Commentary

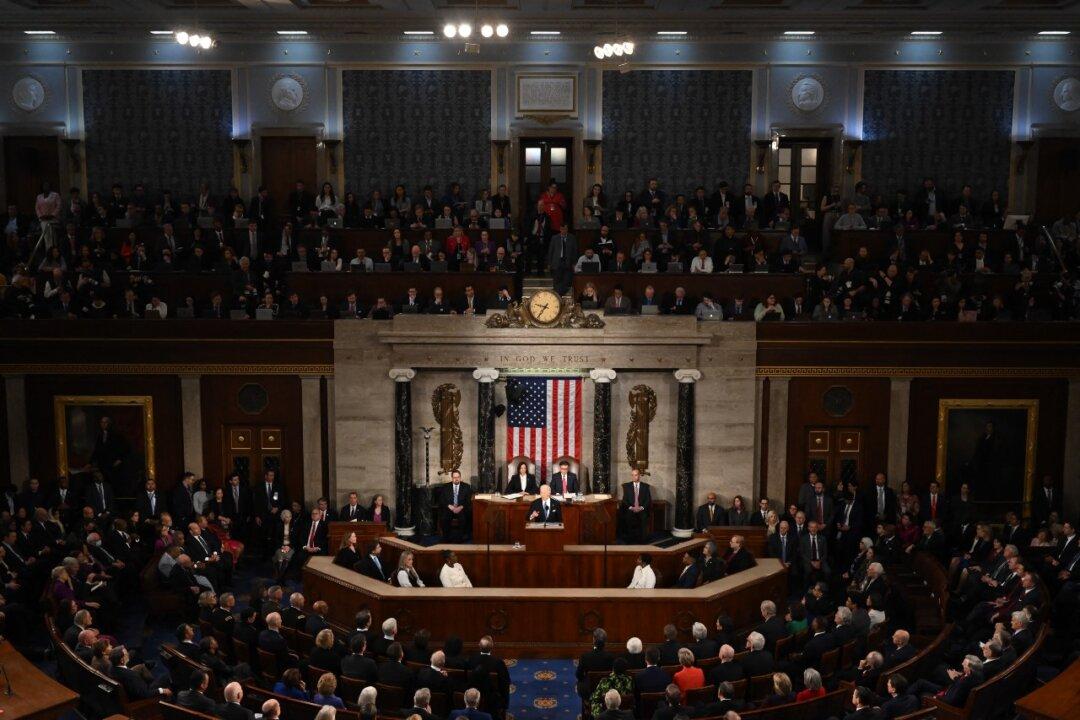

One of my cousins has been bombarding me in recent months with a steady stream of corporation-bashing emails from various left-wing and Democratic organizations. The animus against corporations is vehement, to say the least. And that animus will be a feature of President Joe Biden’s reelection campaign, as was made clear in his State of the Union (SOTU) Address on March 7.