SPECIAL COVERAGE

Read More

Read More

Tufts University Urges Students to End Pro-Palestinian Encampment so Semester Can Start

A ‘Gaza Solidarity Encampment’ protest began on April 7 in the academic quad of Tufts University and has occupied the area since.

Tufts University Urges Students to End Pro-Palestinian Encampment so Semester Can Start

A ‘Gaza Solidarity Encampment’ protest began on April 7 in the academic quad of Tufts University and has occupied the area since.

Trending Videos

Top Premium Reads

Top Stories

Most Read

California’s Tax Revenue Projections Weakening as Newsom’s Budget Revision Deadline Looms

Sales and use taxes are about $1 billion below forecasts since November.

Over 1,000 Protestors Demand Establishment of Islamic State in Germany

The organizers said the rally was to protest the alleged Islamophobic policies of the German government and national media.

Democrats to Contest All 28 Congressional Districts in Florida for First Time Since 2018

The party is allocating more resources in Florida after the state Supreme Court approved ballot initiatives for abortion access and recreational marijuana.

Musk Visits China to Talk Tesla a Week After Canceling India Visit

Elon Musk reportedly met with China’s premier, Li Qiang, and Ren Hongbin, who heads the China Council for the Promotion of International Trade.

Tornadoes Devastate Oklahoma, Killing 4 and Injuring Dozens

The storm devastated historic downtown, damaging and destroying many of the city’s downtown businesses.

Human Rights Is the CCP’s ‘Biggest Weakness:’ Miles Yu

‘We cannot just engage China on what China is good at, but also by ignoring the weakness, [the] vulnerability of that regime.’

White House Denies Rumors of Secretive Plot to Oust Press Secretary Karine Jean-Pierre

A White House spokesperson denied the rumors and reports.

US Space Force General Says China’s Military Developing Space Assets at ‘Breathtaking Speed’

China’s ambitions with regard to the moon are also among Space Command’s concerns.

