SPECIAL COVERAGE

Read More

Read More

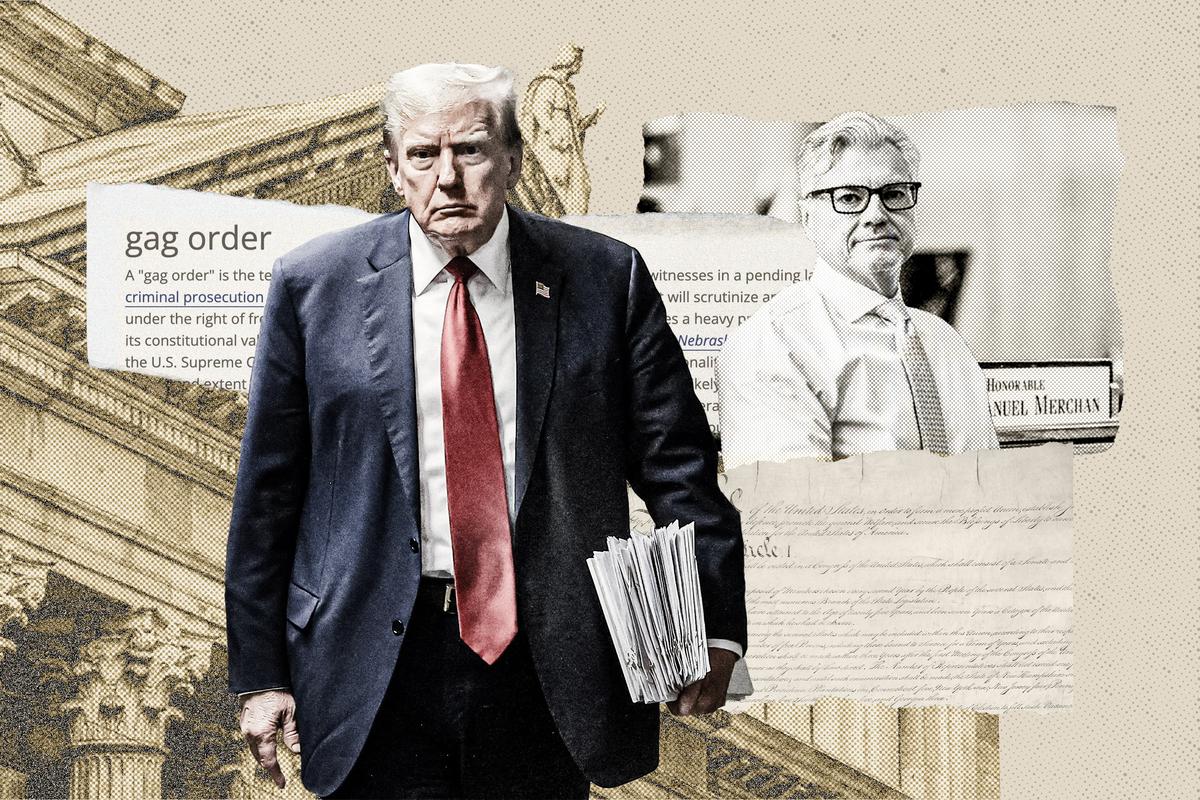

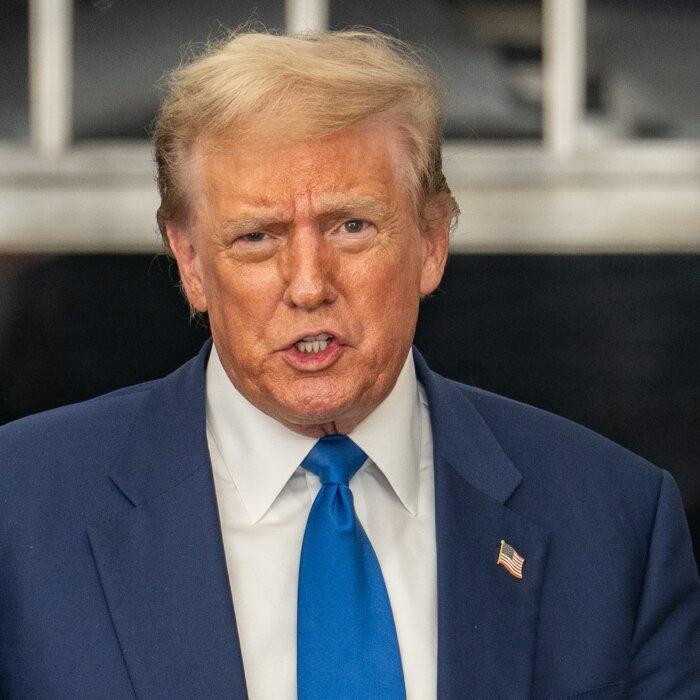

Special Counsel Jack Smith Admits Prosecutors Misled Judge in Trump Case

Prosecutors say they’re not sure what happened.

