“Every stock market investor should consider balancing his market risk with real precious metals and not just gold stocks, which like all stocks, are subject to business risk as well as market risk (and can be extremely volatile at times),” advised Monex, an investment firm, on its website.

Investors’ taste buds for precious metals, especially gold, have been whetted because the value of these metals has increased substantially since January 1971, when one ounce of gold was $38, one ounce of platinum was $109.50, one ounce of palladium $35.04, and one ounce of silver $1.394, less then $2.

It can’t be said, however, that there were no up and down swings in precious metal prices throughout the years.

Gold peaked at an average annual gold price of $612.56 in 1980. At that point, the downward slide took on a course of its own, with slight ups and downs through the years, bottoming out at $246 in October 1998. The latest upward trajectory began in October 2006, after the brakes were hit on a downward slide.

The gold price jumped by 29 percent last year, reaching $1,405 per ounce by the end of 2010.

The World Gold Council suggests that the price of gold increased not only because of inflationary forces but was also artificially inflated by India’s and China’s rush into the gold market by both of their private and public sectors.

A recent World Gold Council report noted, “Not only was gold’s performance strong, but its volatility remained low, providing a foundation for a well diversified portfolio.”

On Feb. 28, one ounce of gold was $1,410, silver reached $33.34, platinum $1,806, and palladium $790. The prices moved up $6, $0.79, $17, and $12, respectively, from the prior day, as published by the Monex Precious Metals website.

On the subject of gold price increases, an article on the kursDinar website advised, “The price of gold in the long term, one year or more based on a statistical trend up—that the longer the time the clearer the trend of [t]his. However, this increase does not follow a straight path, but swing[s] like a pendulum on the clock.”

Race for Owning Gold

In 2010, demand for gold increased by 9 percent over 2009, reaching a 10-year high of 3,912.2 tons, according to the World Gold Council.

“This performance was mainly attributable to strong growth in jewelry demand, the revival of the Indian market and strong momentum in Chinese gold demand, and a paradigm shift in the official sector, where central banks became net purchasers of gold for the first time in 21 years,” informed the World Gold Council report.

Central banks had pumped gold into the market for more than 20 years. This trend reversed when emerging market central banks, including Mauritius, Sri Lanka, Kazakhstan, and the Philippines, stepped up their gold purchases. The largest buyers included India, Russia, and China.

Voracious Appetite for Gold

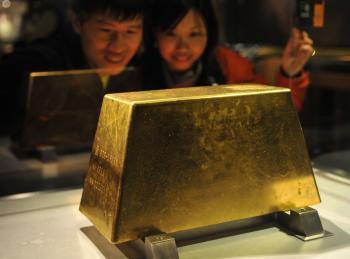

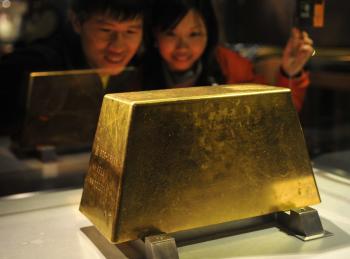

The most voracious appetites for gold were displayed by India and China, with Indians buying 746 tons, a 69 percent increase over 2009, and mainland Chinese buying 400 tons of gold in the form of jewelry.

In 2010, mainland Chinese bought 179.9 tons of gold in the form of bars and coin, a 70 percent increase over 2009. China garnered the gold market by obtaining 25 percent of the world’s gold production.

“Growth in this sector was dominated by China, where investors continued to clamor for gold bars and coins,” informs the World Gold Council report.

ICBC (Industrial Bank of China) published a gold accumulation plan, which led to the amassing of 11.5 tons of gold during 2010.

“For one thing China is already the globe’s largest producer [of gold]. So, it has its own domestic supply of gold,” states a recent article on the Oxstone Investment Club website.

Speculating about Chinese intentions, Oxstone said, “Possibly the Chinese are utilizing far greater amounts of their savings to purchase gold, rather than increase domestic consumption. Or that official figures of Chinese wealth are being understated.”

Economic Tidbits

Economic theory suggests, and reality has proven, this theory to be true when it comes to gold, that investors will sell gold when gold prices are high.

“Because this [unloading gold] is done simultaneously by a large number of investors—the prices driven down (swing down) until a point is perceived as the lowest point,” rationalizes the kursDinar website article. The reverse happens when gold prices reach a low threshold. Large numbers of investors will load up on gold and drive the price up as the supply dwindles.

“While gold has historically been an integral part of financial markets, it is worth noting the increasing trend among financial institutions, most recently JP Morgan, to use gold as collateral in many transactions and securities lending,” suggested a recent World Gold Council report.

Word of Caution to Investors

“Even with gold’s recent appreciation and the financial crisis crushing the stock market, large cap equities ... have outperformed gold ... by a large margin since 1987. And that doesn’t even take into account that stocks can earn dividends, while holding gold can incur costs in the form of storage and/or insurance expenses,” advises an article on the Seeking Alpha website.

The economic upheaval turned the financial markets upside down, but at the same time had a positive effect on the price and demand of gold. However, past trends suggest that gold prices could drop significantly and leave the holder of gold holding the short end of the stick, at least in the short term.

Governments could decide to confiscate gold held by their populations. On April 5, 1933, President Franklin D. Roosevelt confiscated all gold held by the general public and outlawed the hoarding of gold, that is, gold coins, gold bullion, and gold certificates.

“The U.S. government has the authority to prohibit the private possession of gold and silver coin and bullion by U.S. citizens during wartime, and during wartime and declared emergencies, to freeze their ownership of shares of mining companies, the Treasury Department has told the Gold Anti-Trust Action Committee,” as published by the USA GOLD website in a 2005 press release.

Friends Read Free