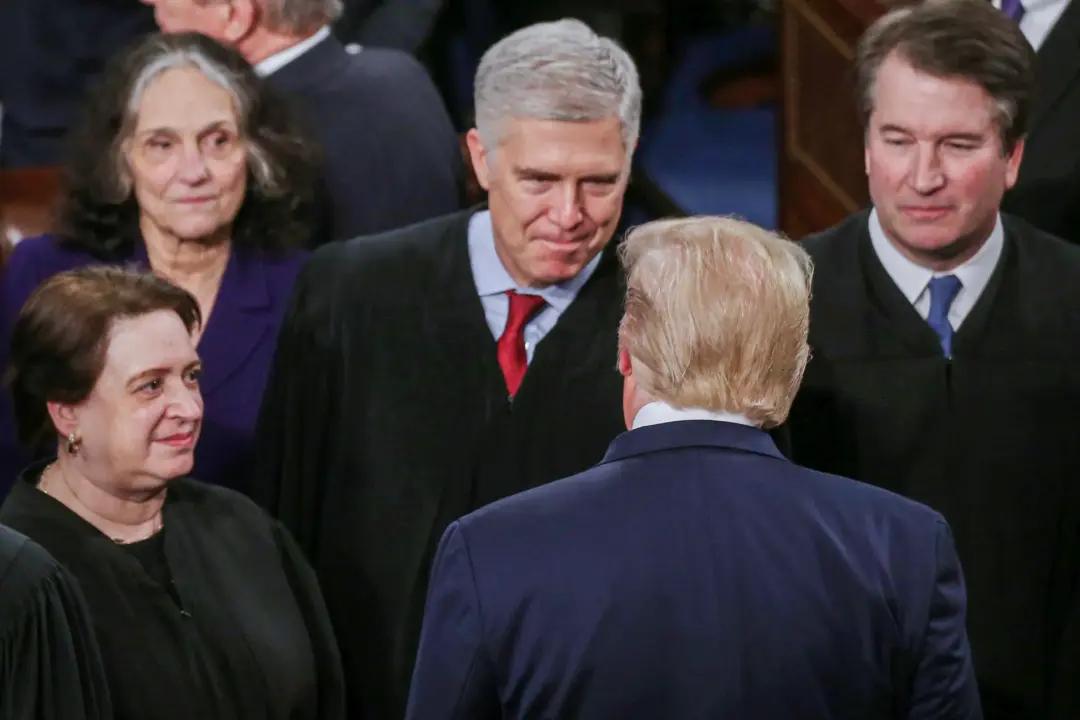

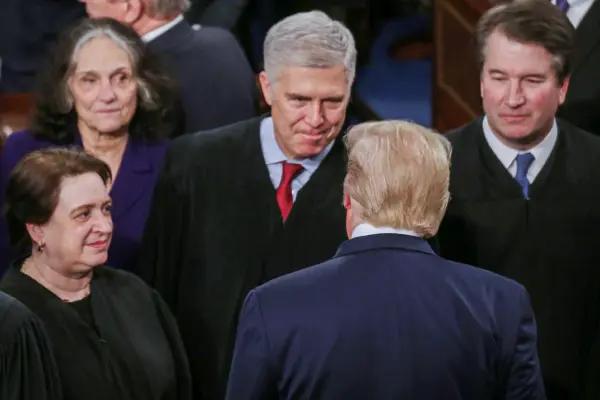

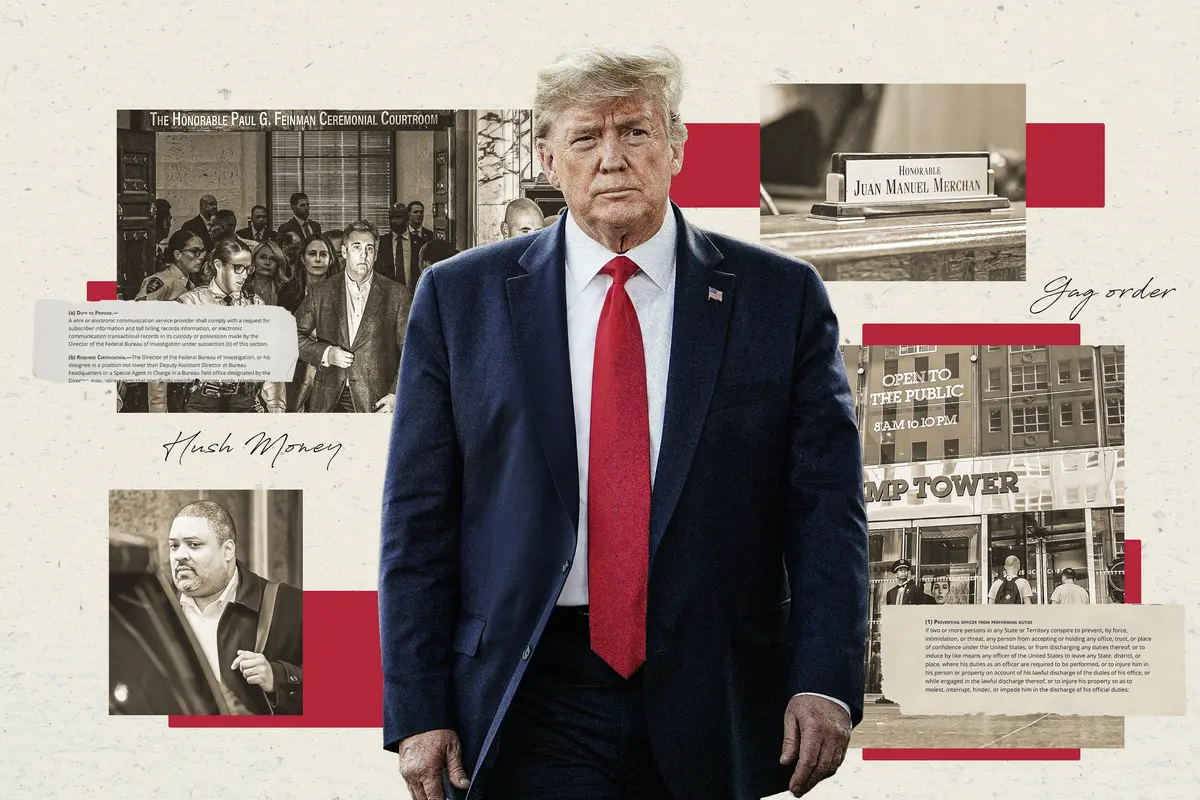

Justice Thomas Raises Scrutiny on Special Counsel Jack Smith’s Appointment in Trump Hearing

Smith was ‘never nominated by the president or confirmed by the Senate at any time,’ Trump’s lawyer pointed out.

