Ever wonder how online retailer Amazon can compete with everybody on price? It’s not just about economies of scale.

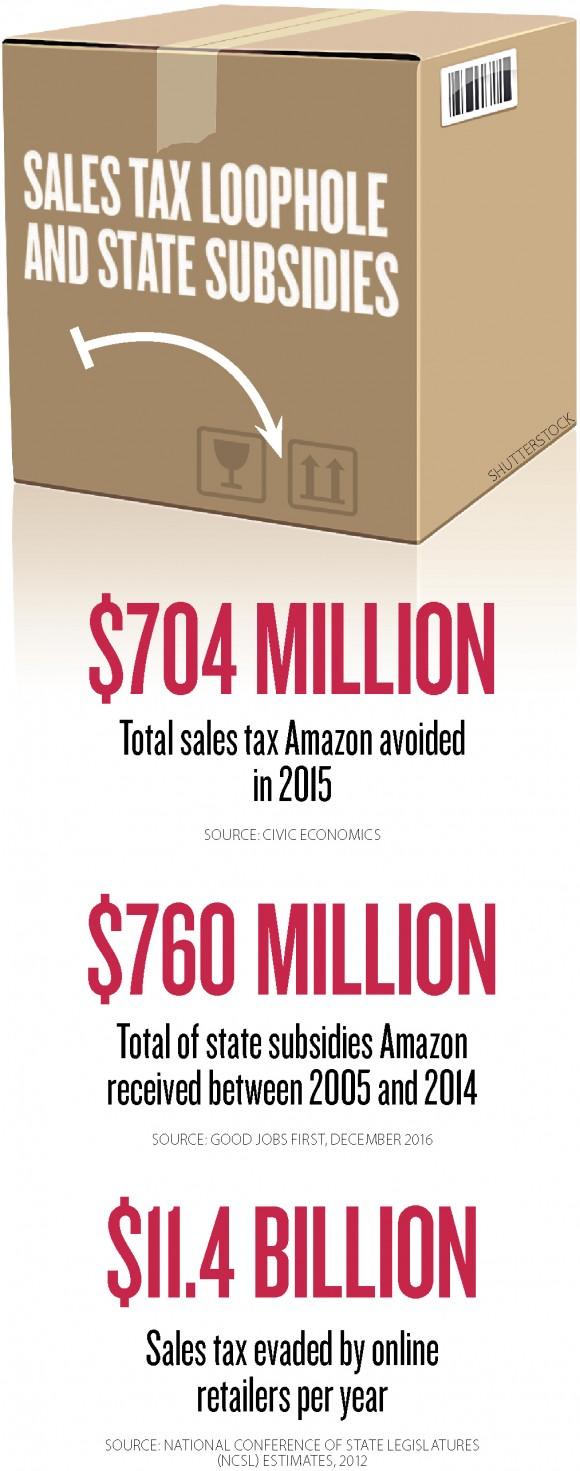

For many years, Amazon enjoyed a competitive advantage by avoiding the collection of sales tax in many U.S. states. The company became the world’s largest online retailer thanks partially to its sales tax strategy and to subsidies from states.

As recently as 2011, Amazon was only collecting sales tax in five states, said Carl Davis, research director at the Institute on Taxation and Economic Policy (ITEP), a nonprofit research organization focused on tax policy.

This is one of the ways by which the giant online retailer has kept its prices low compared to brick-and-mortar retailers such as Wal-Mart and Best Buy.

Online retailers can legitimately avoid collecting sales tax if they avoid building a facility in a state. Combined local and state sales tax rates range between 5 percent and 10 percent, depending on the state.