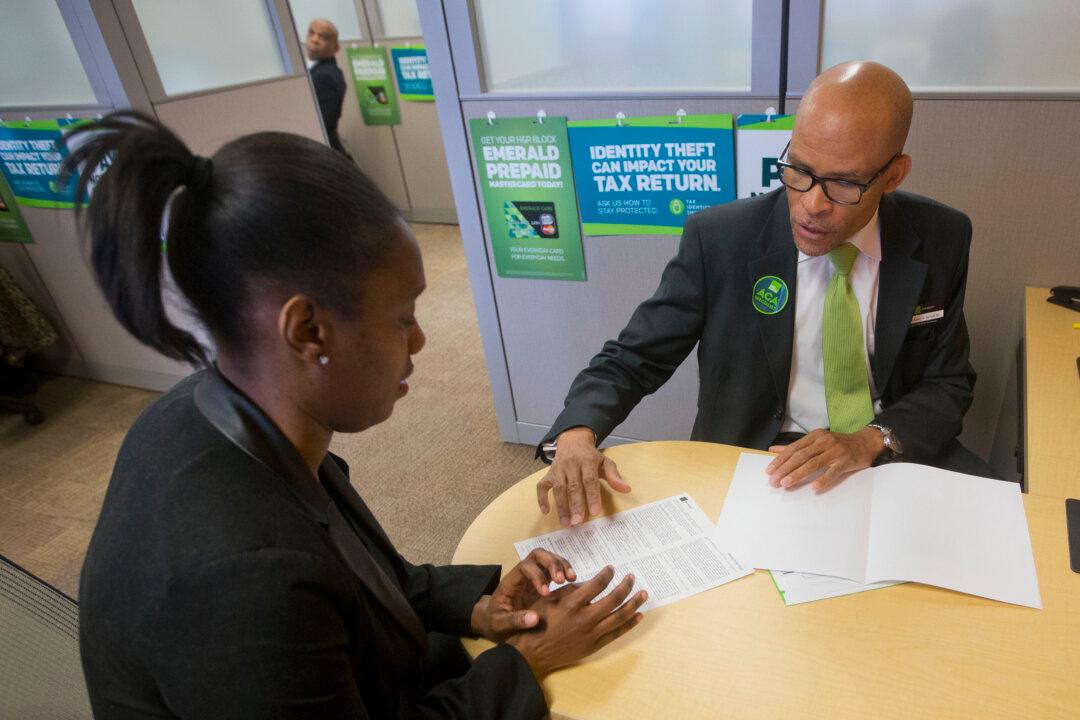

More than half the taxpayers who bought individual health insurance through the Affordable Care Act in 2014 will have to pay back a tax credit once April 15 arrives, according to H&R Block. It’s for a pretty positive reason, though. More than half of taxpayers made more money in 2014 than they thought they would.

Most of those who bought health insurance on state or federal marketplaces during the first Affordable Care Act open enrollment period used their 2012 income to estimate how much they would earn in 2014. The earnings impacted the amount of the Advance Premium Tax Credit (APTC).

When it’s time to file federal income tax, that tax credit makes the tax refund bigger. But higher earnings mean a smaller tax credit. What H&R Block calls repaying is more accurately described as not getting an expected bonus.

The tax preparer’s analysis took an alarming tone. It seemed to imply that people would have to pay out of pocket, but it really meant they would get a smaller refund, 17 percent smaller on average.