The Organization of the Petroleum Exporting Countries (OPEC) reached a much-anticipated deal to curb oil supply. However, the cartel’s attempt to boost the price of oil may be challenged by weak global demand, rising U.S. shale production, and President-elect Donald Trump’s energy policies.

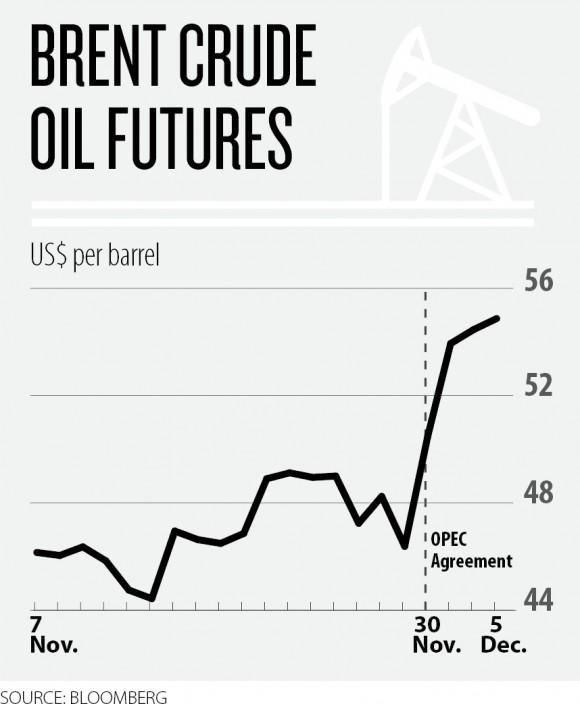

OPEC agreed to cut production for the first time since 2008. Oil price has jumped more than 15 percent in the days following the announcement of the deal on Nov. 30. The S&P 500 energy index gained 6 percent.

“I think there is a short-term effect we’re already seeing in the market, but it does not imply a long-term price recovery,” said Hillard Huntington, executive director at Stanford University’s Energy Modeling Forum.

“I don’t think oil prices will come back up strongly until we start seeing some increased demand for oil—a much stronger world economy than we have now.”

After months of negotiation, OPEC agreed to cut the production by 3.5 percent, to 32.5 million barrels a day. The production cut will start in January next year and last for six months.

US Response

While it is not clear whether OPEC members will comply with the agreement, U.S. shale companies may respond to the cut. If there is a sustained increase in prices, U.S. companies may ramp up oil production, which would, in turn, push down the prices again.

The U.S. response, however, will not be as fast as most people predict, according to Phil Flynn, senior market analyst at Price Futures Group in Chicago.

“This production cut will give a boost to shale, but it will take at least a year for the U.S. oil production to get back to where it was a year ago,” Flynn wrote in a report.

U.S. oil production stands at 8.7 million barrels a day—still almost a million barrels less than at last year’s peak.