Special Counsel Jack Smith Admits Prosecutors Misled Judge in Trump Case

Prosecutors say they’re not sure what happened.

Trending Videos

Top Premium Reads

Top Stories

Most Read

The Firing Squad: A Film That Just Might Change America

‘I believe we will save and change America.’

GOP Senators Demand Biden Cancel Plans to Accept Gazan Refugees into US

Think tank FAIR noted that Arab states refuse to accept Palestinian refugees due to possible security risks, while the U.S. ’seems less cautious in this respect

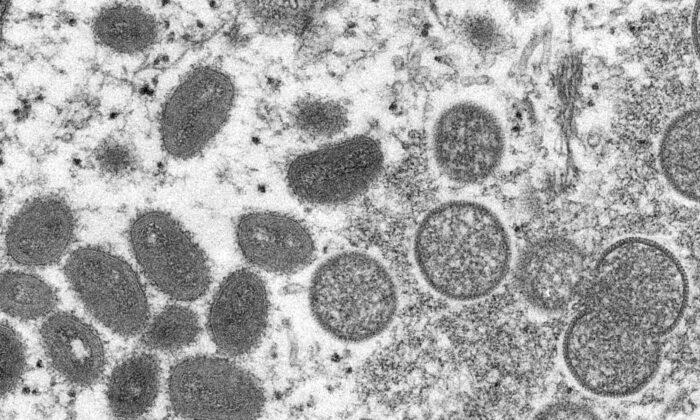

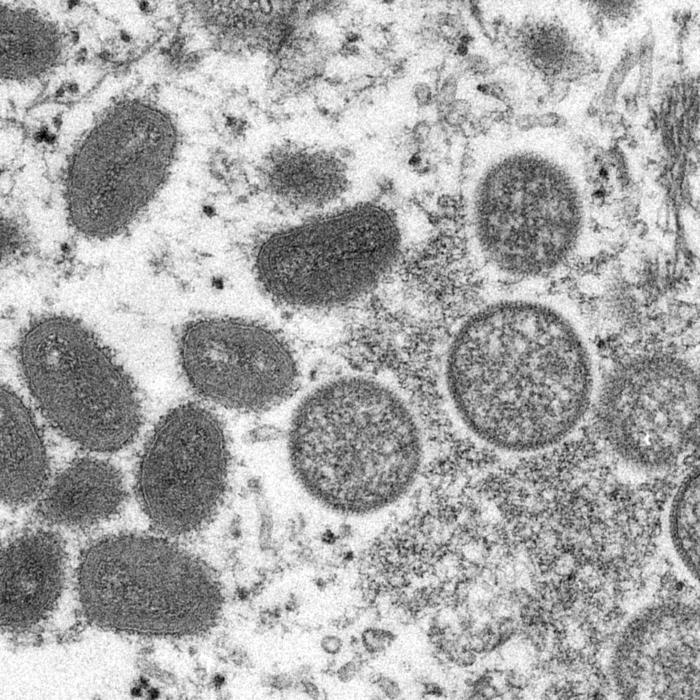

New York Officials Warn of Monkeypox Surge After Sounding Alarm on Deadly Disease Caused by Rat Urine

The spike in cases highlights ’the need for ongoing vigilance, especially approaching the summer when increased transmission may occur,' health officials warned

