SPECIAL COVERAGE

Read More

Read More

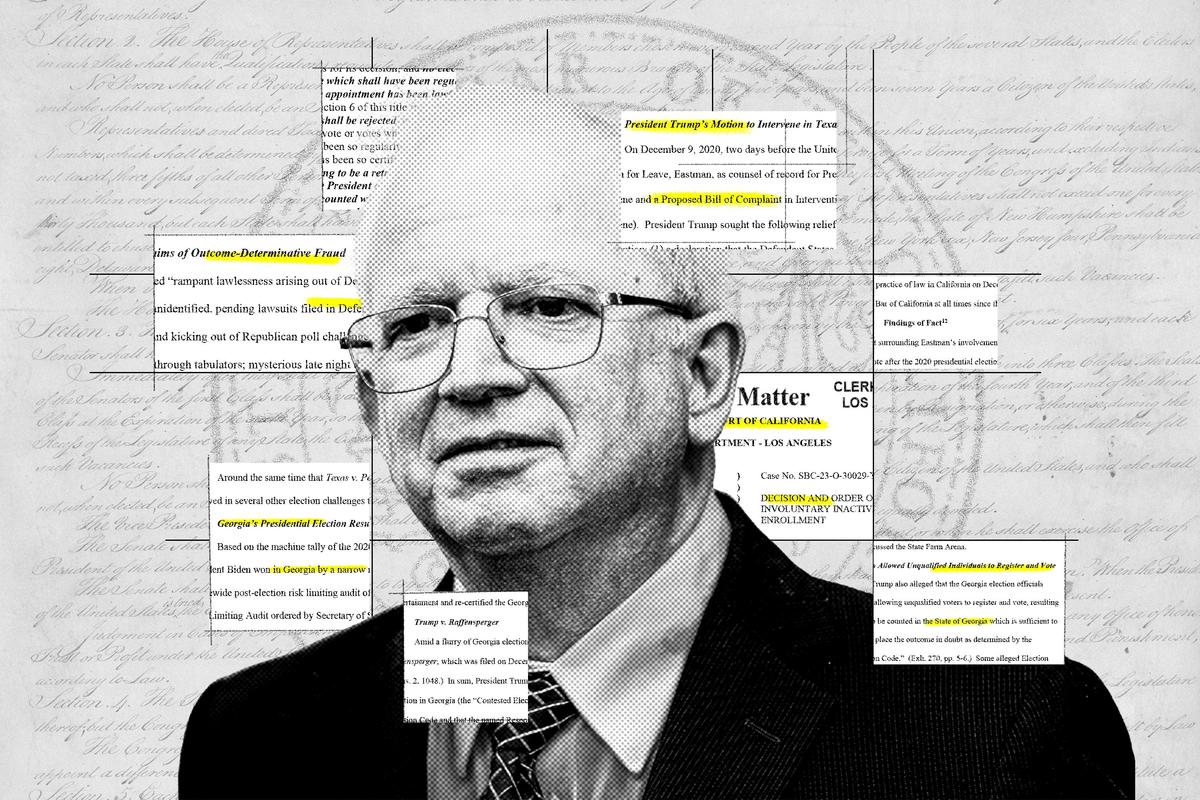

Judge Delays Trump Documents Trial, Won’t Set New Date

President Trump was charged with 40 counts related to allegedly mishandling classified information.

Judge Delays Trump Documents Trial, Won’t Set New Date

President Trump was charged with 40 counts related to allegedly mishandling classified information.

