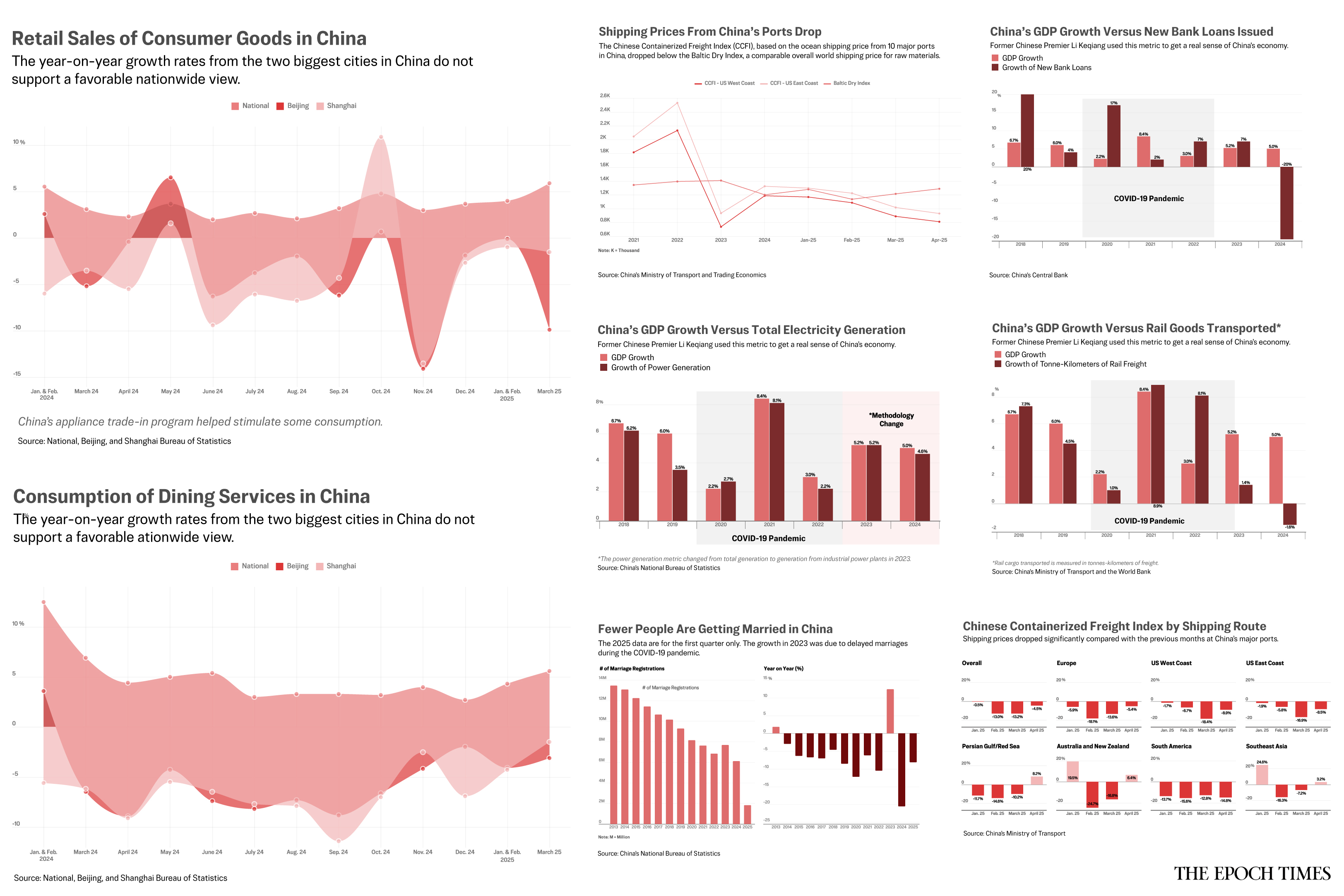

China’s economy entered a sluggish recovery after Beijing lifted its stringent COVID-19 pandemic lockdowns at the end of 2022. Since then, Chinese economic data have shown an array of inconsistencies, painting a murky picture of what is going on in the country.

How bad is China’s economy? Are there better indicators of its condition than the regime’s official gross domestic product growth figure, currently at 5 percent?