SPECIAL COVERAGE

Read More

Read More

Supreme Court Grapples With ‘Official’ vs. ‘Private’ Acts in Trump Immunity Appeal

The high court considers whether Trump is immune from prosecution in the federal election case in a decision that could delay his trials further into the year.

Supreme Court Grapples With ‘Official’ vs. ‘Private’ Acts in Trump Immunity Appeal

The high court considers whether Trump is immune from prosecution in the federal election case in a decision that could delay his trials further into the year.

Top Premium Reads

Top Stories

Most Read

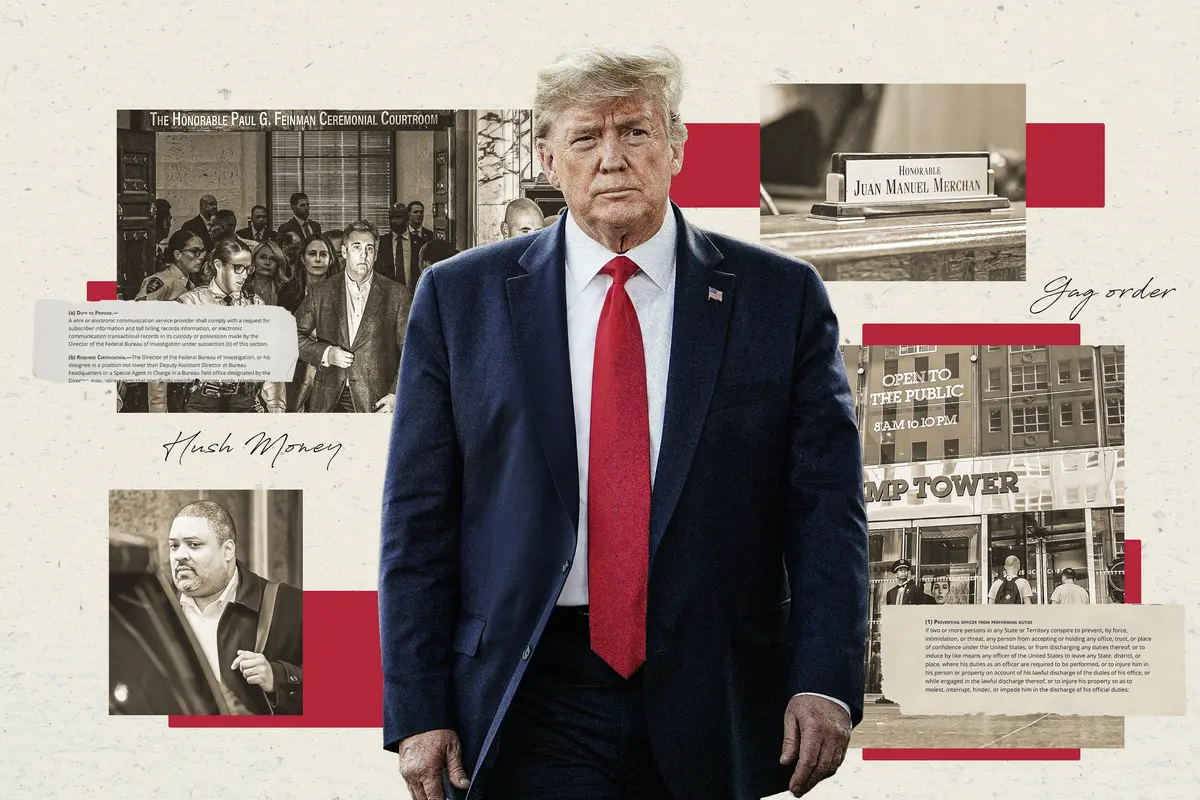

Ex-publisher Pecker Testifies About Deals Made in Trump Trial

Prosecutors charged Trump with 34 counts of falsifying business records, alleging a scheme to influence the 2016 elections.

Indo-Pacific Spending Bill Puts $8 Billion Toward Countering Communist China

‘It’s no secret Communist China is eyeing an invasion of Taiwan, and [Chinese leader] Xi is watching the United States closely,’ said Rep. Bob Latta.

Biden Awards Micron $6 Billion to Boost Chip Production in US

President Biden hailed the investment during a speech in Syracuse, calling it “a big deal.”

JPMorgan CEO Issues Dire Warning About Biden Admininistration’s ‘Huge’ Deficit Spending

‘Deficits which basically aren’t going to go away as far as the eye can see,’ JPMorgan CEO Jamie Dimon said, while warning of stagflation.

Biden Admin Finalizes New Rules to Restrain Fossil Fuel Power Plant Carbon Emissions

The rules include a proposal to implement hydrogen co-firing and carbon capture and sequestration/storage (CCS) technologies in power plants.