Top Premium Reads

Top Stories

Most Read

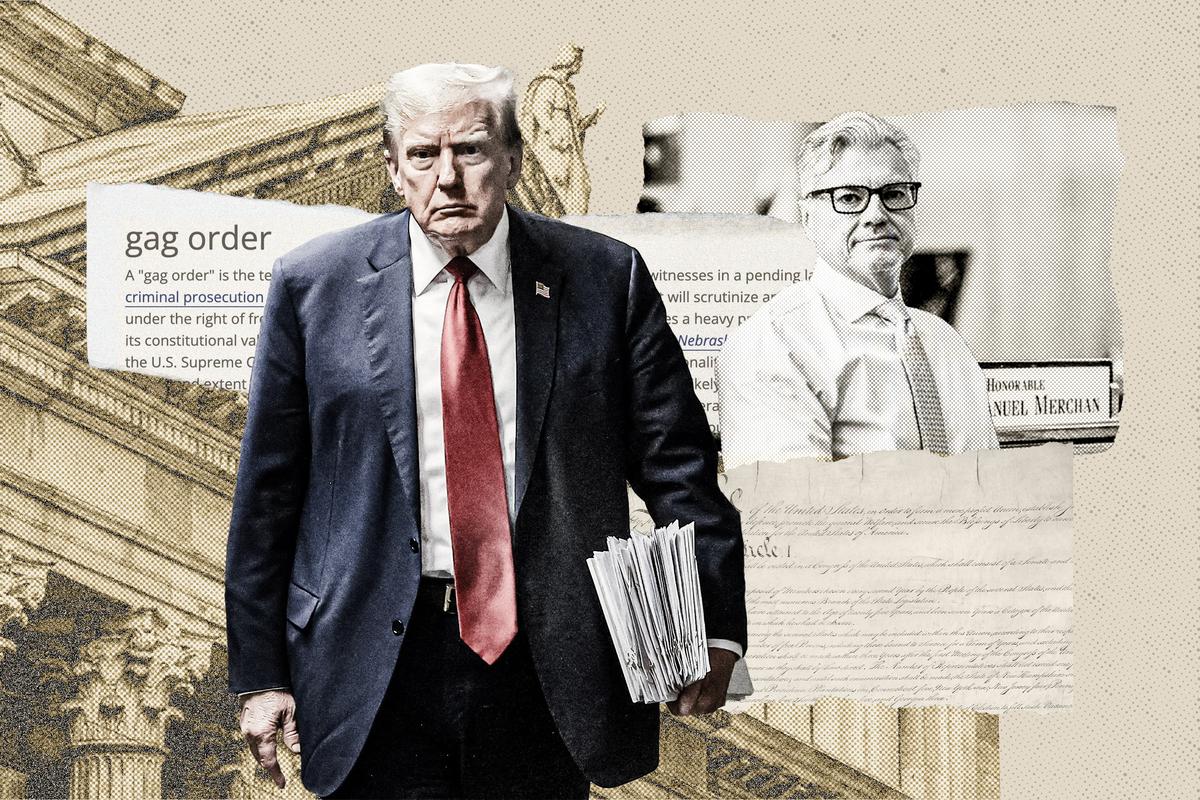

Judge Denies Trump Lawyer’s Motion for Mistrial in ‘Hush-Money’ Case

His attorneys argued that witness testimony from Stormy Daniels was ‘extraordinarily prejudicial.’

Pro-Palestinian Protesters Try to Disrupt Met Gala, 24 Arrested

Protesters said they were upset with Israel’s bombing of Gaza and civilian casualties there.

50 Governors Oppose Federal Plan to Move National Guard Units: ‘Power Grab’

Governors of all 50 states said they oppose a measure to move units to the Space Force.

Boy Scouts Changing Name to ‘Scouting America’ On 5th Anniversary of Letting Girls Into Its Programs

The organization said the change reflects its ‘ongoing commitment to welcome every youth and family in America to experience the benefits of Scouting.’

IRS Asks Tax-Exempt Entities to File Returns Before May 15 Deadline

Entities can seek a six-month filing extension, delaying the due date to Nov. 15.

Biden Condemns Mounting Anti-Semitism in Holocaust Remembrance Speech

‘It’s absolutely despicable and it must stop,’ the president said.

Speaker Says Meeting With Rep. Greene ‘Not a Negotiation’

Rep. Marjorie Taylor Greene made a list of demands that she revealed publicly on May 7.

Sen. Ted Cruz, Rep. Ronny Jackson Push Bill to Help Ranchers Devastated by Texas Wildfires

The Republican lawmakers introduced legislation to expand a federal aid program that assists ranchers whose pregnant livestock are killed in disasters.

Stormy Daniels Takes Witness Stand in Trump Trial as Judge Scolds Prosecutors

Stormy Daniels on Tuesday reiterated her previous claims about an alleged affair to members of the jury.

