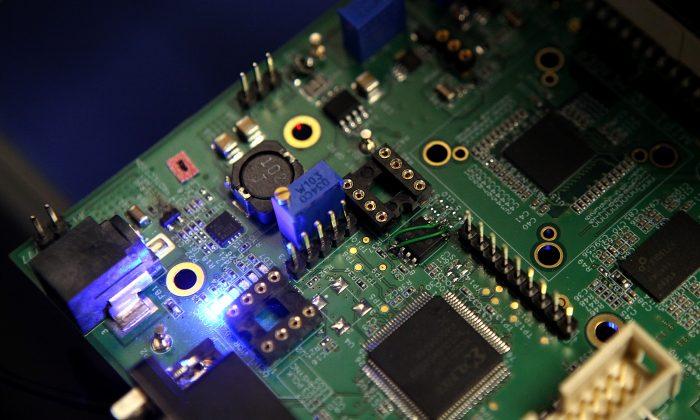

Both houses of Congress have tabled new legislation to boost domestic production and development of semiconductors, which are chips that power everything from smartphones, computers to missiles systems.

“As the Chinese Communist Party (CCP) aims to dominate the entire semiconductor supply chain, it is critical that we supercharge our industry here at home,” he said.

The bill would require that the secretary of commerce create a $10 billion federal program to match incentives offered by state and local governments to companies for constructing semiconductor manufacturing plants in the United States.

Companies would also be entitled to tax benefits in the form of refundable investment tax credits (ITC) for expenses related to purchasing semiconductor equipment or building manufacturing facilities. The ITC rate would be 40 percent through 2024, 30 percent in 2025, and 20 percent in 2026.

Additionally, the bill would set aside $12 billion in research and development funds for various federal agencies. For example, the National Science Foundation (NSF) would receive $3 billion to implement basic research programs.

A $750-million trust fund over ten years would also be established for activities such as aligning U.S. policy on developing microelectronics with those of foreign government partners.

If passed, the U.S. president would be required to establish a subcommittee on semiconductor leadership through the National Science and Technology Council, to ensure U.S. leadership in semiconductor technology and innovation.

“This legislation would help stimulate advanced semiconductor manufacturing capabilities domestically, secure the supply chain, and ensure U.S. maintains our lead in design while creating jobs, lowering our reliance on other countries for advanced chip fabrication, and strengthening national security,” Cornyn said in the press release.

“The U.S today accounts for only 12 percent of global semiconductor manufacturing capacity,” said Keith Jackson, SIA chairman and president and chief executive officer of U.S. firm ON Semiconductor.

Jackson added that the bill would allow the United States to “remain the world leader in chip technology, which is strategically important to our economy and national security.”

But in terms of manufacturing, there are three companies in the world capable of producing the fastest and most advanced chips: U.S. firm Intel, South Korean tech giant Samsung, and Taiwan-based TSMC, the world’s biggest contract chipmaker.

Intel has six chip plants: three in the United States, one in Ireland, another in Israel, and one in Dalian city, China.

Although China lags behind in semiconductor manufacturing capabilities—with China’s chipmakers at least two generations behind TSMC—some parts of the supply chain are based in China. For example, TSMC and Samsung both have chipmaking factories in China.

IC Insights pointed out that China-based companies only produced $7.6 billion (38.7 percent of production) worth of semiconductors, while the remaining $11.9 billion (61.3 percent) of chips were produced by foreign companies such as TSMC, Samsung, Intel, and Korean chipmaker SK Hynix that have factories in China.

“IC Insights forecasts that at least 50% of IC [integrated circuit] production in China in 2024 will come from foreign companies such as SK Hynix, Samsung, Intel, TSMC, UMC, and Powerchip with fabs in China,” the report stated. UMC and Powerchip are both Taiwan-based semiconductor companies.

Friends Read Free