The home mortgage interest deduction (MID) is up for discussion as lawmakers consider how to rein in the federal deficit. Real estate business lobbyists are likely to oppose abolishing the tax break, yet now would be a good time to end it, according to some experts.

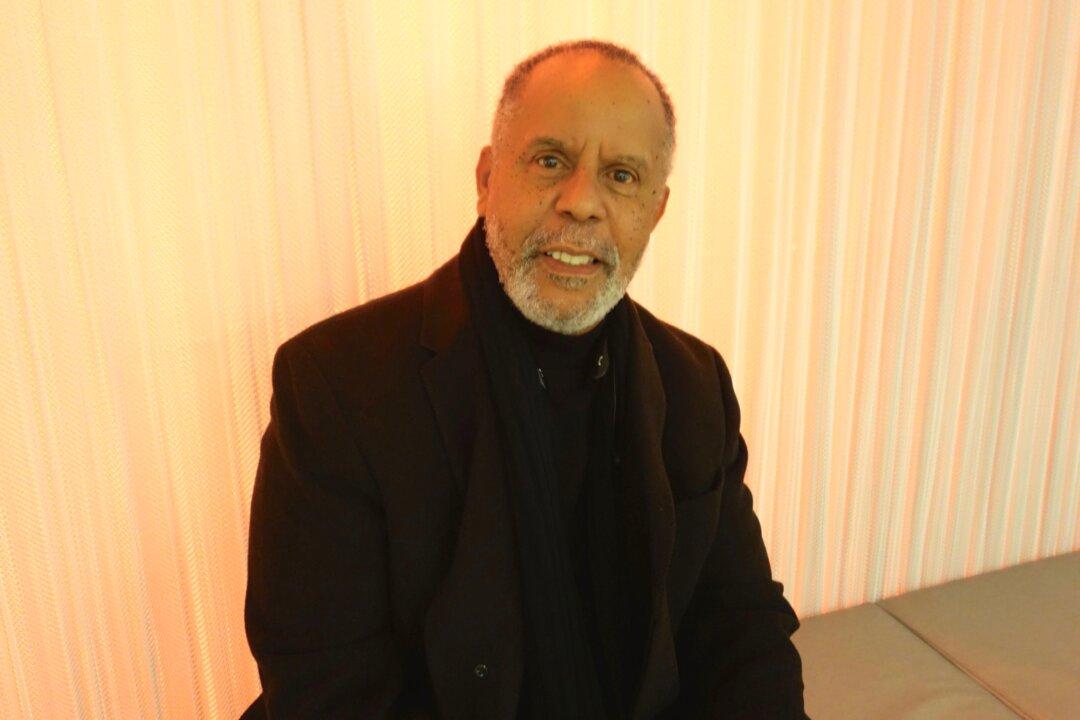

“At the end, the idea of this deduction was always to make it easier for people to buy homes,” said Dr. Andreas Rauterkus, assistant professor of accounting and finance in the School of Business at the University of Alabama Birmingham. If legislators change the policy, “generally it will make people buy more appropriate homes,” he said.

According to the Brookings Institution, the country foregoes about $100 billion per year in revenue through the deduction.

According to an article by Brookings Institution nonresident senior fellow Robert C. Pozen, there are two big myths about MID: it increases home ownership, and it primarily benefits the middle class.

Canada, Australia, and England, all similar to America in their legal and economic systems, have no mortgage interest deduction yet have higher rates of homeownership than the Unites States.

“Most European countries have no mortgage interest deduction,” said Rauterkus, a native of Germany. “That was very interesting to me [when I came to America] because I had never heard anything about it.”

He agrees with Brookings that MID disproportionately benefits higher income people. No one should take on a mortgage just for the tax break, but the larger the mortgage, the larger the deduction. The greatest deduction is gained in the early years of a loan, yet right now interest rates are so low that the tax break is also proportionately low, according to Rauterkus.