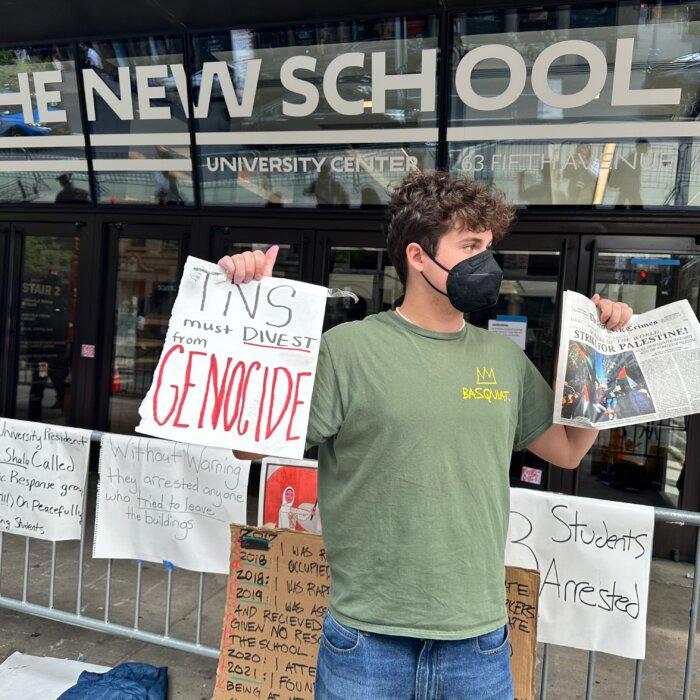

California Democratic Lawmaker Calls for Civil Rights Investigation Into UCLA Protests

The assemblyman cited incidents where protestors were reportedly denying Jewish students access to certain locations on campus for identifying as ‘Zionists.’

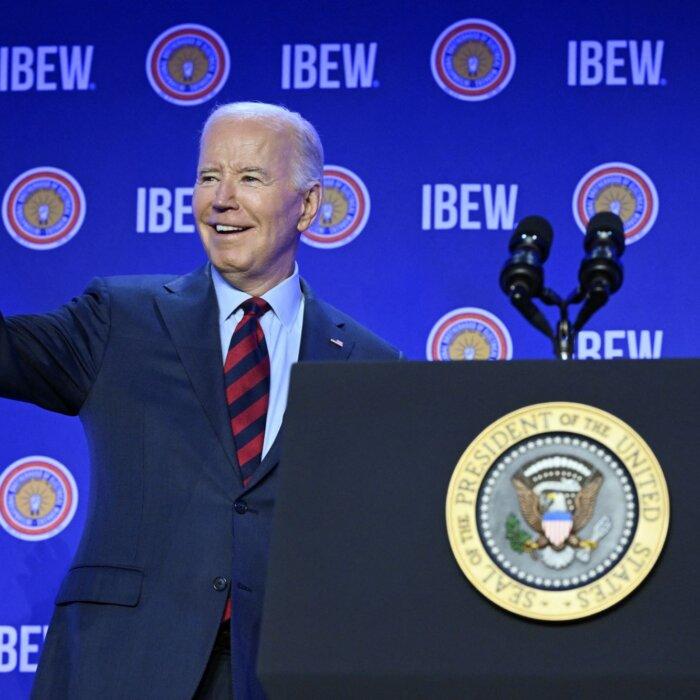

Biden Administration Finalizes Rule to Allow ‘Dreamers’ to Enroll in ’Obamacare’

The new directive is expected to provide coverage to approximately 100,000 immigrants next year.

TB Outbreak Prompts Long Beach to Declare Health Emergency

One person is dead, nine are hospitalized and about 170 have probably been exposed, officials said, but the risk to the public is low.

Officials Don’t Know Which Farm Employs Person Who Tested Positive for Bird Flu

One person has tested positive for the avian influenza in the United States in 2024.

Economist Shoots Down White House Shrinkflation Claims

Other economists assert corporate greed is lifting inflation pressures.

Terrain Theory vs. Germ Theory–A Fresh Look at an Old Principle

The theory that a strong and healthy body keeps illness at bay is reemerging as a foundation for maintaining wellness and fighting potential disease.

Iowa Defiant as DOJ Threatens Lawsuit to Block Illegal Immigrant Law: ‘Will Not Back Down’

‘I have a duty to protect the citizens of Iowa. Unlike the federal government, we will respect the rule of law and enforce it,’ Iowa governor said.

Amid Closer Ties With China, Russia Raids Homes of Falun Gong Practitioners

‘We are concerned about this whether it happens in China or Russia or elsewhere in the world,' a White House National Security Council spokesperson said.

