SPECIAL COVERAGE

Read More

Read More

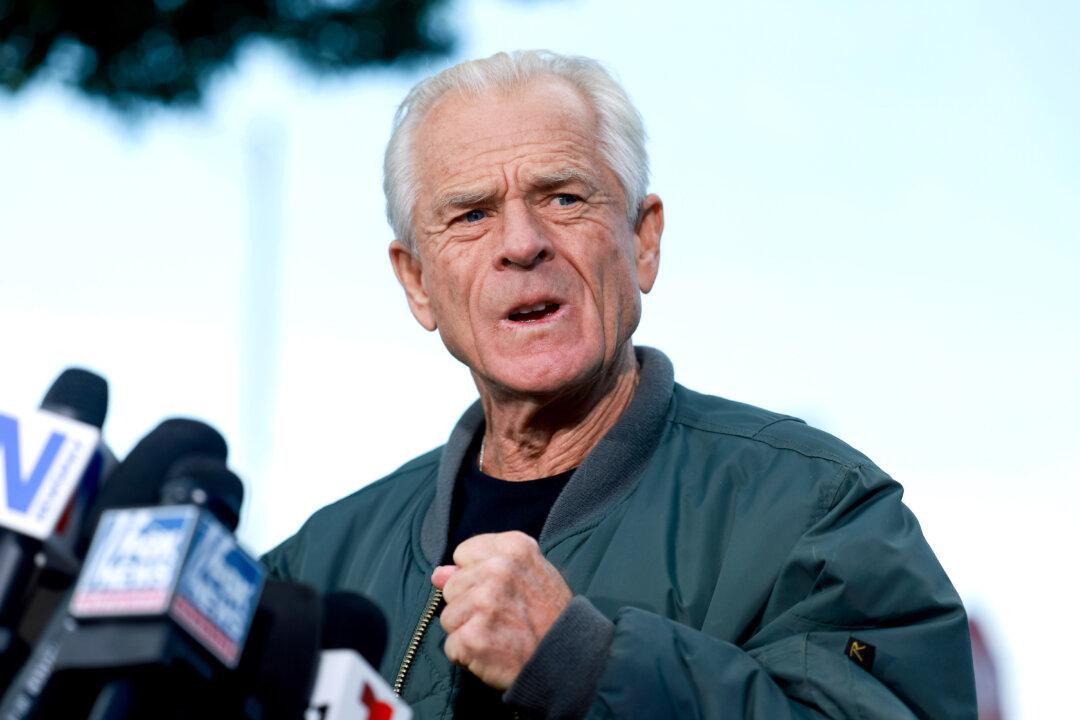

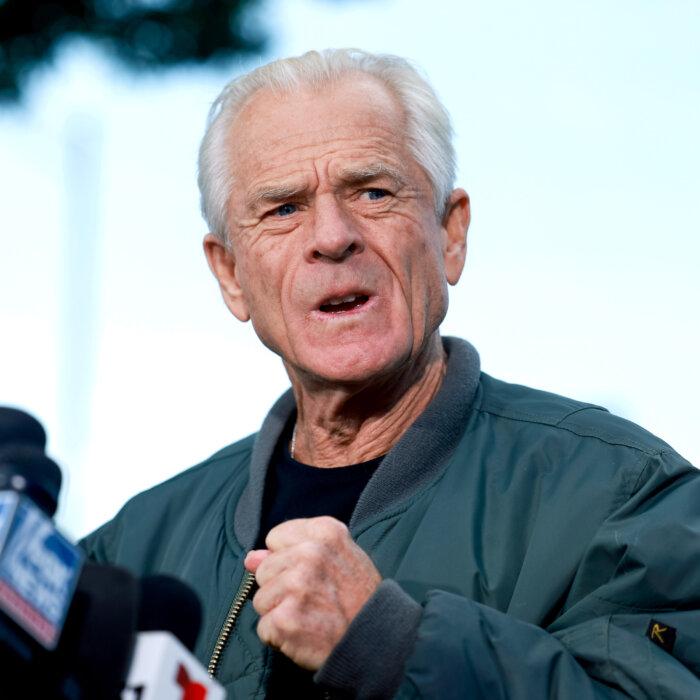

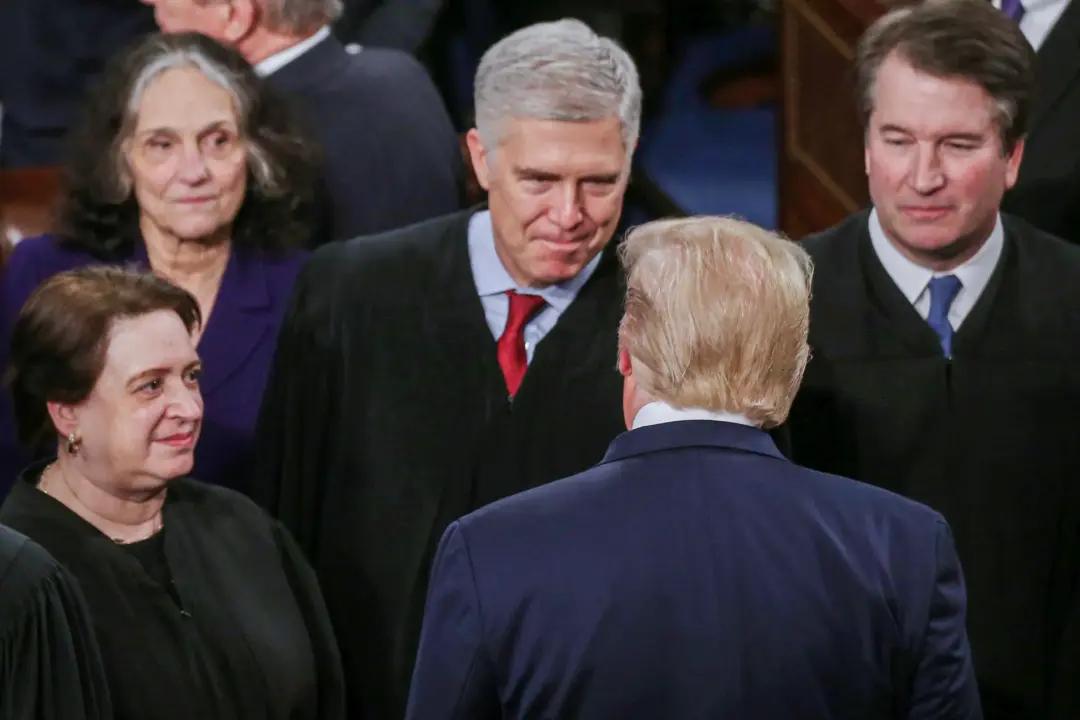

Supreme Court Rejects Peter Navarro’s Request to Leave Prison

‘The application for release pending appeal addressed to Justice [Neil] Gorsuch and referred to the Court is denied.’

Supreme Court Rejects Peter Navarro’s Request to Leave Prison

‘The application for release pending appeal addressed to Justice [Neil] Gorsuch and referred to the Court is denied.’

Trending Videos

Top Premium Reads

Top Stories

Most Read

Biden’s New Nightmare: Escalating Campus Protests

Some protesters say that their anti-war campaign is reminiscent of the demonstrations against the Vietnam War almost 60 years ago.

US Nonprofit Submits Over 81,000 Names of China’s Human Rights Abusers to FBI

The CCP’s persecution of Falun Gong is ‘a crime of genocide and a crime against humanity.’

Gov. Desantis Says Florida Will Not Comply With New Title IX Rules

The changes had been held back by lawmaker opposition and a whopping 240,000 public comments submitted over the 30-day public commentary period.

House Democrats Disappointed in Ongoing ‘Anti-Israel, Anti-Jewish’ Encampments at Columbia University

‘Those who violate the law cannot dictate the terms of the University’s ability to comply with that law.’

California’s Tax Revenue Projections Weakening as Newsom’s Budget Revision Deadline Looms

Sales and use taxes are about $1 billion below forecasts since November.

Early Tests Find Pasteurization Killed Bird Flu in Milk: FDA

Regulators are conducting more testing.

Over 1,000 Protestors Demand Establishment of Islamic State in Germany

The organizers said the rally was to protest the alleged Islamophobic policies of the German government and national media.

