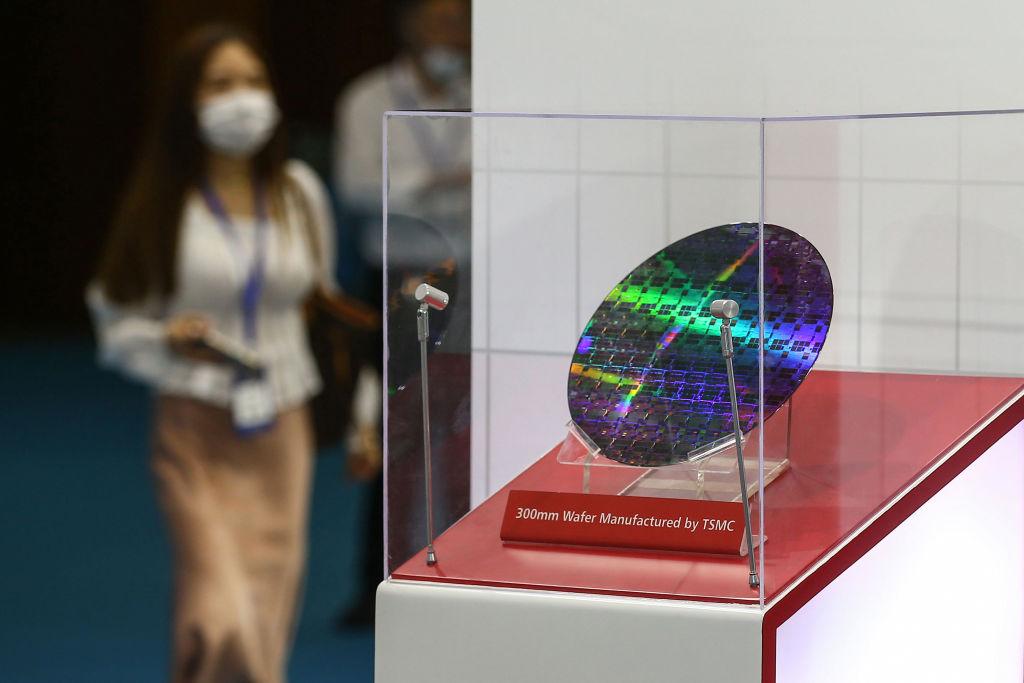

The Chinese regime’s semiconductor ambitions will fall short of its policy goal, according to a newly-released analysis by U.S. market research company IC Insights.

The market researcher forecasted that China won’t be able to meet its goals of domestically producing 70 percent of its semiconductor needs by 2025, an objective under Beijing’s industrial policy of “Made in China 2025.”