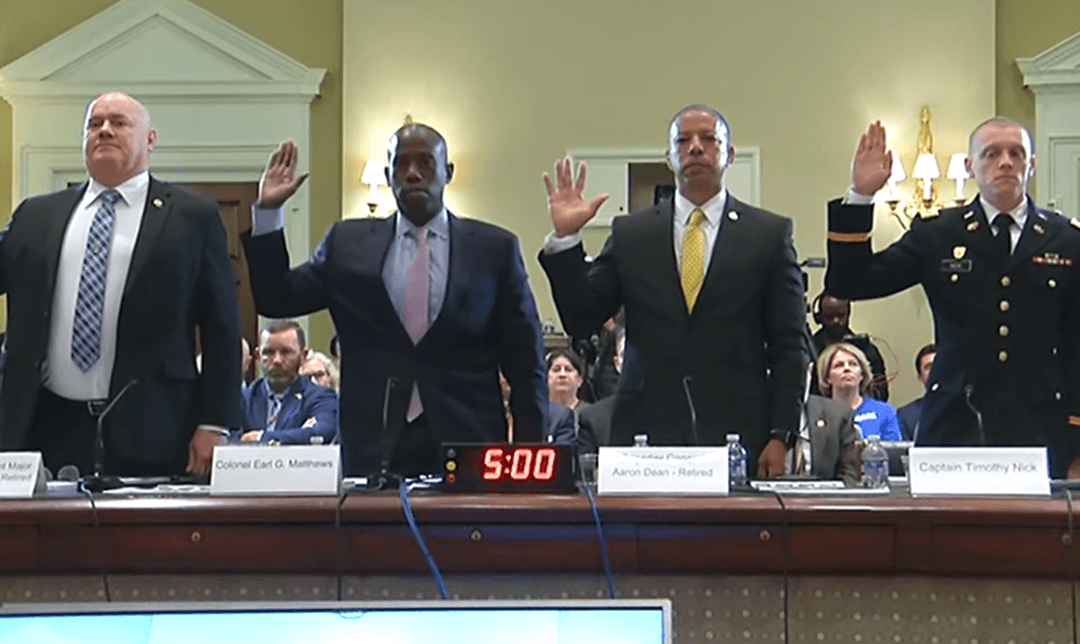

House Panel Calls to Defund Federal Agencies That Stonewall Congressional Probes

Biden administration accused of defying congressional authority by being reluctant to comply with legitimate oversight requests.

White House Commends ‘Admirable’ Students Protecting American Flag

White House press secretary Karine Jean-Pierre says deploying the National Guard ‘is something that governors decide on.’

Sen. Manchin Slams Final EV Tax Credit Rules: Endorsing ‘Made in China’

Mr. Manchin considers the final eased rules as ‘providing a long-term pathway’ for China and other foreign adversaries to ’remain in our supply chains.’

6 Things You Can Do to Secure Your Home

Put yourself in the shoes of potential intruders and assess your home for weak points.

6 Things You Can Do to Secure Your Home

Put yourself in the shoes of potential intruders and assess your home for weak points.

Epoch Readers’ Stories

A History Of The American Nation

A patriotic poem by Ted Schneider

Of Cars and Kids

Why should our kids have to settle for a Trabant, or a Pyonghwa, education when they could have a BMW?

A Nation Divided

Poem by an American Patriot

What Is Going on Here?

There are two major things plants need to survive and continue generating our life saving oxygen. The first is CO2, and the second is sunshine.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Special Coverage