Mouth Breathing Could Be Sabotaging Your Health, Experts Warn

Mouth breathing can lead to a load of issues, including ADHD-like symptoms. Nasal breathing unlocks numerous health benefits.

US Government, Lawmakers Condemn Russia’s Detention of Falun Gong Practitioner

US officials said they are ‘troubled and saddened’ to hear of the Moscow police raid and ‘deeply concerned’ about the persecution of Falun Gong globally.

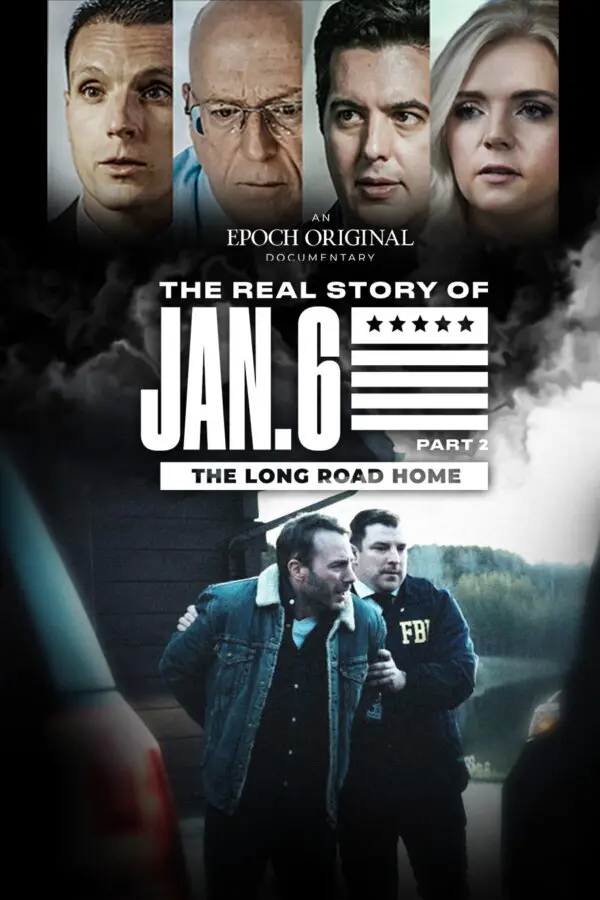

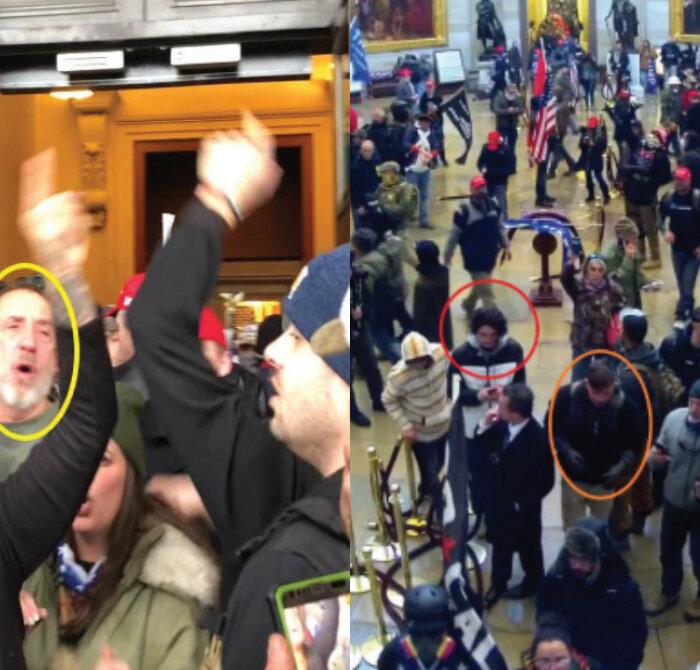

Father and Sons Charged for Entering US Capitol on Jan. 6

The FBI received a tip about the family, resulting in the charges.

Trump Says He’s Willing to Go to Jail After Judge’s Contempt of Court Order

‘I have to watch every word I tell you people,’ he told reporters at the court.

