Satellite architecture is required for everything from GPS to bank transactions to missile defense systems. As such, it’s no surprise that both nations are investing heavily in their militaries’ space and counterspace capabilities.

What is often overlooked in this race, however, is just how each nation intends to win.

Indeed, over the past decade, China’s and the United States’ visions for the future of space have increasingly diverged, and the means through which each nation seeks to leverage its native space industry has evolved with those visions.

In China, a growing statist architecture is designed to organize and direct space industry as one part of the whole of society, in unison with the communist whole. The United States, meanwhile, is betting big on American corporations to innovate a new answer to secure peace in the final frontier.

What is certain is that the relationship between these two states and their respective space industries will determine the character of their militaries, and of war, for decades to come.

To understand that, however, it’s necessary to first understand just what the competition is about, and how it got here.

The State of US–China Space Competition

Commercial and military competition between China and the United States has been accelerating for years as relations between the two nations have plummeted. Perhaps nowhere is this more true than in the space domain, which is critical to military and civilian technologies the world over.“The Chinese Communist Party (CCP) is executing a long-term strategy to exploit U.S. technology, talent, and capital to build up its military space and counterspace programs and advance its strategic interests at the expense of the United States,” the report stated.

“China’s zero-sum pursuit of space superiority harms U.S. economic competitiveness, weakens U.S. military advantages, and undermines strategic stability. In short, it represents a threat to U.S. national security.”

All of this has created an imminent demand for next-generation space technologies in both China and the United States. Whether those technologies are rockets, image processing, weather data collection, broadband communications, or something else entirely, the militaries of each nation are in a rush to acquire and field them before the other can.

To be sure, the CCP is currently behind in this race. The United States has about 2,700 satellites in orbit, while China currently has fewer than 500. Much of that satellite infrastructure is dated, however, and terribly prone to attacks that could cause cascading failures across a plethora of systems.

As such, the No. 1 driving factor in assessing the weakness or strength of space-based systems is currently its resiliency as measured by the size of its satellite clusters. To this end, China and the United States are looking to the growing commercial space industry for scalable, affordable answers as to how they might get as many satellites up and running as quickly as possible.

What these companies are creating, then, and how governments can leverage it, is the central issue at the heart of the new space race, and will determine the success or failure of national and military strategies in the decades to come.

The methods that China and the United States are developing to leverage such technologies, however, are very, very different.

The New Statism: China’s Answer to Development

While the Chinese space industry is managed by a complex array of military and civil organizations, the vast majority of the program is either directly organized or indirectly guided by the CCP’s military wing, the People’s Liberation Army (PLA), and specifically its Strategic Support Force (PLASSF), headquartered in Xi'an in western China.The PLA’s two primary entities for developing the space program are the state-owned China Aerospace Science and Technology Corp. (CASC) and China Aerospace Science and Industry Corp. (CASIC), which used to be a single entity but were split up to promote competition.

CASC carries out most of the CCP’s research and overseas launches for the PLA, while CASIC develops all of China’s missiles.

Those companies, however, largely receive their directives on what to develop from the PLA and its associated entities such as CASC and CASIC, which funnel monies and milestone goals to companies in order to meet the Party’s strategic objectives.

In this way, the CCP’s model for space development is a form of statism not unsurprising to a communist nation, in which the innovation of private companies is commanded which direction to go and their labor is subsumed for the state good.

