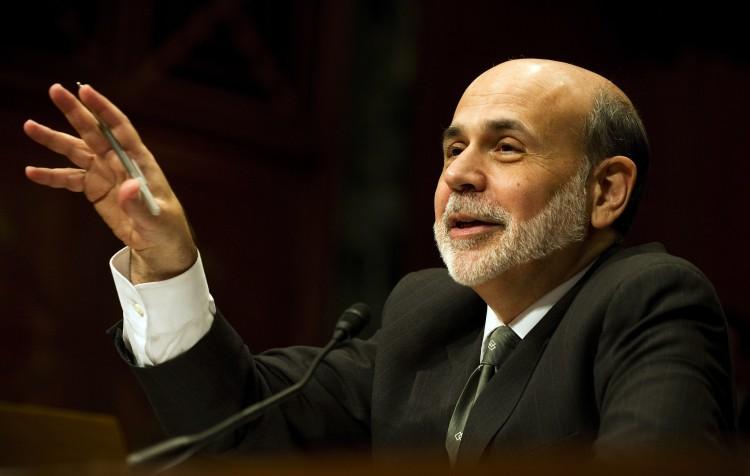

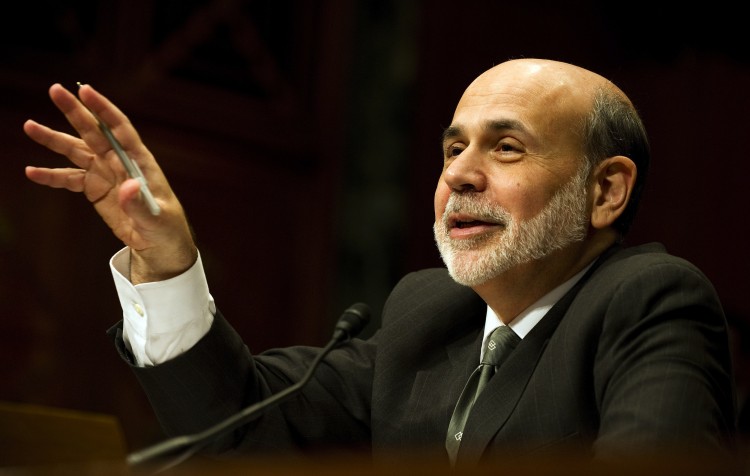

Federal Reserve Chairman Ben Bernanke says the U.S. economy is slowly improving but a roadmap for long-term sustainable growth is critical.

Appearing before the Senate Budget Committee in Washington, D.C., Feb. 7, Bernanke told legislators that a reduction in unemployment, lower inflation, and increased productivity in the last quarter were all positive signs for the U.S. economy.

There remained however, long-term concerns that could make those gains short-lived unless fundamental structural reform was addressed.

“To achieve economic and financial stability, U.S. fiscal policy must be placed on a sustainable path that ensures that debt relative to national income is at least stable or, preferably, declining over time,” Bernanke told the committee. “Attaining this goal should be a top priority.”

U.S. employment figures rose in January bringing the unemployment rate down for the fifth straight month to 8.3 percent, and adding 243,000 jobs, according to the U.S. Bureau of Labor Statistics. In a sign of a more resilient economy, jobs have also grown across a range of industries including professional and business services, the leisure industry, as well as manufacturing.

Bernanke said manufacturing had led the recovery, helped by foreign demand for U.S. goods, and high-value technology industries.

Unemployment rates, however, remain high, with just under 13 million unemployed. With long-term unemployed at record levels, around 40 percent, and the housing market continuing its slump, the chairman warned that the economy was still fragile.

Low Interest Rates Remain

Bernanke confirmed that interest rates would remain at an “exceptionally low rate,” presently zero to 0.25 percent, until at least late 2014.

Republican legislators have raised concerns that low interest rates would increase inflation, as has Jeffrey Lacker, the only member of the Reserve’s Federal Open Market Committee (FOMC) to vote against the resolution.

Lacker said in a speech Feb. 8, 2011, that he expected the economy to expand by 4 percent next year and 2014 may be too long to hold rates that low.

Sen. Pat Toomey (R-Penn.) told Bernanke at the hearing that he was concerned low interest rates were eroding savings.

Bernanke, however, remained firm on the rates. In addressing Toomey’s concerns he said the Reserve was aware of the risks, but research had indicated that people had spread their savings across a number of investments, and so were not as harshly affected by low interest rates as assumed.

He also noted that inflation had been relatively low throughout his term as chairman and expected that trend would continue. “Our projections are that inflation will be very subdued—probably below our 2 percent target in 2012 and 2013.”

He particularly warned against moving too hastily in the current economic climate.

“We are wanting people to move away from saving,” he said and move to “slightly riskier investments. We don’t want to scare them off.”

Sen. Pete Sessions (R-Ala.), the highest-ranking Republican on the committee, suggested that the deficit was holding back growth in the U.S. economy and discouraging investors.

Bernanke replied, “They’re not reacting to the current level of debt. What they’re attentive to is the process,” and pointed to the political dysfunction in Congress last year that led to Standard & Poor’s downgrading of the U.S. credit rating.

Deficit reduction was a major problem, however, he said, noting that even with an improved economy and near full employment, the debt to GDP ratio would still be too high to buffer against either the known or extraneous events in the future.

He cited an aging population and increasing health care costs as predictable, but also referred to unpredictable events like the European financial crisis that could cause an impact.

Reforms to the tax code and cutting spending were areas that needed to be addressed, he said and noted that, while sharp changes in fiscal policies in a short period of time should be avoided, it was imperative to develop an action plan.

“What we want to do is have a credible, strong plan so that the economy doesn’t hit a huge pothole,” he said, adding that plan should be done “as soon as possible.”