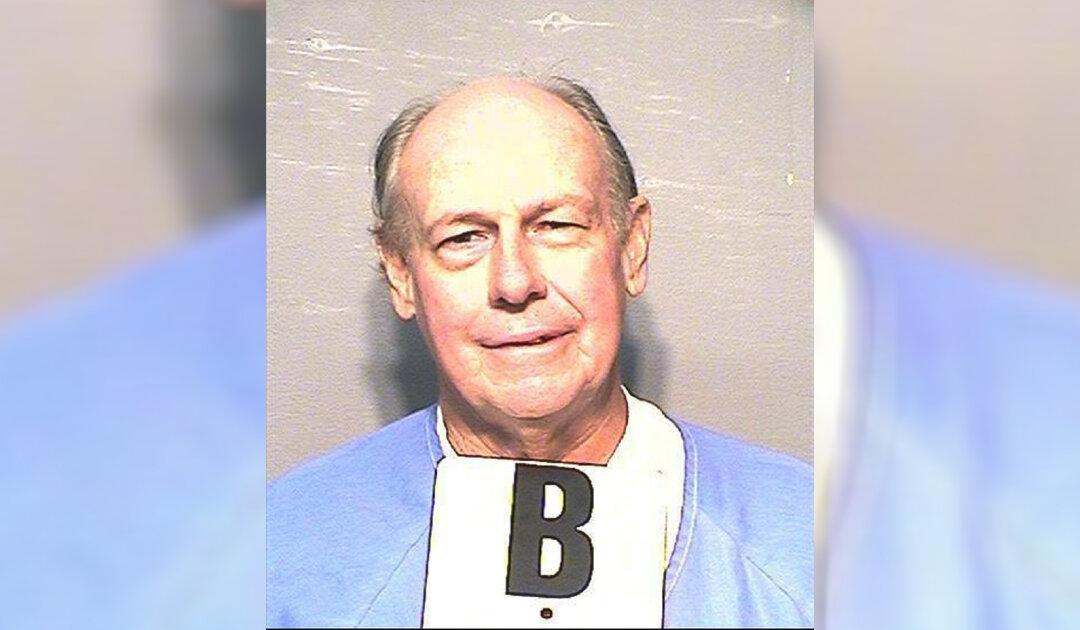

A disabled Air Force veteran may have no choice but to sleep rough after his Arizona home was auctioned off by the authorities on June 20.

Former U.S. Air Force Officer Jim Boerner was gobsmacked when a stranger arrived at his Mesa mobile home and said they had bought his property for $4,400, the Arizona Republic reported.