‘I’m Not Done’: Arizona Lawmaker Commits to Combating Forced Organ Harvesting After Bill Veto

The bill made it through both chambers of the state Legislature with health insurers on board—only to be killed on the governor’s desk.

Tesla’s Autopilot Results in Hundreds of Crashes, Multiple Fatalities, Federal Authorities Say

The Department of Transportation found that Tesla’s Autopilot system ‘created an unreasonable risk’ to driver and vehicle safety.

Beyond Lead: A Pediatrician’s Concerns With ‘Lunchables’ and School Lunch Standards

Ultraprocessed foods are the real villains in the deteriorating health of our nation’s children.

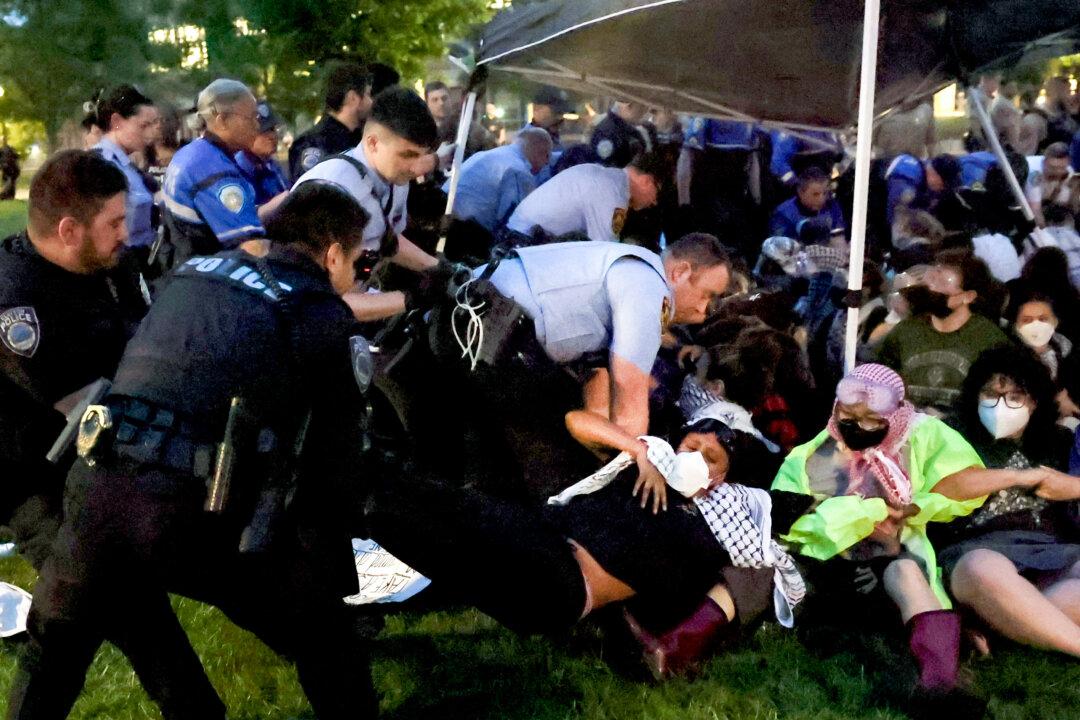

Police, Universities Clear Encampments and Make Arrests of Pro-Palestinian Protesters on Campuses

Protesters are demanding that the schools cut all financial ties with Israel, in addition to separating from companies they claim are enabling the Gaza war.

The Biggest Money-Wasting Mistake Beginner Preppers Make

A frugal prepper shares how to prepare your family for emergencies without spending a fortune.

