The number of initial jobless claims—a measure of Americans newly applying for unemployment benefits—fell in late January, in a sign that the robust U.S. labor market remains on solid footing.

![4-Week Moving Average of Initial Jobless Claims [IC4WSA]. (U.S. Employment and Training Administration / FRED)](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2020%2F01%2F30%2F4-Week-Moving-Average-of-Initial-Claims-Weekly-Seasonally-Adjusted-3.jpg&w=1200&q=75)

The newly released claims numbers are advance figures and subject to revision. The current release revised upward the previous week’s initial claims level by 12,000 from 211,000 to 223,000, the Labor Department noted.

The number of continued jobless claims—a measure of Americans collecting unemployment benefits on an ongoing basis—fell during the week ended Jan. 18 by 44,000 to 1,703,000. The four-week moving average of continued claims dropped by 6,250 to 1,755,500.

![4-Week Moving Average of Continued Claims (Insured Unemployment) [CC4WSA]. (Source: Source: U.S. Employment and Training Administration / FRED)](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2020%2F01%2F30%2F4-Week-Moving-Average-of-Continued-Claims-Weekly-Seasonally-Adjusted-2.jpg&w=1200&q=75)

The total number of people claiming benefits in all programs for the week ending Jan. 11 was 2,171,792, a decrease of 106,447 from the previous week. There were 2,148,787 persons claiming benefits in all programs in the comparable week in 2019, which reflects a year-over-year drop of 1.06 percent.

Fed Keeps Rates on Hold, Citing Strong Labor Market

The Federal Reserve on Jan. 29 kept interest rates unchanged, noting in a statement that “the labor market remains strong and that economic activity has been rising at a moderate rate.”“Job gains have been solid, on average, in recent months, and the unemployment rate has remained low,” the Fed’s rate-setting body stated after members voted to hold the benchmark Federal Funds rate within a target range of 1.5 to 1.75 percent.

Economic Growth in 2019

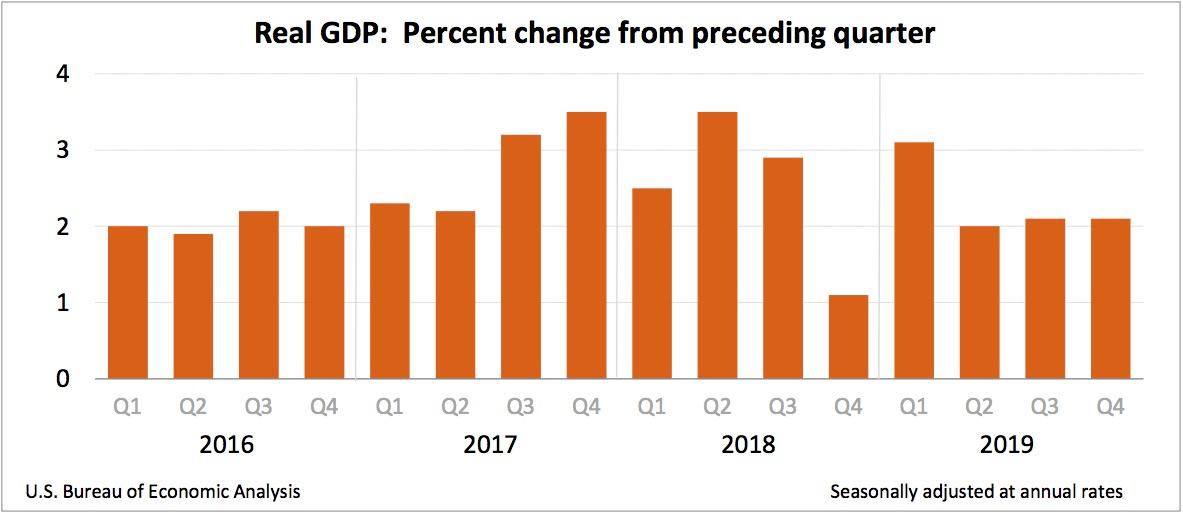

The U.S. economy maintained a steady rate of growth in the fourth quarter of 2019, with newly released Commerce Department figures showing that the year-over-year quarterly rate of expansion was 2.1 percent.This rate of growth, which compares the fourth quarter of 2019 with the fourth quarter of 2018, remains unchanged from the previous quarter.

Headwinds to economic expansion include negative contributions from private inventory investment and nonresidential fixed investment, the Commerce Department said.

The GDP number is an advance estimate and is subject to revision.

Economic growth for the full year came in at 2.3 percent for 2019, the Commerce Department figures show, which is a drop of 0.6 percent compared to the 2018 rate of economic expansion of 2.9 percent.

Factors that helped lift the GDP in 2019 include positive contributions from personal consumption expenditures, nonresidential fixed investment, federal government spending, state and local government spending, and private inventory investment.

The Commerce Department attributed headwinds to 2019 growth mostly to a slowdown in nonresidential fixed investment and personal consumption, as well as contraction in exports.

Friends Read Free