Chinese investments in the United States reached a new record in 2016, more than tripling the previous year’s. However, the pace of investments has begun to cool in 2017, following a crackdown in China on capital outflows.

In reaction to massive capital outflows and the resulting downward pressure on the Chinese currency, Beijing tightened its controls on many outbound mergers and acquisitions (M&A) deals, writes research firm Rhodium Group in a recent report.

In particular, outbound investments in real estate, entertainment, and deals outside investors’ core businesses are now under much more scrutiny, and Chinese investors, wary of having their deals struck down by Beijing, have been more reluctant to bid.

With these recent changes, the pace of newly announced investments in the United States has already begun to slow.

“In the first quarter of 2017, the volume of announced acquisitions fell by 20 percent compared to the fourth quarter of 2016. The combined value of announced deals decreased by about half,” stated the Rhodium report.

Chinese Buying Spree

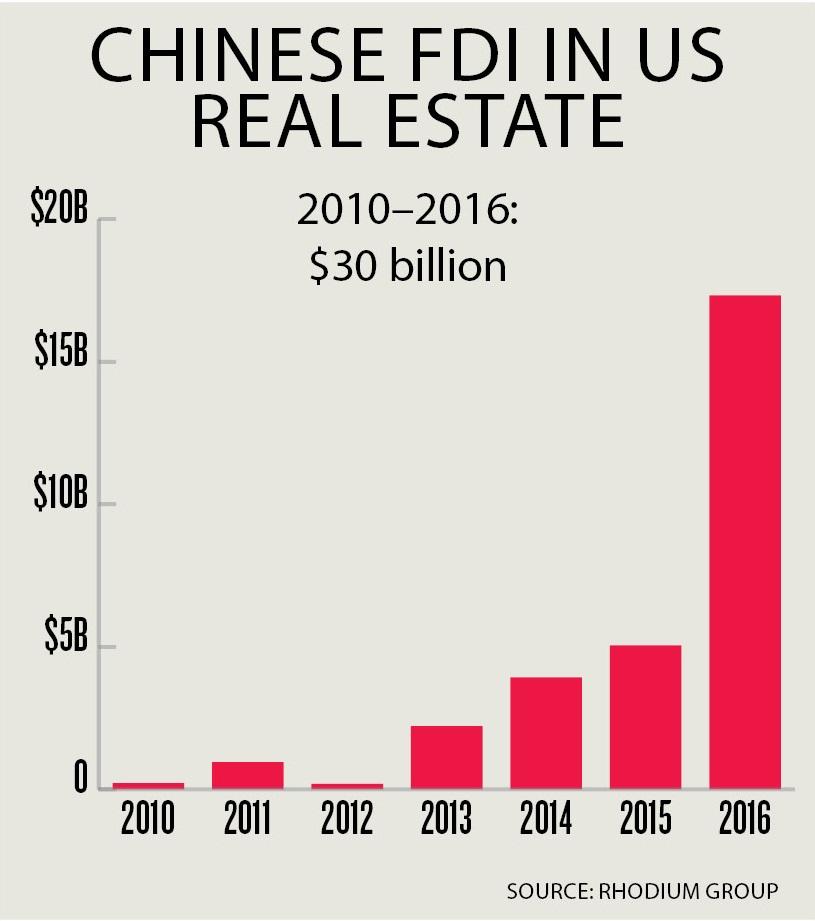

The investment activity that peaked last year started in 2010, when China relaxed rules on outbound investment for institutional investors in order to expand its political and economic influence abroad.

Since 2010, Chinese companies have invested more than $100 billion in the United States across a wide range of industries, with the real estate and hospitality industries attracting nearly 30 percent of the total.

Capital flight from China skyrocketed in 2016 in particular, with mounting economic problems at home and a devaluation of the yuan.