Airbus Enjoys Record Orders Amid Boeing Delays

Boeing and Airbus were the two biggest rivals at the Le Bourget airfield outside Paris last week.

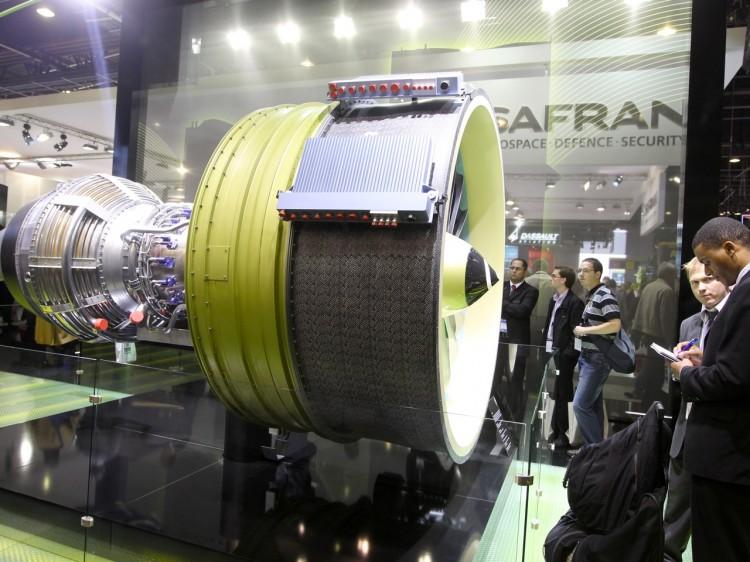

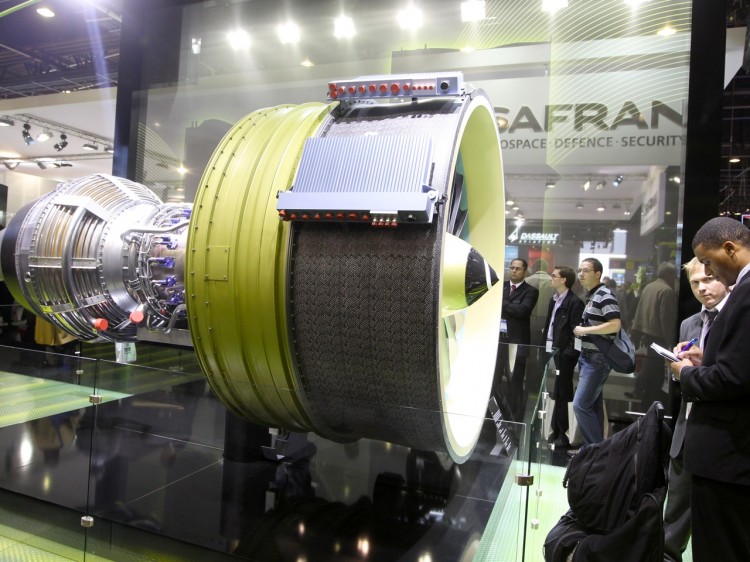

NEW ENGINE: Visitors look at the LEAP engine by CFM, selected by Airbus to power the A320neo, at the International Paris Air Show on June 22. Pierre Verdy/AFP/Getty Images

|Updated: