Investors and stock traders are paying close attention to President Donald Trump’s Twitter account for good reason: His tweets can move markets. They can even use computer algorithms to capture these tweets and make more money.

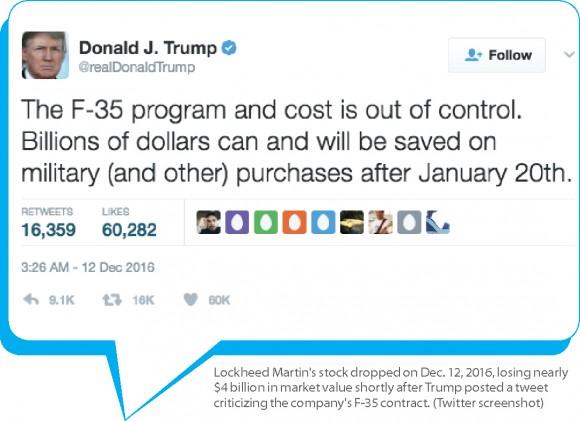

Defense contractor Lockheed Martin’s stock took a hit in December last year, losing nearly $4 billion in market value, shortly after Trump criticized the company’s F-35 contract on Twitter. Companies including Boeing, General Motors, and Ford were also recent victims of Trump’s tweets.

Trump prefers Twitter to other media, as he gets his messages out more efficiently and honestly, he says.

Fund managers have been using Twitter data for years to make investment decisions. According to a recent study published by NPR for example, 25 percent of institutional investors said they use social media for research.

Fortunately, investors themselves do not have to monitor 500 million tweets posted daily. They can rely on advanced machine learning and artificial intelligence techniques to analyze millions of messages.

Data Mining

Among social media platforms, Twitter is by far the largest source of data, according to Valerie Bogard, an equities research analyst at Tabb Group, a capital markets consulting firm.

With growing demand, the number of companies that mine and analyze social media data, like Dataminr and TickerTags, has exploded in recent years.

“Traders have been using Twitter since its launch [in 2006],” but gained more traction in 2013, said Bogard.

In that year, the Securities and Exchange Commission (SEC) approved a rule allowing companies to use social media sites like Twitter and Facebook to disclose corporate news.

Then, the Associated Press (AP) Twitter account was hacked, resulting in a false tweet that said two explosions in the White House had injured President Barack Obama. The event, known as “hash crash,” sparked a selloff in U.S. stocks and showed how fast a tweet could move the markets.

Such events changed the way investors viewed social data, said Bogard.

Alternative data can be used in sentiment analysis. It can identify the market’s opinion on a particular product, a stock, or the mood of traders. It can also be used to detect events like breaking news that move the markets as well as long-term trends, ideas, or cultural movements important for certain stocks.