For the US, a New Commercialism

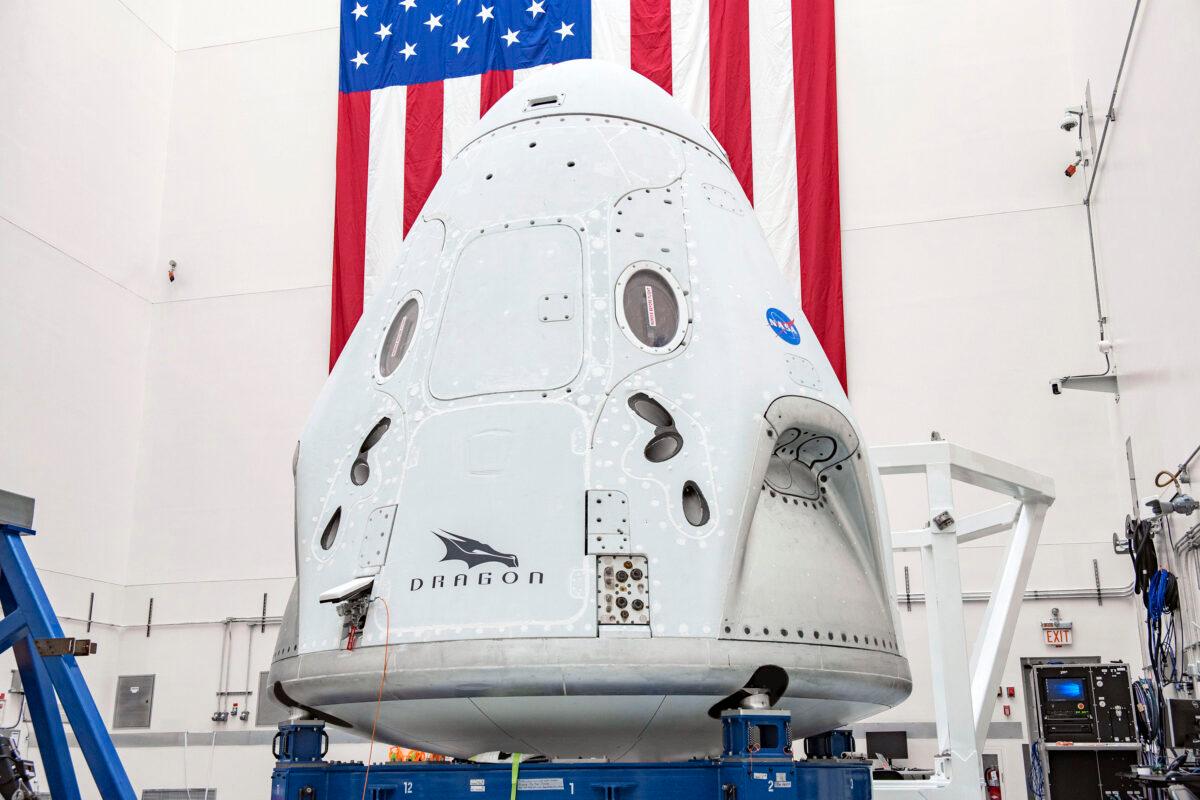

To many, the CCP’s model for space development might appear as merely a heavy-handed version of the U.S. military’s traditional acquisition process, in which the defense bureaucracy lethargically invests increasingly large sums into a few dedicated defense corporations for custom technologies.Indeed, it’s the hope of the U.S. Space Force to co-opt readily available, and cost-friendly, commercial space technologies for all its endeavors except so-called no-fail missions such as missile defense.

Thus, even as the CCP appears to be taking a page from the United States’ old playbook in leveraging the state to purchase from a directed commercial sector, the United States is prioritizing the purchase of dual-use technologies that already serve a commercial market and aren’t entirely dependent on government funding.

U.S. Space Command considers this acquisition-through-collaboration approach to be necessary in an age of ever-evolving and ever-expanding space technologies that, if the government had to fund from scratch, would be out of date by the time they became operable.

“Commercial space activities have expanded significantly in both volume and diversity, resulting in new forms of commercial capabilities and services that leverage commoditized, off-the-shelf technologies and lower barriers for market entry,” the strategy said.

“These developments are contributing to a burgeoning space industry driven by entrepreneurial innovation and investment, advanced technology, decreased costs, and increased demand for space-based services. The [Pentagon] has an opportunity to leverage innovation and cost-effective investments driven by the private sector, presenting opportunities for collaboration to develop game-changing capabilities with a more streamlined and responsive acquisition process.”

A ‘Gold Rush’ for Space Manufacturing

This strategic need for commercial innovation may make the Pentagon much more dependent on the genius behind individual businesses, but has also led to something of a manufacturing boom among up-and-coming space companies in the United States, which are now seeking to have their products picked up for use by the U.S. military.“Government[s] are getting to feed off all of that private industry, investment, and advances, and creating much more capability for nations,” he said.

“I grew up and it was only NASA that did amazing things. Now, commercial companies are doing amazing things and it’s not a rarified event.”

During a speech to the U.S. Chamber of Commerce, Beck said the push to put commercial technologies at the forefront of government initiatives was democratizing space by allowing publicly traded companies to lead the innovation that would improve and protect the nation.

What’s more is that the initiative is already bearing some fruit.

Space in the Age of Technospheres

The heated efforts to accelerate and secure military and civil technologies, both in space and otherwise, are driving the United States and China to develop distinct and mutually unintelligible technologies, according to a new report (pdf) by the Center for Strategic and International Studies, a security-focused think tank.The decoupling of digital innovation, systems, and data flows between Western nations and China, the increased statism of the CCP and standardized corporate leadership of the United States, are compounding the trends that have been in place since the Wolf Amendment in 2011, and creating two very different and rival technospheres.

“The overall geopolitical rivalry between China and the West makes it unlikely that technology decoupling will decrease,” the report states. “Both see technology as a method to promote their respective worldviews while seeing each other’s efforts as focused on national security competition.”

What is left to be seen is how a centrally planned and authoritarian space architecture and an open and freely created one differ, and how they compete.

Friends Read Free