The least-investigated part of the federal government is the senior-level civil service. It’s invisible to mainstream media, mostly because reporters rely heavily on career bureaucrats for reporting and tips. They therefore leave it alone for career reasons, and it becomes a kind of cabal, with each side protecting the other.

The administrative state is easily the most powerful branch of government in terms of influence and longevity, and yet it’s mentioned nowhere in the Constitution. It didn’t even exist from the founding period until the late 19th century. It had little or no power until after World War I. Even today, most Americans know nothing about it, even though its power is evident everywhere.

At least then there would have been some oversight. But that order was shot down by President Joe Biden the day he took office.

The battle over the future of the administrative state—sometimes and rightly called the deep state for its seeming invisible power and permanence—might be the most important issue in American political life today. The massive and overweening power of the federal government utterly depends on it. The Democrats rely on its continuation and, to some extent, the Republicans do, too.

When Trump entered office as president, he naively assumed that he was a kind of CEO. In charge. His wishes would be obeyed. His policies would be enacted. What he faced instead was a power he didn’t anticipate. The swamp he wanted to drain wasn’t a swamp but a Hoover Dam, made of concrete and impossible to move.

They came after him, trying to destroy his presidency. Twice, they struck out, until finally they unleashed the killer app: a pandemic. That put him in the odd position of being forced to listen to the “experts” from inside the government, who told him to shut down the whole economy. Incredibly, and thanks to the persuasion of people within his own administration, he went along with it. After that point, the deep state ran the show while he was sidelined until he was swept out of office.

In any case, many people today are newly aware of this beast that rules the Beltway. Many politicians running today swear that they will take it on and dismantle it. There’s no way to do that other than to defund it completely via Congress. There must be dramatic cuts in funding. There will be cries and screams like we’ve never heard, should that day come. We shall see.

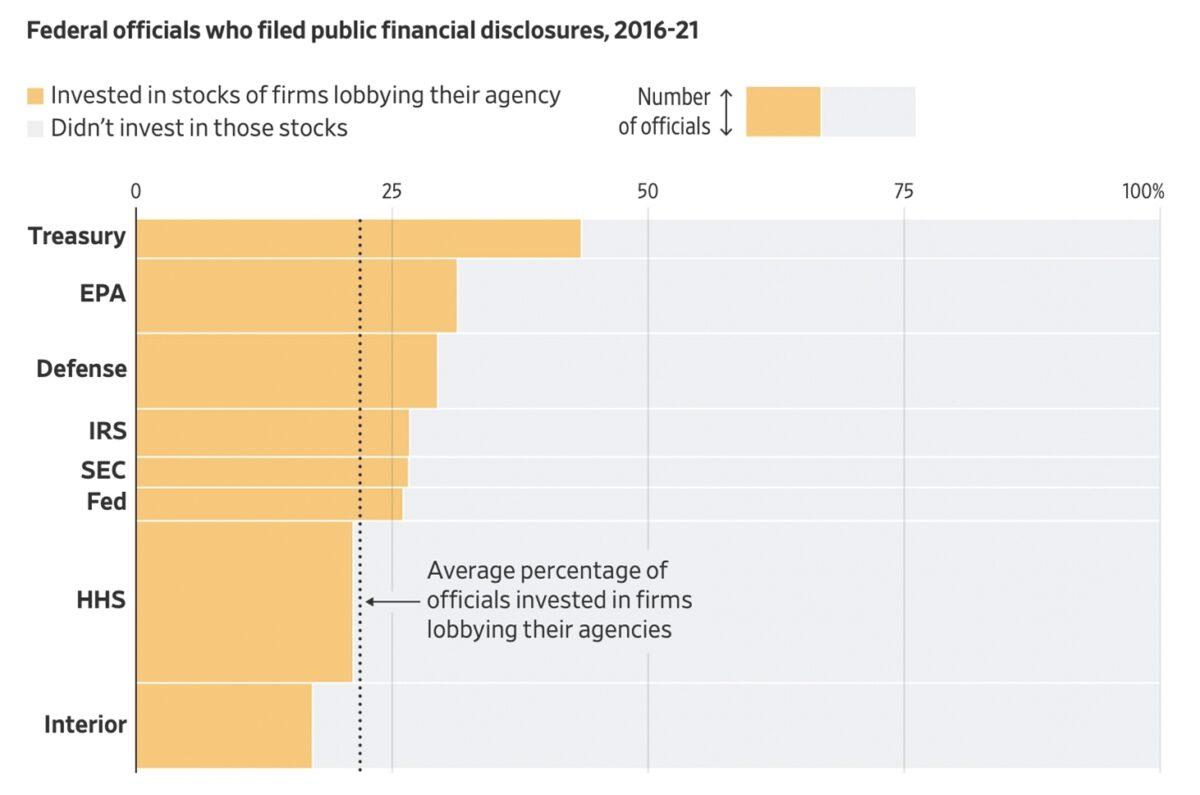

The results are hugely newsworthy and utterly shocking:

“Thousands of officials across the government’s executive branch reported owning or trading stocks that stood to rise or fall with decisions their agencies made.

