After the dust settles and the data comes in, it’s always easier to explain why markets do what they do.

One year ago, U.S. markets tanked because China surprised everyone with a mini-devaluation of its currency and a clear indication it will further liberalize foreign exchange markets.

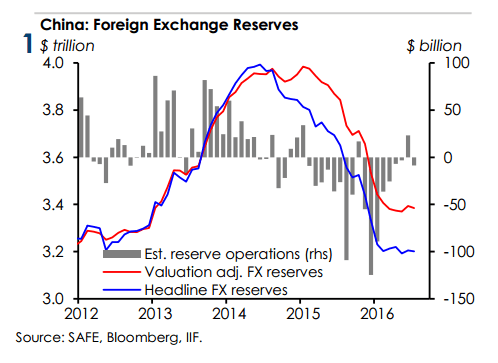

This led to massive private sector capital outflows, and the People’s Bank of China (PBOC) had to sell foreign exchange reserves to keep the exchange rate stable.

Much later we learned that China’s central bank had not only sold U.S. government bonds but also $126 billion in U.S. stocks over the period from July 2015 to the end of March 2016, contributing to short-term corrections in the fall of 2015 and the spring of 2016.

Capital outflows from China haven’t stopped, as the Institute of International Finance (IIF) estimates that $227 billion has left China in the first half of 2016.