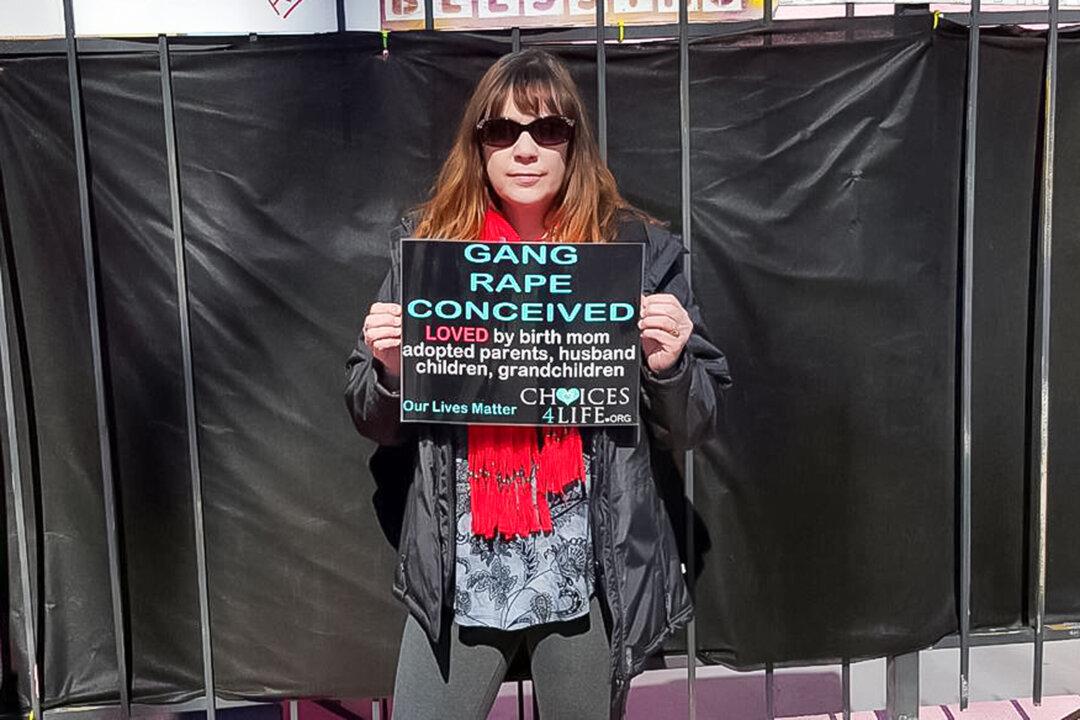

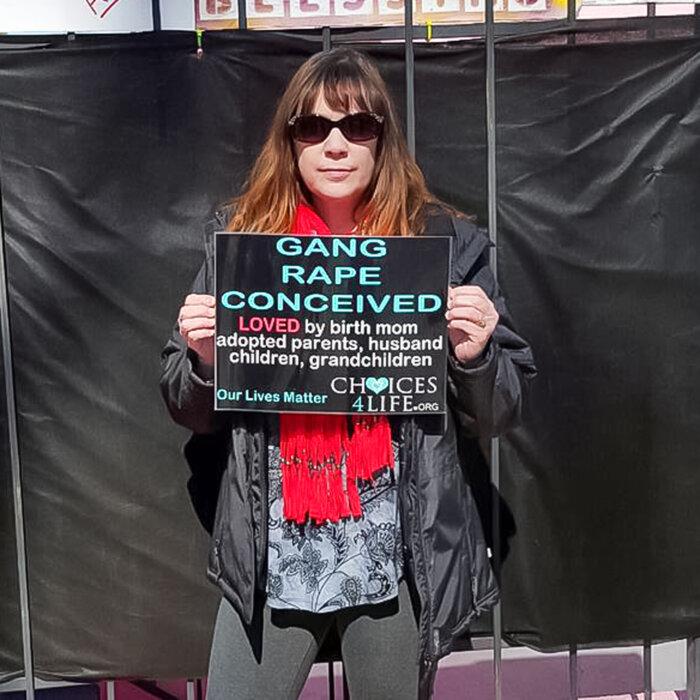

Woman Conceived in Gang Rape Says It’s Time to Rethink Abortion Exception

Juda Myers says every person has worth, regardless of the circumstances of their birth.