“More than 2,600 officials at agencies from the Commerce Department to the Treasury Department, during both Republican and Democratic administrations, disclosed stock investments in companies while those same companies were lobbying their agencies for favorable policies. That amounts to more than one in five senior federal employees across 50 federal agencies reviewed by the Journal.”

More than 1 in 5 federal employees have investments in the companies they regulate! This is truly remarkable and much worse than anything I would have imagined.

None of this information is publicly accessible. It has to be requested, and then reporters have to wait for the return of information. One might suppose that reporters would have been all over this for years. In truth, apart from regular coverage in The Epoch Times and now this report from the Wall Street Journal, it’s been entirely ignored.

To put a fine point on it: This is corruption, and it must be more thoroughly investigated. We cannot have companies lobbying rule-making agencies where the individuals with the power to make or break those companies hold a financial position in the outcome.

It is so common now—the virus of corruption so ubiquitous—that this crowd of bureaucrats probably believe this is entirely normal and expected. For goodness sake, they probably brag about it at this point and trade stock tips. This is major third world-level corruption one would suppose we would never see in a constitutional republic. And yet, here it is.

- More than five dozen officials at five agencies, including the Federal Trade Commission and the Department of Justice, reported trading stock in companies shortly before their departments announced enforcement actions, such as charges and settlements, against those companies.

- More than 200 senior officials at the Environmental Protection Agency, nearly 1in 3, reported investments in companies that were lobbying the agency. EPA employees and their family members collectively owned between $400,000 and nearly $2 million in shares of oil and gas companies on average each year between 2016 and 2021.

- At the Department of Defense, officials in the office of the secretary reported collectively owning between $1.2 million and $3.4 million of stock in aerospace and defense companies on average each year examined by the Journal. Some held stock in Chinese companies while the United States was considering blacklisting the companies.

- About 70 federal officials reported using riskier financial techniques such as short selling and options trading, with some individual trades valued at between $5 million and $25 million. In all, the forms revealed more than 90,000 trades of stocks during the six-year period reviewed.

- When financial holdings caused a conflict, the agencies sometimes simply waived the rules. In most instances identified by the Journal, ethics officials certified that the employees had complied with the rules, which have several exemptions that allow officials to hold stock that conflicts with their agency’s work.

In the British comedy series “Yes, Minister”—which is brilliant—we are presented with a picture of an administrative bureaucracy that is skilled at foiling the plans of the politicians and temporary ministers who inhabit it. They show up and are mostly laughed at by the civil service.

The civil service has all the institutional knowledge, and they can break the reputation of appointees without any trouble. This has gone on for decades, and we see it daily in the operation of politics. This is why no matter who comes and goes from office, fundamental change never really happens. These people are masters of making democracy an illusion.

This is bad enough, and good enough reason to immediately institute Schedule F as a first step in the dismantlement of this machinery. In reality, however, the situation is actually worse. It’s not just an impenetrable and impossible bureaucracy, foiling the wishes of voters at every turn. It turns out that it’s also a corrupt financial racket. This story proves it with shocking detail.

Years ago, when federal bureaucracies weren’t entirely closed to the public, I spent some time hanging around offices at the Department of Transportation and the Department of Housing and Urban Development. Both places were a ramshackle mess of laziness, incompetence, disregard, and indifference. The career people there were making bank, specializing in survival, and otherwise totally useless so far as I could tell.

I wondered at the time why more journalists didn’t care to investigate. Later, all these bureaucracies closed themselves to visitors. Now we know why they are especially invisible. It’s because terrible things are taking place in these marble palaces that dominate the D.C. streets. They use their power to puff up their 401Ks. That’s the key to understanding what drives them.

I suppose this is one of those secrets of Washington that everyone knows but no one talks about publicly. If there is ever to be change in this country, there must be deep investigations and decisive action.

Friends Read Free