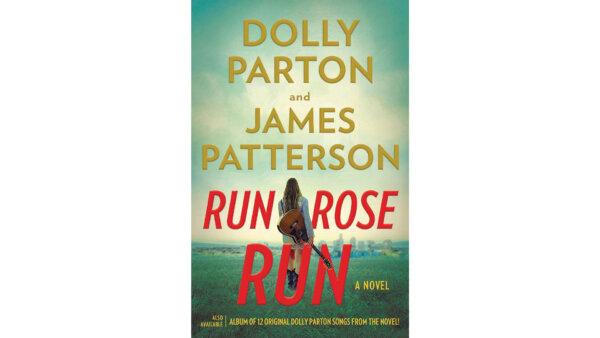

The Biggest Money-Wasting Mistake Beginner Preppers Make

A frugal prepper shares how to prepare your family for emergencies without spending a fortune.

Epoch Readers’ Stories

A History Of The American Nation

A patriotic poem by Ted Schneider

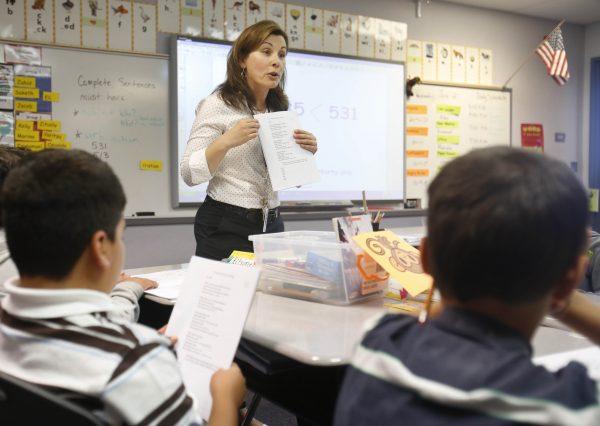

Of Cars and Kids

Why should our kids have to settle for a Trabant, or a Pyonghwa, education when they could have a BMW?

A Nation Divided

Poem by an American Patriot

What Is Going on Here?

There are two major things plants need to survive and continue generating our life saving oxygen. The first is CO2, and the second is sunshine.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Special Coverage

Special Coverage

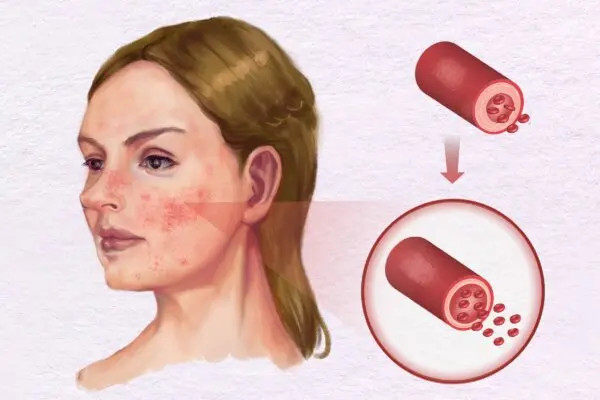

Natural Supplement Cocktail May Ease Inflammation in Long COVID Patients: Study

New study finds herbal supplement with echinacea, rosehip, zinc & royal jelly may really help long haulers.

Natural Supplement Cocktail May Ease Inflammation in Long COVID Patients: Study

New study finds herbal supplement with echinacea, rosehip, zinc & royal jelly may really help long haulers.