Hans Sachs: Where Shoemaking Meets Songwriting

The Meistersinger guild of blacksmiths, carpenters, lawyers, teachers, and businessmen wrote and recited songs. Hans Sachs was the greatest of them.

Hans Sachs: Where Shoemaking Meets Songwriting

The Meistersinger guild of blacksmiths, carpenters, lawyers, teachers, and businessmen wrote and recited songs. Hans Sachs was the greatest of them.

Epoch Readers’ Stories

A History Of The American Nation

A patriotic poem by Ted Schneider

Of Cars and Kids

Why should our kids have to settle for a Trabant, or a Pyonghwa, education when they could have a BMW?

A Nation Divided

Poem by an American Patriot

What Is Going on Here?

There are two major things plants need to survive and continue generating our life saving oxygen. The first is CO2, and the second is sunshine.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Special Coverage

Special Coverage

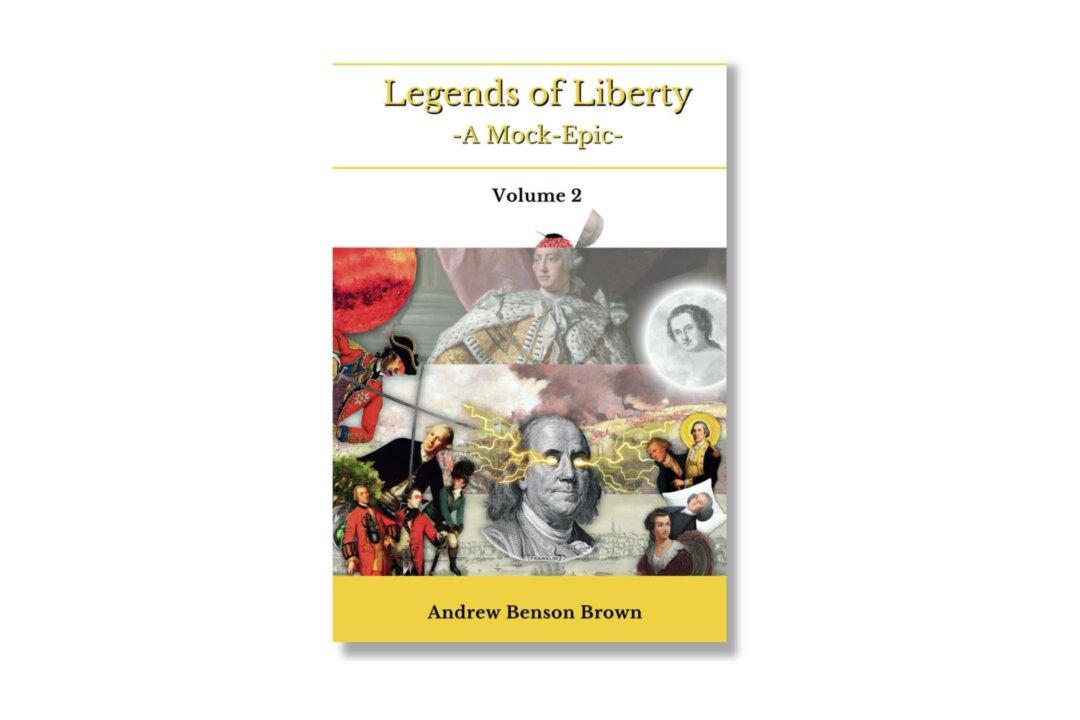

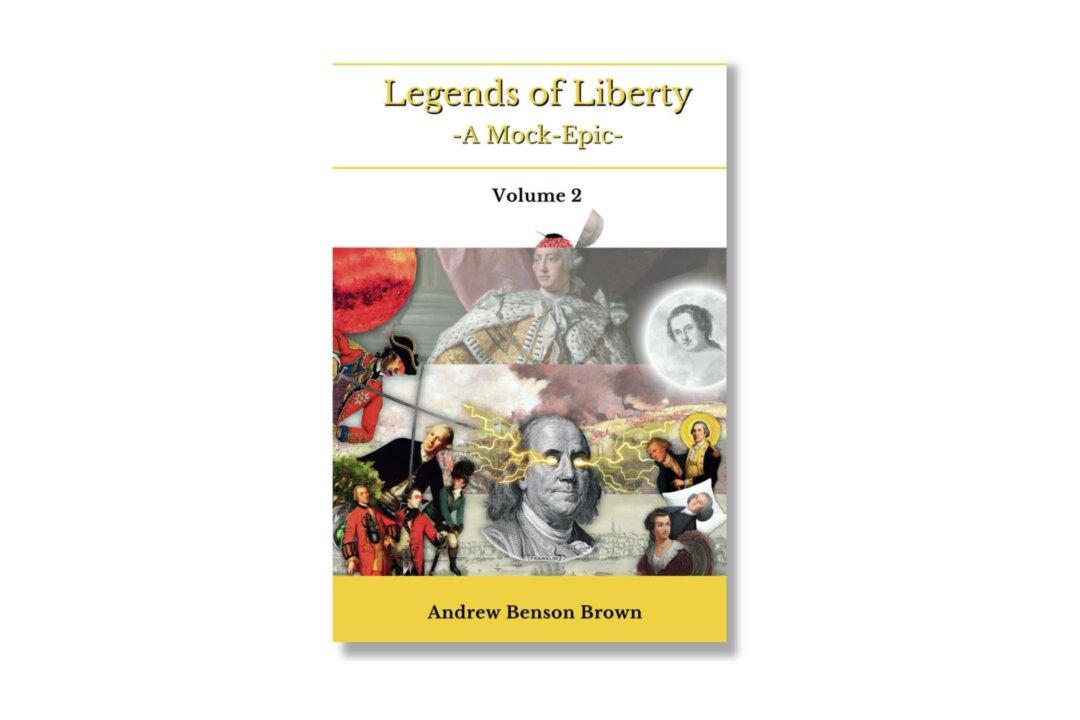

‘Legends of Liberty 2’: A Fabulous Sequel

Andrew Benson Brown has reached new heights of poetic achievement with his second volume of ‘Legends of Liberty.’

‘Weapons of Mass Migration’: An American Crisis

Director-presenter Josh Philipps points a finger at international organizations helping illegal migration into the United States.

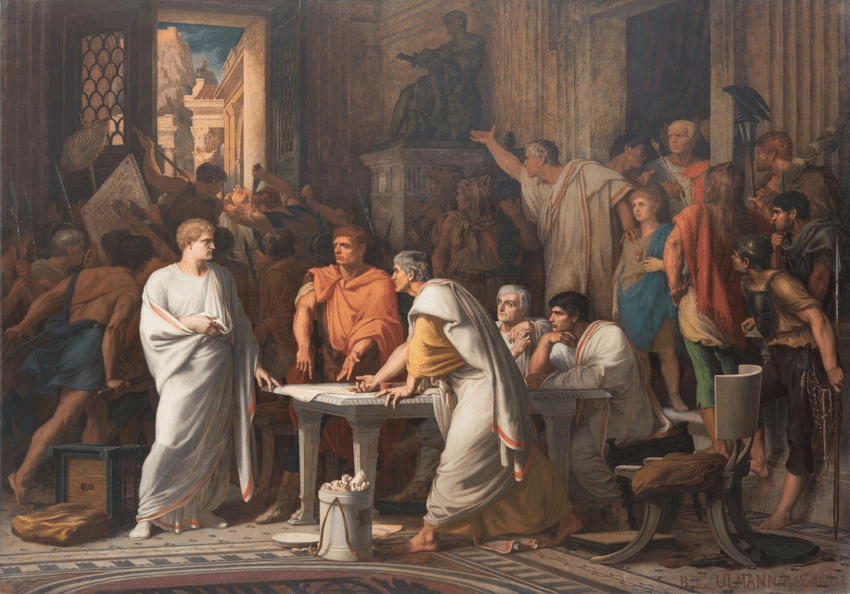

From Republic to Dictatorship: The Rise of Sulla

Examining the political feud that led to the near-death of Rome’s Republic.