Special Coverage

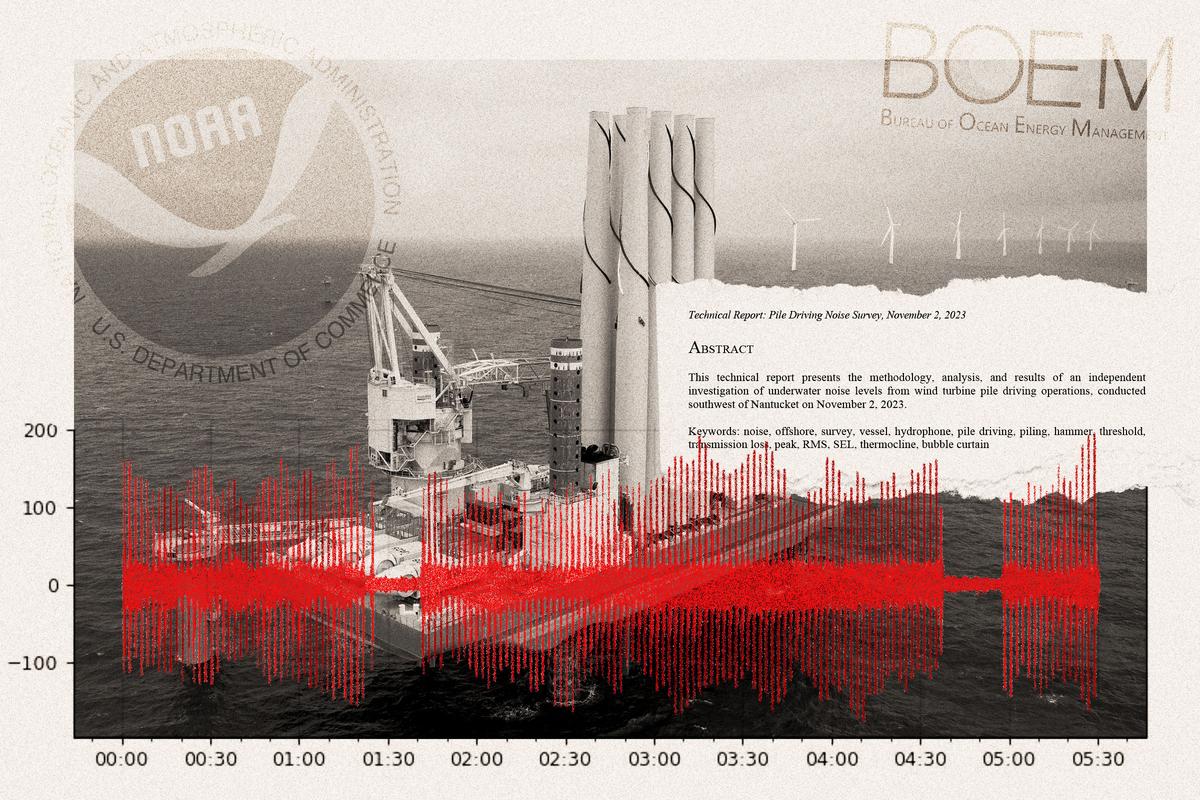

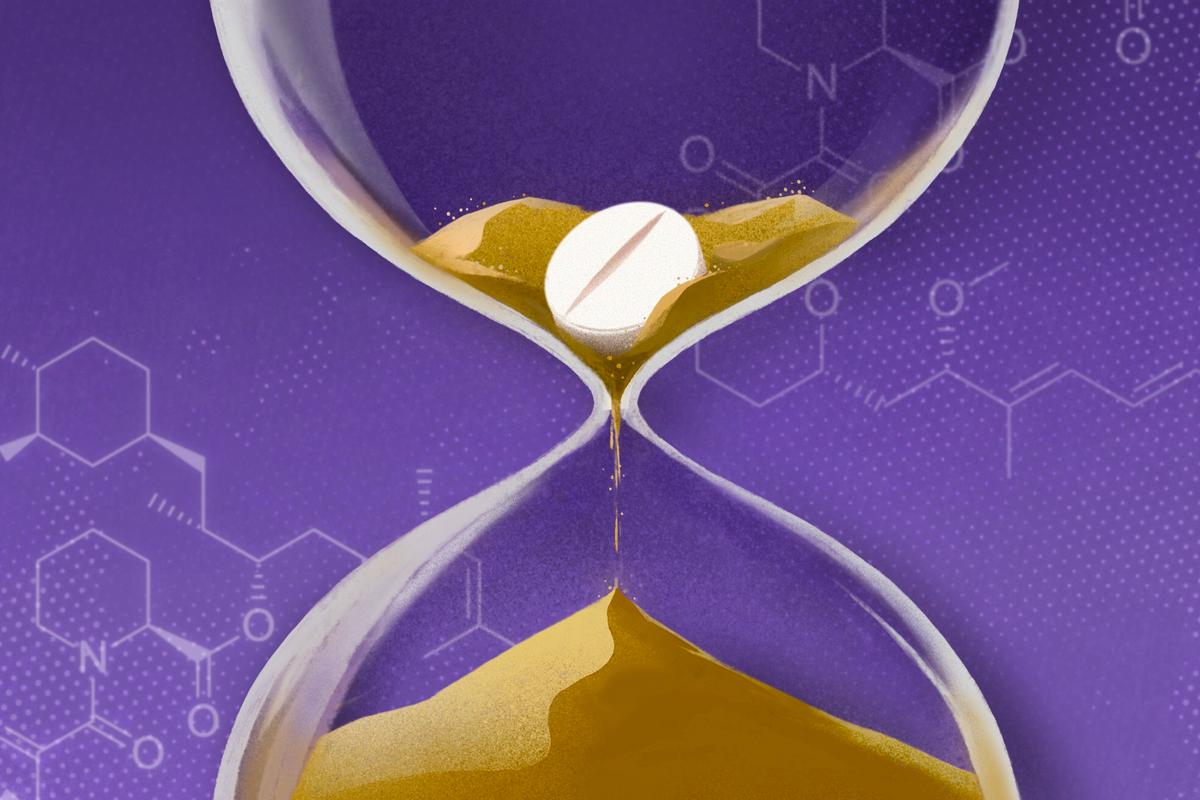

Lipid Nanoparticles Cause Inflammation in Cells, but Damage Can Be Reduced: UPenn Preprint

The study found that lipid nanoparticles cause inflammation by damaging cellular components called endosomes, but the degree of inflammation varies.

Lipid Nanoparticles Cause Inflammation in Cells, but Damage Can Be Reduced: UPenn Preprint

The study found that lipid nanoparticles cause inflammation by damaging cellular components called endosomes, but the degree of inflammation varies.

How a Composer and an Industrialist Created an Iconic Music Hall

In ‘This Week in History,’ a German composer brought a grand vision to New York City and left a lasting legacy for American music.

Raphael’s ‘Sistine Madonna’

Famous for his paintings of the Virgin, Raphael’s composition is admired for its extraordinary juxtaposition of a celestial vision and the earthly realm.

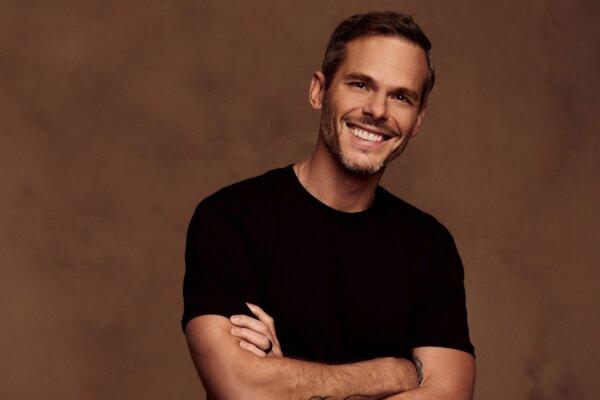

From Country Music to Ministry: Granger Smith Shares the Faith Journey That Set Him on a Path Beyond Music

Through faith, Granger Smith was able to overcome the unimaginable grief at his son’s death. Now he’s set on a path to help others process their loss.

Railroad Magnate and Governor Mansion

The Leland Stanford Mansion is a stunning example of Victorian era splendor in the heart of Sacramento.

‘Second Class’: The Working Class Struggles