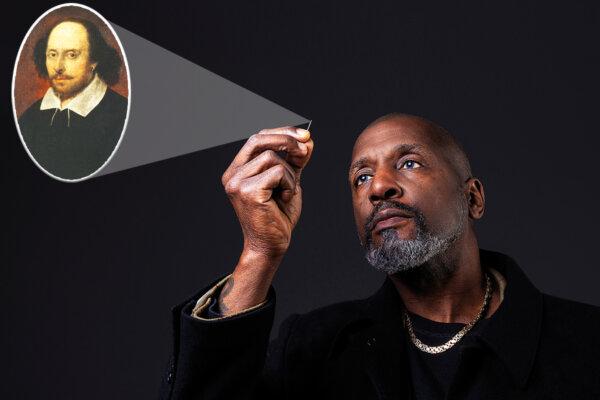

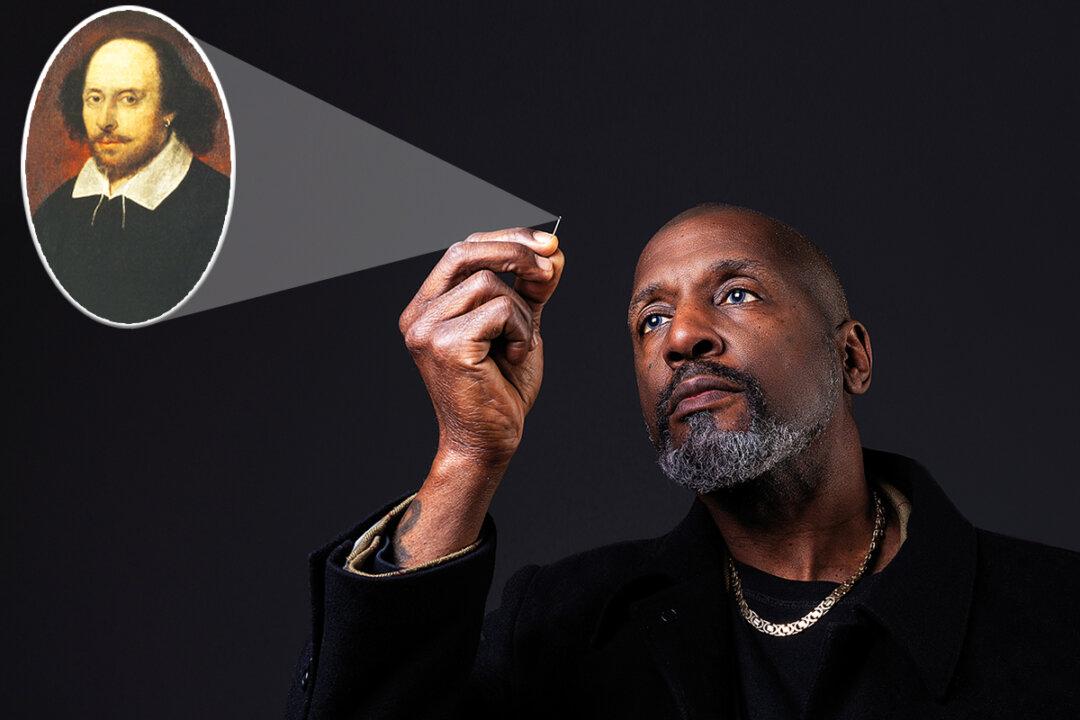

Artist With Autism Creates Microscopic Bust of Shakespeare Inside a Human Hair, Pays Tribute to the World’s Greatest Playwright

April 23 marks the birth and death anniversary of William Shakespeare

‘Jim Thorpe, All-American’: An Olympic Athlete and More

Burt Lancaster gives a strong performance in a finely crafted production about a great American hero.