Stephen Vincent Benet’s Short Story, ‘The Blood of the Martyrs’

This story shows how a meek scientist took a stand for the truth.

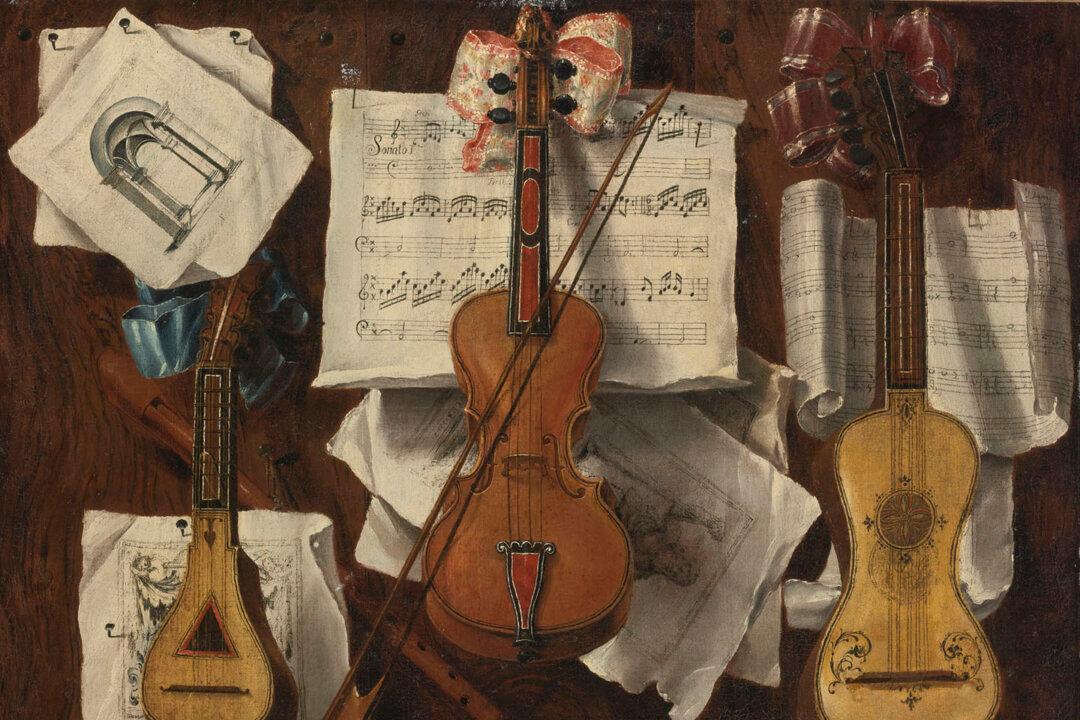

Pythagoras To Beethoven: A Hillsdale College Free Online Music Course

“Join me at the piano,” says concert pianist Hyperion Knight for a free, online course on classical music through Hillsdale College.