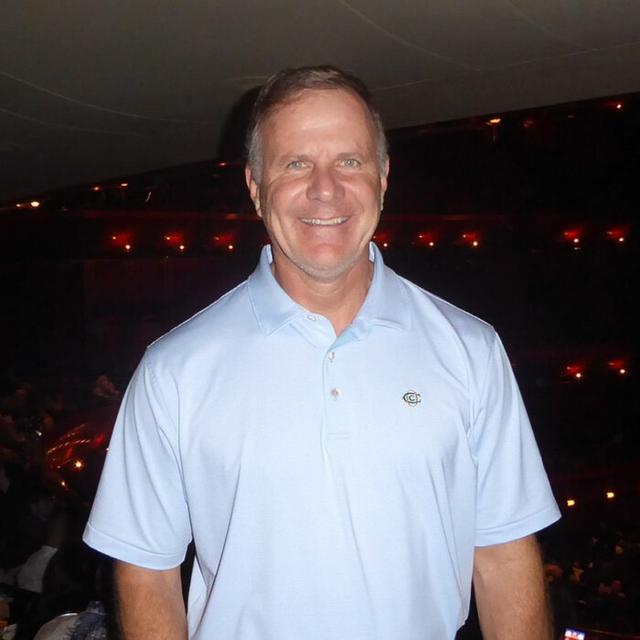

Democrats to Contest All 28 Congressional Districts in Florida for First Time Since 2018

The party is allocating more resources in Florida after the state Supreme Court approved ballot initiatives for abortion access and recreational marijuana.

Tornadoes Devastate Oklahoma, Killing 4 and Injuring Dozens

The storm devastated historic downtown, damaging and destroying many of the city’s downtown businesses.

‘I’m Not Done’: Arizona Lawmaker Commits to Combating Forced Organ Harvesting After Bill Veto

The bill made it through both chambers of the state Legislature with health insurers on board—only to be killed on the governor’s desk.

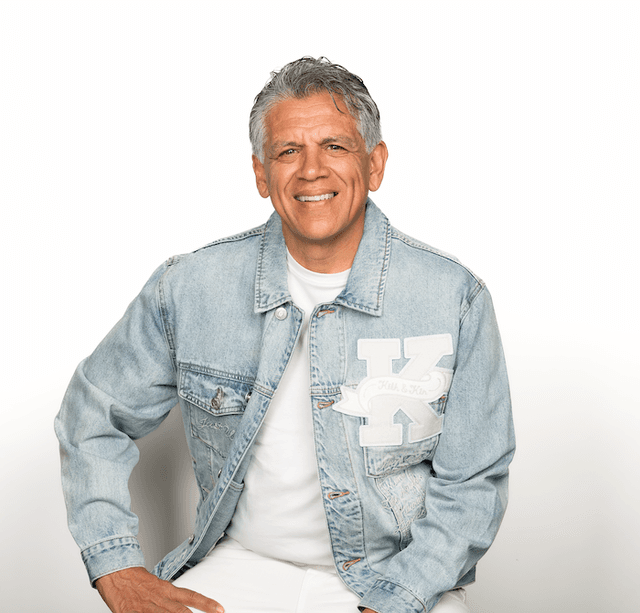

Human Rights Is the CCP’s ‘Biggest Weakness:’ Miles Yu

‘We cannot just engage China on what China is good at, but also by ignoring the weakness, [the] vulnerability of that regime.’

White House Denies Rumors of Secretive Plot to Oust Press Secretary Karine Jean-Pierre

A White House spokesperson denied the rumors and reports.

Supreme Court Justice Gorsuch Issues Caution During Trump Hearing

‘We’re writing a rule for the ages,’ he cautioned last week.

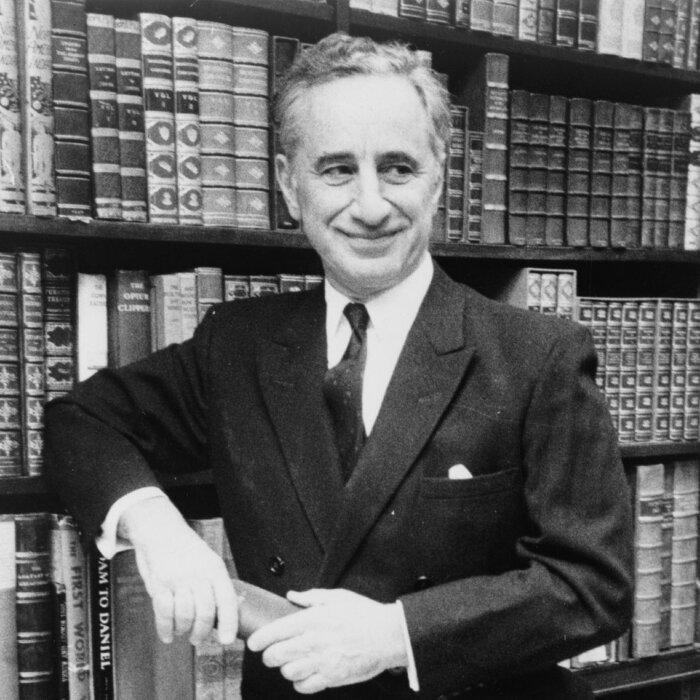

Director Elia Kazan’s Choice: America

Kazan made the hard choice and named names.