Author Batya Ungar-Sargon believes there is a growing class divide between service and knowledge workers.

How a Composer and an Industrialist Created an Iconic Music Hall

In ‘This Week in History,’ a German composer brought a grand vision to New York City and left a lasting legacy for American music.

Greek Burgers With Feta Aioli

These insanely flavorful Greek Burgers have seasoned turkey patties topped with feta aioli, grilled onions and arugula.

Unusual Tours Teach Local Culture With Flair

There are areas around the country where people go to experience unusual phenomenon.

Taking the Kids: And Shopping Smarter (And More Sustainably) for Mother’s Day

Treat mom to gifts that also give back to the environment.

Traveling This Year? Here’s What You Need to Know About TSA PreCheck, CLEAR Plus and Global Entry

While each offer similar privileges, the three programs often get conflated together.

Unusual Tours Teach Local Culture With Flair

There are areas around the country where people go to experience unusual phenomenon.

![[PREMIERING MAY 9, 8:30PM ET] Weapons of Mass Migration | NEW Documentary](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F05%2F04%2Fid5643663-900x1350-600x900.jpg&w=1200&q=75)

![[PREMIERING NOW] RFK Jr. Takes on Trump and Biden Over Four ‘Existential’ Issues](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F05%2F04%2Fid5643727-240501-ATL_RFK_HD_TN-600x338.jpg&w=1200&q=75)