Canadian families are struggling to balance high debt loads against modest savings and often unstable income flow, according to a report by the Vanier Institute of the Family.

In its 13th annual report, the institute says that despite signs of continued economic recovery, income security is an “elusive dream” for many families.

“The good news is that real personal disposable incomes per household recovered in 2010 from the recession a year earlier,” the report says.

“The bad news is that the real change from the 2010 average to the third quarter of 2011 indicates that personal disposable incomes per household may have slipped back to recession levels.”

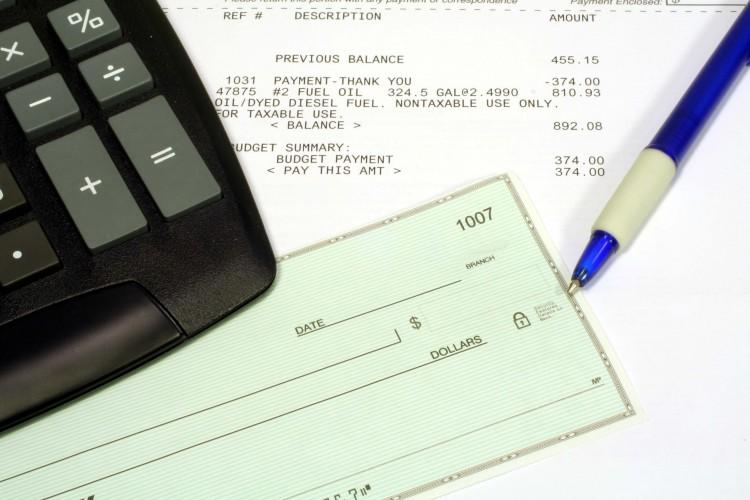

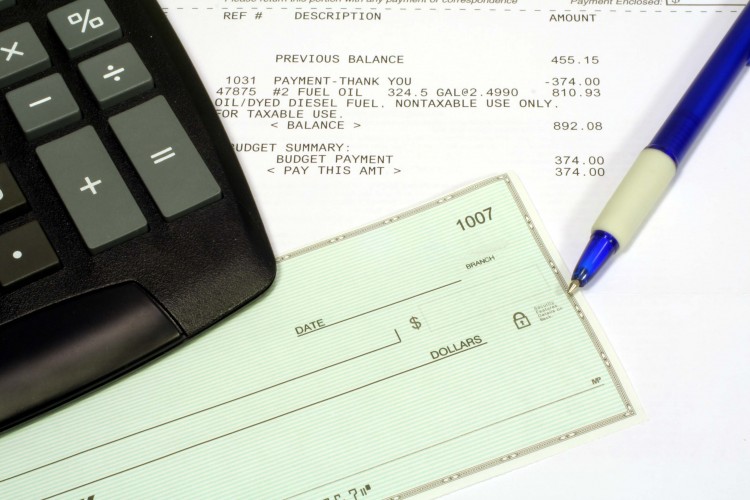

The average debt load per household is also on the rise, standing at $103,000, an increase of 80 percent in real terms compared to 1990. The total debt-service ratio of 1.7 million Canadian households is at 40 percent or more, making them very vulnerable to issues such as rising unemployment and rising interest rates.

“More young people are living with their parents longer and staying in school longer,” Nora Spinks, CEO of the Vanier Institute, said in a statement.

“Grandparents are spending increasing amounts of time in the work force. Parents are stretched, often providing care and financial support to both young and old, while trying to plan and save for their own retirement.”

The report also shows that income inequality is growing in Canada, and that the highest bankruptcy rate has been among Canadians 65 years and older over the last two decades.

“The rate of insolvencies among 55–64 year olds jumped by almost 600 percent over the period (the last two decades) while the rate for those aged 65+ soared by 1747 percent. Seniors were 17 times more likely to become insolvent in 2010 than they were in 1990,” the report finds.

The report also says more Canadians are turning to self-employment to generate supplemental income, with the number growing to 350,000 people today compared to low and statistically irrelevant numbers in the 1990s.

Other findings include:

- While Canadians aged 55 and older continue to experience employment growth, youth aged between 15 and 24 are facing more challenges finding employment.

- The rise in real estate prices has been the highest compared to total increases in wealth from all other financial and non-financial assets.

- Between 2002 and the end of 2011, the overall consumer price index has gone up by over 20 percent, with many basic items such as home fuel oil having a price increase as high as 140 percent. However, several items, such as recreational equipment and services had a decrease of more than 40 percent.