WASHINGTON—As states across the country progress through their reopening phases, some economic indicators that surpass expectations have boosted hopes of a speedy U.S. recovery.

A spike in retail sales and in personal consumption in May indicated that consumers were back and eager to open their wallets.

While the U.S. economy shows clear signs of recovery, some economists are taking a more cautious stance, raising concerns about the possibility of a second wave of COVID-19 that could stall reopening plans and hurt consumer spending.

Despite some setbacks in several states, White House economic adviser Larry Kudlow still predicts a sharp economic recovery in the second half of the year.

“Virtually every number is showing a V-shaped recovery now—private surveys, government statistics, restaurants, home builders, truckers, durable-goods makers, Apple mobility and travel, gasoline demand,” he said on June 26 during a workforce policy roundtable at the White House.

The consumer spending number is “tremendous” and will continue to be a key driver of the recovery, he said.

Consumers increased their spending by a record 8.2 percent in May after sharp drops in March and April caused by strict lockdown measures across the country. American consumers account for more than two-thirds of economic activity and are expected to spend more in the coming months as stores and restaurants reopen their doors.

The U.S. consumer confidence in June also posted the biggest increase since late 2011, beating the estimates.

According to Kudlow, if consumer spending grows by 20 percent in the second half of the year and 5 percent in the first quarter of next year, “we will be right back to the peak in 2019.”

Retail sales, which account for about a quarter of all consumer spending, rose 17.7 percent in May, marking the biggest monthly increase ever.

“Recent economic indicators, including the strong May retail sales report, suggest that the coronavirus hit is abating more quickly than expected,” Jan Hatzius, chief economist at Goldman Sachs, said in a report.

The Wall Street firm on June 17 revised up its forecasts for the gross domestic product (GDP) and unemployment for 2020 and estimated a “front-loaded” recovery.

According to the revised forecasts, there will be a stronger rebound in the third quarter, with 33 percent economic growth, up from 29 percent previously. Hatzius also raised the outlook for the full-year GDP contraction to -4.2 percent from -5.2 percent earlier.

The pandemic devastated the U.S. labor market, leaving millions out of work. But the U.S. economy added 2.5 million jobs in May, making a stunning comeback. A sharp drop in the unemployment rate suggested that Americans were returning to work.

Goldman Sachs lowered its projections for the jobless rate as well. It now forecasts a 9.5 percent rate by the end of 2020, down from a previous estimate of 10 percent.

Forecasters warn of significant risks to the recovery, with many predicting the economy won’t return to pre-pandemic levels until mid-2021.

“The virus outlook is perhaps the single most important factor determining growth risks over a longer horizon,” Hatzius wrote.

However, he predicts a significant upside surprise, should a vaccine arrive earlier than expected.

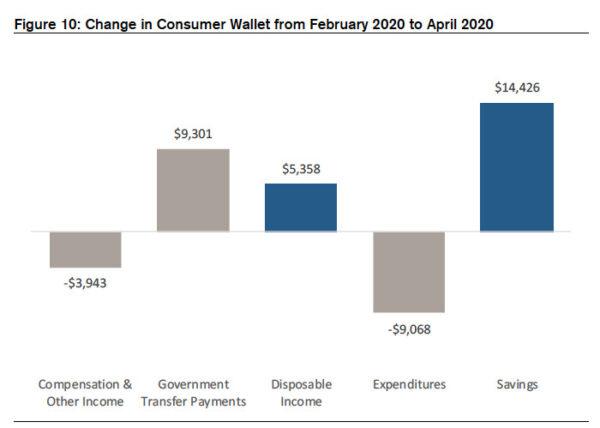

Note: All measured on an annualized per capita basis.

The increase in government transfer payments and a drop in spending contributed to a large jump in personal savings in recent months.

On an annualized per capita basis, the savings from February to April have expanded by $14,426, according to Jonathan Golub, chief U.S. equity strategist at Credit Suisse.

Reopening Setbacks

Gauges of mobility have risen over the past few weeks as states have lifted their lockdown measures. However, the recent spike in CCP virus cases has led more than a dozen states to consider changing or pausing phased reopening plans.There’s a reversal of mobility trends and a cutback in economic activity in these hardest-hit states, according to Matthew Luzzetti, chief U.S. economist at Deutsche Bank.

“States with faster case growth are now underperforming economically based on measures of small business activity, restaurant bookings, and consumer spending,” he wrote in a report dated June 24.

According to his analysis, the continued spread of the virus remains a significant threat to the recovery as about 30 to 50 percent of GDP comes from counties that have seen worsening virus trends.

“This new inverse relationship between economic activity and COVID cases is particularly acute for several of the states exhibiting the most troubling trends, including Arizona, Florida, South Carolina, and Texas. The lesson is that behavioral changes in response to COVID trends can hinder the economic recovery even if states do not reimpose containment measures,” he wrote.

Conversely, earlier hotspots such as New York, New Jersey, and Massachusetts are seeing declines in new cases.

Besides the risk of a second wave of infections, economists believe there are other significant challenges to the recovery, including a reluctance to spend from consumers and a lack of an additional fiscal stimulus from Congress.

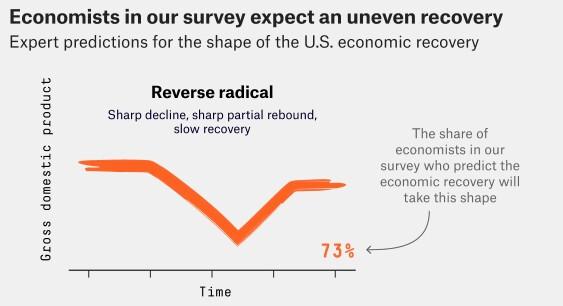

The shape, which 73 percent of economists predicted for the U.S. economic outlook, implies a sharp drop followed by a quick partial recovery and a long period of slower, mixed growth.

A previous survey conducted in May found that the majority of economists predicted a “swoosh shape” recovery (as in Nike logo), which meant a sharp downturn followed by a long, slow recovery.

Many economists believe that another stimulus package is needed to support the recovery. Congress in March passed the $2.2 trillion CARES Act, which provided $1,200 checks to most Americans, and an extra $600 in weekly unemployment benefits through the end of July. Congress may consider another stimulus package this month.

According to Kudlow, any federal spending plan should include a reemployment bonus to encourage more hiring.

Friends Read Free