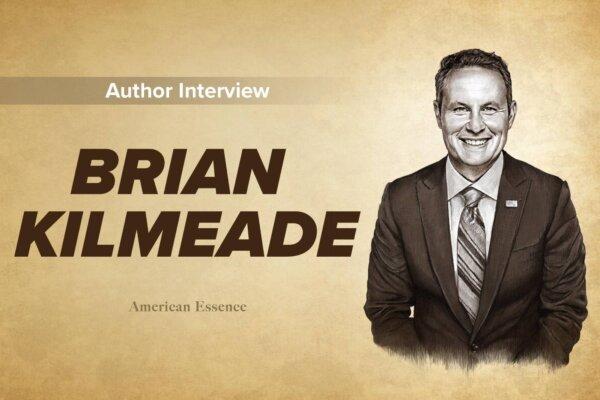

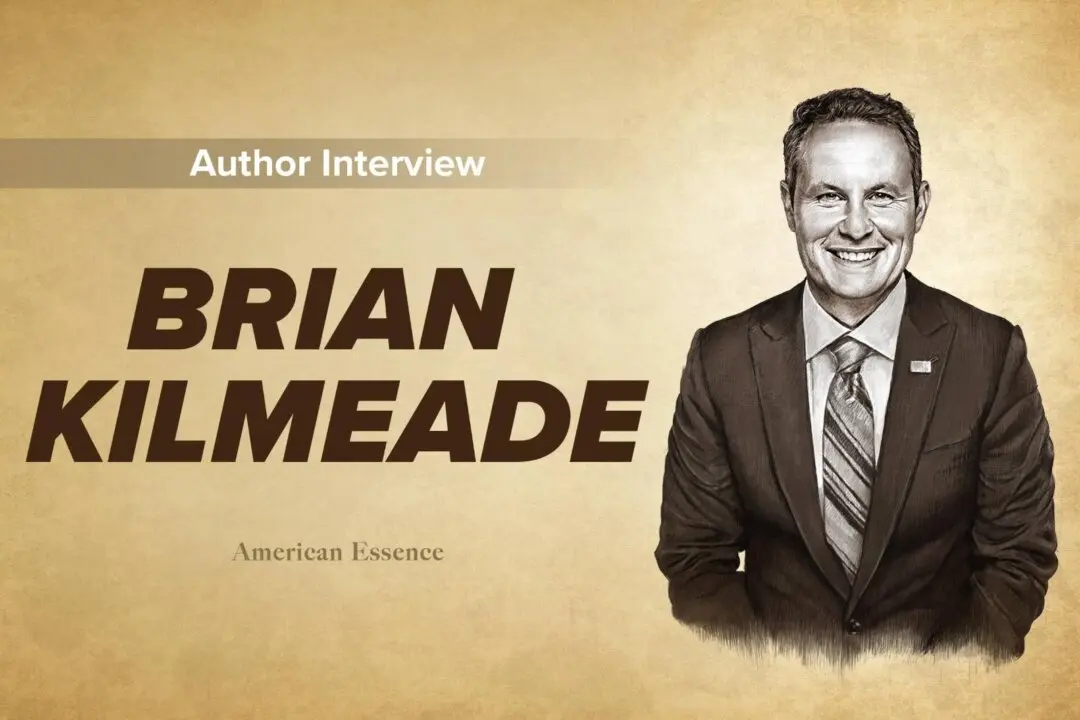

Brian Kilmeade’s Love of America and Defense of Its History

The ‘Fox & Friends’ host has written six books that highlight American heroes who put their love of country before their own interests.

A Classical Music Resurgence

Studies over the last two years indicate a rise in popularity of the classical genre and a cultural shift towards more interest in traditional music.

‘Legends of Liberty 2’: A Fabulous Sequel

Andrew Benson Brown has reached new heights of poetic achievement with his second volume of ‘Legends of Liberty.’

Dining Out Woes

Enjoying wine at a restaurant comes with record high prices. Consider dining at home and buying a good wine yourself.

Rick Steves’ Europe: Madrid’s Outdoor Delights

Madrid is best enjoyed on the car-less streets and after the sun sets, when the temperature is more bearable.

Why Adult Children Are Finding Benefits to Traveling With Their Parents

Adult children are giving back to their parents with trips and adventures.

Guatemala Becoming Tourism Hot Spot for Young Travelers

Guatemala is a place to go for adventure but be sure to keep safety in mind.

Rick Steves’ Europe: Madrid’s Outdoor Delights

Madrid is best enjoyed on the car-less streets and after the sun sets, when the temperature is more bearable.

![[PREMIERING MAY 9, 8:30PM ET] Weapons of Mass Migration | NEW Documentary](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F30%2Fid5640415-1920x1080-no-epochtv.jpg&w=1200&q=75)

![[PREMIERING MAY 9, 8:30PM ET] Weapons of Mass Migration | NEW Documentary](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F30%2Fid5640415-1920x1080-no-epochtv-1080x720.jpg&w=1200&q=75)

![[PREMIERING MAY 9, 8:30PM ET] Weapons of Mass Migration | NEW Documentary](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F05%2F04%2Fid5643663-900x1350-600x900.jpg&w=1200&q=75)

![[PREMIERING 5/7, 9PM ET] The Giant UN Agency Hijacked by Hamas: Asaf Romirowsky](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F07%2Fid5645334-240501-ATL_Asaf-Romirowsky_HD_TN-600x338.jpg&w=1200&q=75)