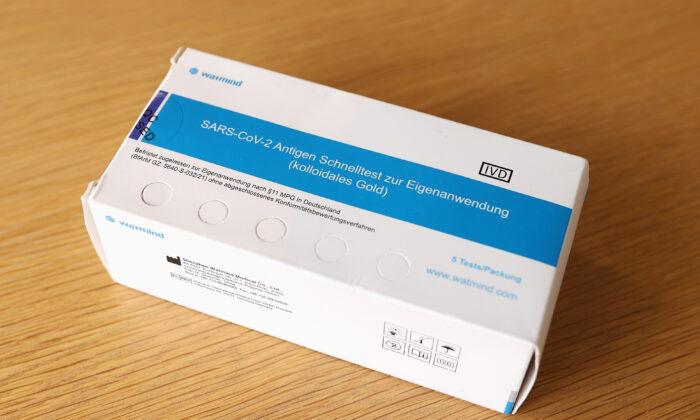

The Australian Tax Office (ATO) has confirmed that Australian taxpayers could claim a reduction for COVID-19 test expenses incurred for work-related purposes.

As individuals and businesses are preparing tax documents for the end of the financial year, the ATO is expected to see the impacts of COVID-19 on tax returns.

From July 1, people can claim the cost of COVID-19 tests as a tax deduction if they buy them due to work requirements.

While they must retain a record, ATO allows taxpayers to use a bank or credit card statement alongside employers’ documentation as evidence that they paid for the expense.

However, the tax office said workers could not claim a deduction for COVID-19 tests provided or reimbursed by their employers.

At the same time, the ATO said only tests purchased for work-related purposes were deductible.

“If you purchased a COVID-19 test for a trip with your mates, you can’t claim a deduction,” Loh said.

In addition, the tax authority permits taxpayers to claim deductions for any spending on protective items that prevent illness or injury from occurring while at work.

“If you’re spending your working day in close proximity to customers and at risk of contracting COVID-19, you may be able to claim a deduction for protective items such as gloves, face masks, or sanitiser.”

It is noteworthy that federal COVID-19 disaster payments are exempt from tax and thus do not need to be included in tax returns.

However, JobSeeker and Pandemic Leave Disaster payments are classified as taxable income and must be declared.

The ATO also noted that the Pandemic Leave Disaster Payment would not be prefilled into the tax lodgement system. Therefore, taxpayers must manually calculate the total amount and include it in their tax returns.

“While the information isn’t prefilled for you, not adding Pandemic Leave Disaster Payments to your tax return will delay the processing of your return and your potential refund,” said Loh.