, particularly those at the bottom end of the economic scale,” Mr. Biden said in a White House address on June 30. “So, we need to find a new way. And we’re moving as fast as we can.”