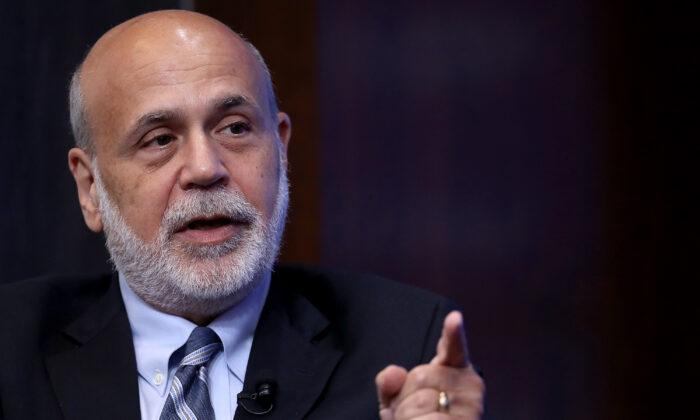

Federal Reserve officials have a “decent chance” of avoiding a recession in the United States with a “soft landing,” former Federal Reserve Chair Ben Bernanke said on Sunday.

“The U.S. economy today is a mixed bag,” Bernanke said on CNN’s “Fareed Zakaria GPS” while noting inflation levels that have reached 40-year highs.

“A recession is possible. Economists are very bad at predicting recessions, but I think the Fed has a decent chance, a reasonable chance of achieving what [Fed Chair] Jay Powell calls a ’soft-ish landing;' either no recession or a very mild recession to bring inflation down,” he added.

Bernanke pointed to a strong labor market in the United States, saying that “with some luck, and if the supply side improves, the Fed can get inflation down without imposing the kind of costs we saw in the early ‘80s.”

The former Fed chair also noted that the central bank “knows it is responsible” for inflation and will take the lead in bringing it down, citing its political support from President Joe Biden and lawmakers in Congress.

Bernanke did, however, note that “some things could go wrong” and said he was counting on the supply chain crisis to improve, adding that there is already “some evidence” that it is.

“I’m hoping and guessing that oil and food prices will at least stabilize and preferably begin to moderate,” he said, while acknowledging that “things could go bad” if the above does not go to plan and inflation persists, leading Americans to start losing confidence in the central bank.

“Then the Fed might have to crack down much harder,” Bernanke said.

Bernanke’s comments come as experts have sounded the alarm on a potential full-blown recession in the United States, despite the Biden administration insisting that inflation is a “top economic priority.”

Friends Read Free