Epoch Readers’ Stories

A History Of The American Nation

A patriotic poem by Ted Schneider

Of Cars and Kids

Why should our kids have to settle for a Trabant, or a Pyonghwa, education when they could have a BMW?

A Nation Divided

Poem by an American Patriot

What Is Going on Here?

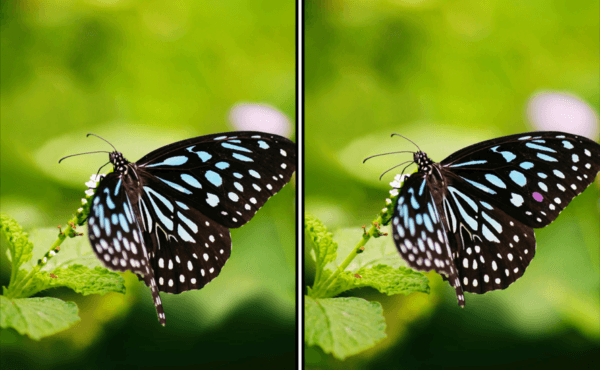

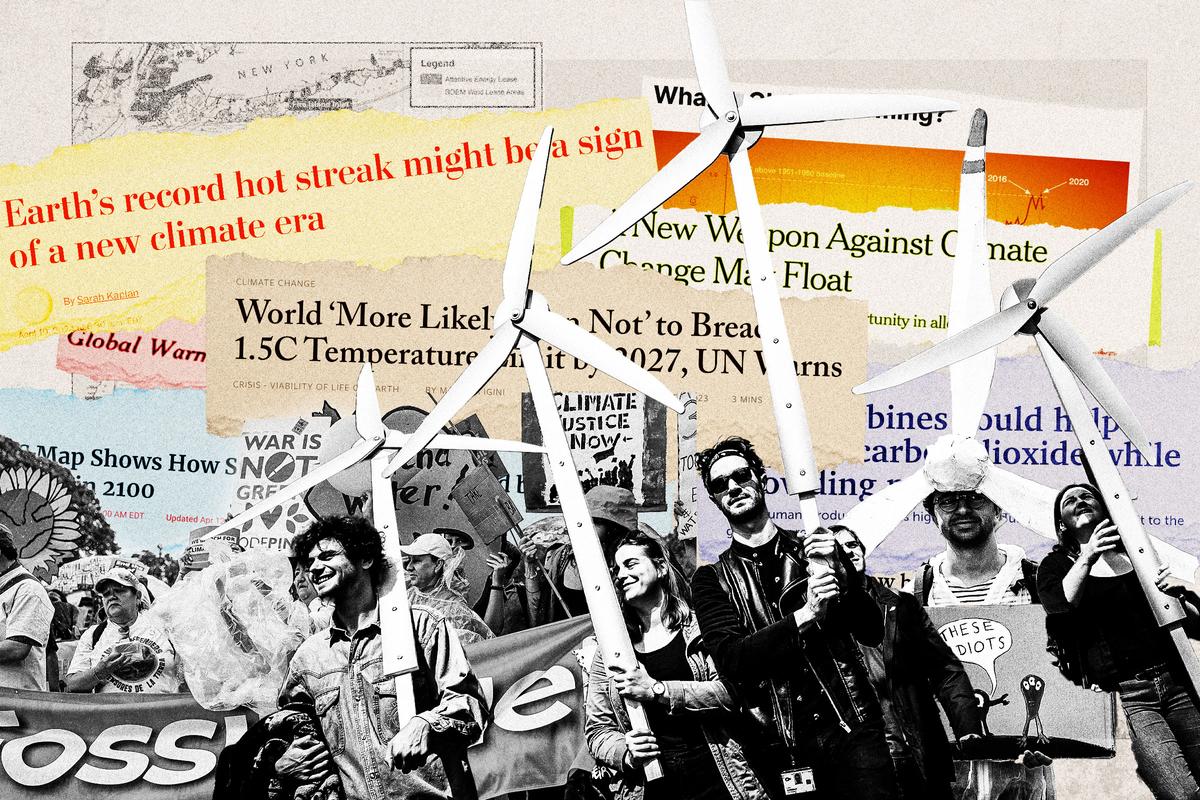

There are two major things plants need to survive and continue generating our life saving oxygen. The first is CO2, and the second is sunshine.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Special Coverage

Special Coverage

The Salt and Cortisol Connection

The terms “salt” and “sodium” are often interchanged—knowing the difference between them and what types of salt are best to eat could improve your health.

