U.S. Steel made a record $4.174 billion net earnings for 2021, or $14.88 per diluted share, and fourth quarter 2021 net earnings of $1.069 billion, or $3.75 per diluted share, owing to a robust economic recovery and high price for steel driven by strong demand.

The company outperformed Wall Street expectations and has climbed over 4.5 percent in Friday’s trading. Compared to Q4 2020, U.S. Steel gained more than 1,600 percent when it earned 22 cents a share, or $49 million, in Q4 2021 when earnings rose to nearly $1.1 billion, or $3.75 a share.

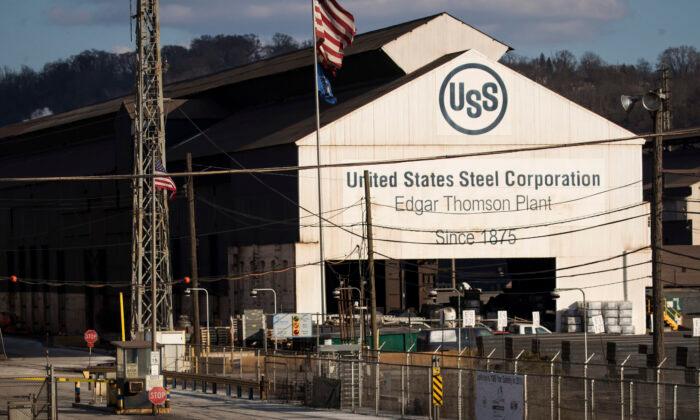

Sales have gone up from $2.56 billion in 2020 to $5.62 billion last year. This number exceeded Factset analysts’ expectations which was $4.37 a share on sales of $5.4 billion. The Pittsburgh-based steelmaker has also authorized $500 million worth of stock buyback which will begin in the first quarter.

“2022 will be another year of strategic progress and upon completion, our announced strategic investments will deliver approximately $850 million of incremental through-cycle earnings power with winning customer solutions while reducing our capital and carbon intensity. We are becoming a better, not bigger company as we continue to innovate and develop the next generation of our sustainable steel solutions for our people and our planet.”

With a liquidity of $4.97 billion, U.S. Steel holds a cash reserve of $2.52 billion. The company, which operates Gary Works and the Midwest Plant in Portage, Indiana, made adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $1.728 billion during Q4 2021 and $5.592 billion for 2021.

According to the earnings report, the company had a net loss in 2020 of $1.165 billion, or $5.92 per diluted share, and an adjusted net loss of $920 million during the year or $4.67 per diluted share. The adjusted net loss for Q4 2020 was $60 million, or $0.27 per diluted share.

During the last quarter, U.S. Steel had repurchased $150 million worth of common stock as part of its $300 million buyback program announced in October 2021.

“We have never been more confident in our Best for All strategy as we reward stockholders with a new $500 million stock buyback authorization as part of a balanced capital allocation approach," Burritt concluded. “This is in addition to our previously announced $300 million authorization and our continued $0.05 per share quarterly dividend. We look forward to another year of progress for investors, customers, employees, and the communities where we live and work.”

Friends Read Free