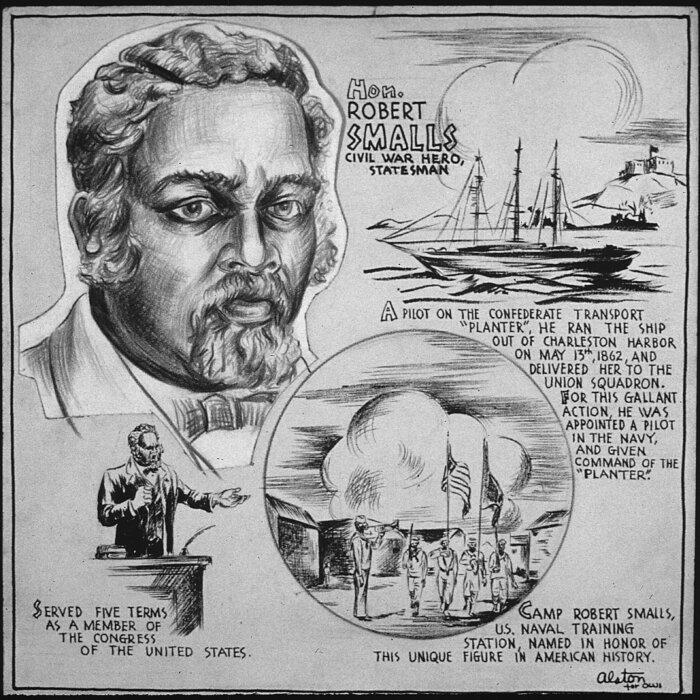

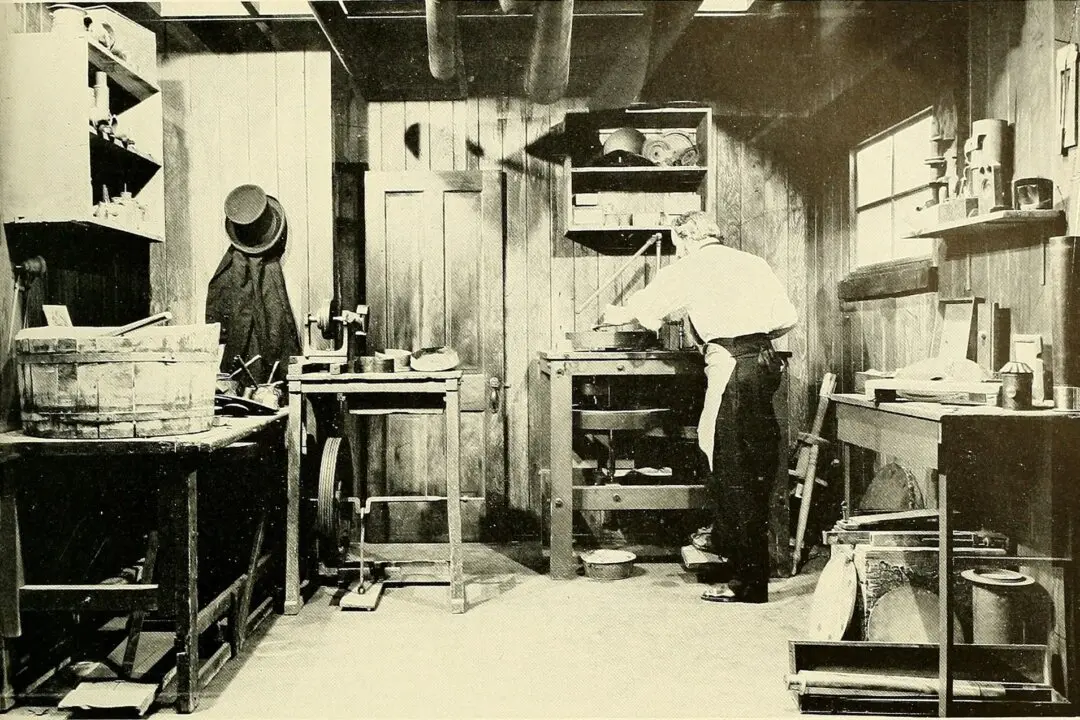

Henry Fitz Jr., America’s Telescope Maker

In this installment of ‘Profiles in History,’ we meet a tinkerer whose interest in the stars led him to build the first American telescope company.

An American Classic: The Republic’s First Statehouse

In this installment of ‘Larger Than Life: Architecture Through the Ages,’ we visit the Virginia State Capitol, America’s first Neoclassical public building.

How the 1939 World’s Fair Predicted Europe’s Future

In ‘This Week in History,’ ‘a valley of ashes’ becomes the site of America’s second largest World’s Fair that presents a look at the modern city.

99 Cents Only Stores Are Closing. How I Spent $20 in Groceries at Other Discount Chains

99 Cents Only Stores offered a wide selection of fresh food and prices sometimes beat Walmart.

Surprises Await Off Washington’s Major Highways

The first people of the land named it, “the shimmering heat waves which dance and play above the prairie when the summer sun shines hot.”

Universal Unwraps Some Details for 2 Epic Universe Hotels

Two resorts by Universal Orlando are scheduled to open in 2025.

San Diego County Museums Worth a Trip

Learn about surfing, artwork, music, and more at various museums in San Diego county.

Surprises Await Off Washington’s Major Highways

The first people of the land named it, “the shimmering heat waves which dance and play above the prairie when the summer sun shines hot.”

![[LIVE 4/29 10:30AM ET] Judges Signal Key Trump Charges Could be Dropped](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F28%2Fid5639390-CR-TN_REC_0429-600x338.jpg&w=1200&q=75)

![[Premiering Now] ‘Organ Harvesting Is the Genocide Aspect’: Expert](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F23%2Fid5635552-CIF_TN-0427-ETV-copy-600x338.png&w=1200&q=75)