The Salt and Cortisol Connection

The terms “salt” and “sodium” are often interchanged—knowing the difference between them and what types of salt are best to eat could improve your health.

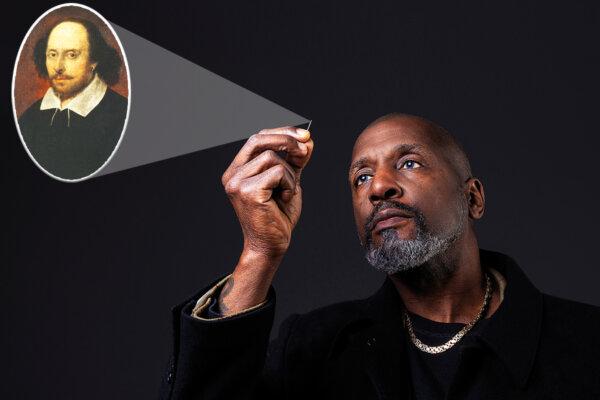

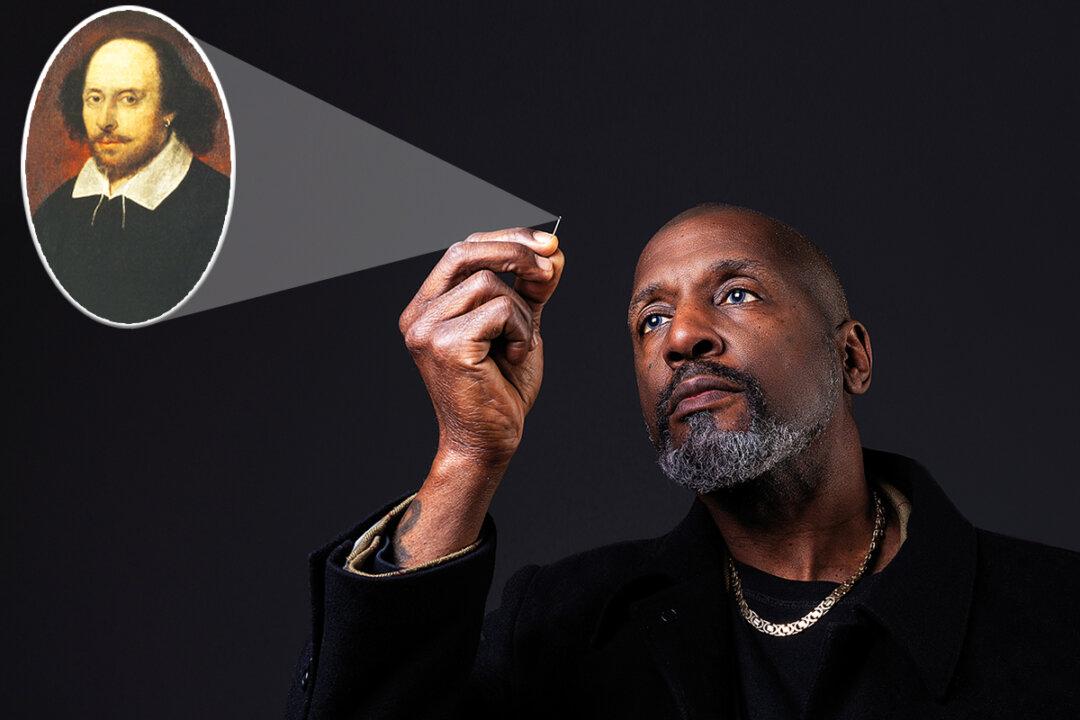

Artist With Autism Creates Microscopic Bust of Shakespeare Inside a Human Hair, Pays Tribute to the World’s Greatest Playwright

April 23 marks the birth and death anniversary of William Shakespeare

‘Jim Thorpe, All-American’: An Olympic Athlete and More

Burt Lancaster gives a strong performance in a finely crafted production about a great American hero.

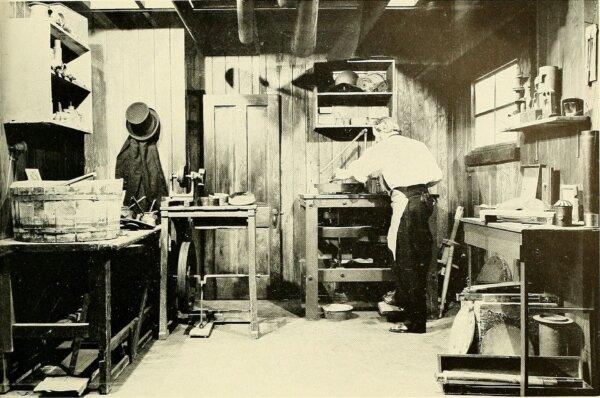

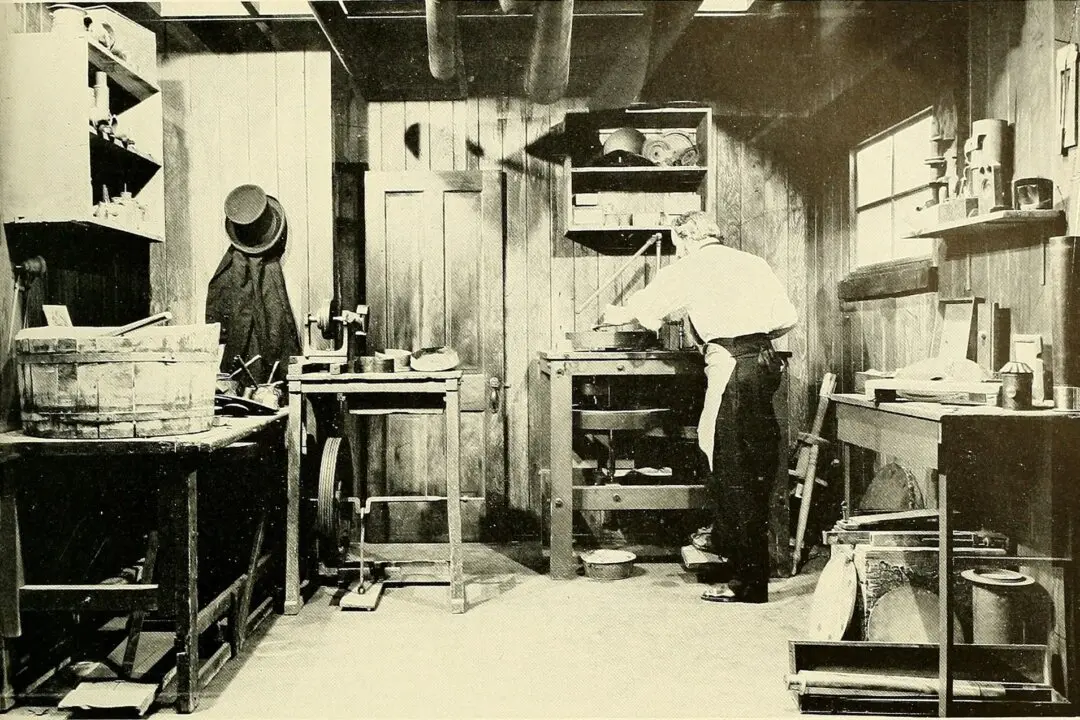

Henry Fitz Jr., America’s Telescope Maker

In this installment of ‘Profiles in History,’ we meet a tinkerer whose interest in the stars led him to build the first American telescope company.

An American Classic: The Republic’s First Statehouse

In this installment of ‘Larger Than Life: Architecture Through the Ages,’ we visit the Virginia State Capitol, America’s first Neoclassical public building.

How the 1939 World’s Fair Predicted Europe’s Future

In ‘This Week in History,’ ‘a valley of ashes’ becomes the site of America’s second largest World’s Fair that presents a look at the modern city.

99 Cents Only Stores Are Closing. How I Spent $20 in Groceries at Other Discount Chains

99 Cents Only Stores offered a wide selection of fresh food and prices sometimes beat Walmart.

Surprises Await Off Washington’s Major Highways

The first people of the land named it, “the shimmering heat waves which dance and play above the prairie when the summer sun shines hot.”

Universal Unwraps Some Details for 2 Epic Universe Hotels

Two resorts by Universal Orlando are scheduled to open in 2025.

San Diego County Museums Worth a Trip

Learn about surfing, artwork, music, and more at various museums in San Diego county.

Surprises Await Off Washington’s Major Highways

The first people of the land named it, “the shimmering heat waves which dance and play above the prairie when the summer sun shines hot.”

![[Premiering Now] ‘Organ Harvesting Is the Genocide Aspect’: Expert](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F23%2Fid5635552-CIF_TN-0427-ETV-copy-600x338.png&w=1200&q=75)