Judge Shoots Down Effort to Identify FBI, Undercover Police on Jan. 6

U.S. District Judge Rudolph Contreras agreed with prosecutors that material sought by defendant William Pope “is irrelevant and immaterial.”

Blinken Raises Concerns on Unfair Trade Practices in China

Blinken is on the second trip to China as secretary of state to tackle a series of contentious issues, including trade, human rights, and Russia’s Ukraine war.

House Judiciary Committee Launches Investigation Into Corporate Suppression of ‘Disfavored Platforms’

Coca-Cola and Orsted ’may be acting inconsistent with U.S. antitrust laws.’

Supreme Court Seems Open to Allowing Some Presidential Immunity, May Delay Trump Trial

Justices wrestled with how to define a president’s ‘official’ versus ‘private’ acts. A decision may delay President Trump’s trial, which would hand him a win.

House Lawmakers Introduce Legislation to Hold CCP Accountable for Genocide in China’s Xinjiang

‘Xi Jinping gave his henchmen the order to show no mercy,’ said Rep. Chris Smith.

Editors' Picks

Judge Unseals Documents Showing FBI Discussed ‘Loose Surveillance’ of Trump’s Plane

A large tranche of documents were unsealed by Judge Aileen Cannon on Monday, revealing the FBI’s code name for the probe.

Could Pomegranates Pave the Way for Lower Blood Sugar?

Filled with juicy ruby-red seeds, pomegranates are a fun to eat, delightful seasonal fruit with numerous studies indicating added benefits.

‘Zero Emissions’ Freight: Biden Spending $1.5 Billion to Electrify US Trucking Industry

Transitioning commercial truck fleets requires up to $1 trillion in investment and will potentially push up freight rates, an expert warned.

Outspoken Billionaire Says He’s Considering Voting for Trump

Bill Ackman wrote he is considering the move after voting for Joe Biden in 2020.

Mahler’s ‘Resurrection’ Symphony: Answering Nihilism

Mahler’s “Resurrection” Symphony is the musical equivalent of “Hamlet.” What led to its creation?

Mahler’s ‘Resurrection’ Symphony: Answering Nihilism

Mahler’s “Resurrection” Symphony is the musical equivalent of “Hamlet.” What led to its creation?

Epoch Readers’ Stories

A History Of The American Nation

A patriotic poem by Ted Schneider

Of Cars and Kids

Why should our kids have to settle for a Trabant, or a Pyonghwa, education when they could have a BMW?

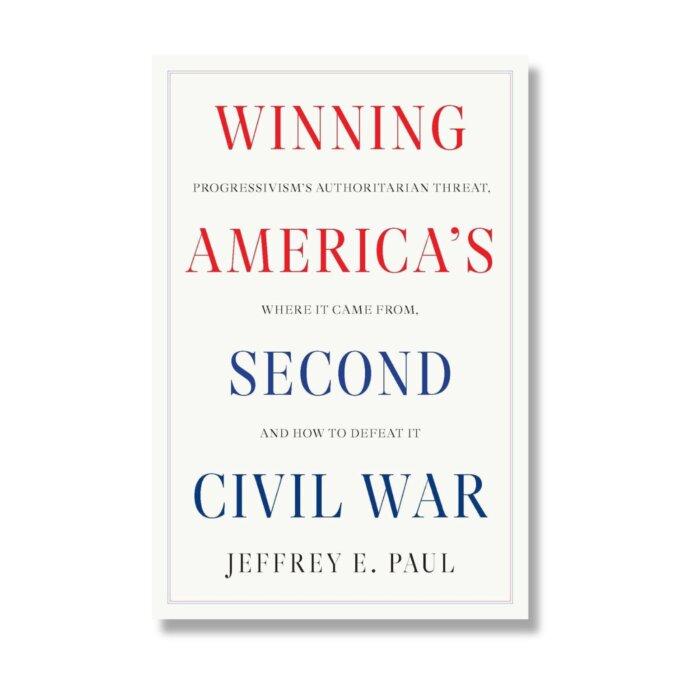

A Nation Divided

Poem by an American Patriot

What Is Going on Here?

There are two major things plants need to survive and continue generating our life saving oxygen. The first is CO2, and the second is sunshine.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Special Coverage

Special Coverage

Starting Antihypertensive Medications Associated With Higher Risk of Falls, Fractures

When first initiated, blood pressure-lowering drugs pose an increased risk of falls for residents living in health care facilities, a new study shows.

Starting Antihypertensive Medications Associated With Higher Risk of Falls, Fractures

When first initiated, blood pressure-lowering drugs pose an increased risk of falls for residents living in health care facilities, a new study shows.

Art Awakens the Soul in Evelyn Waugh’s ‘Brideshead Revisited’

The 1945 novel traces the young man’s path from self-indulgence to a discovery of deeper meaning.

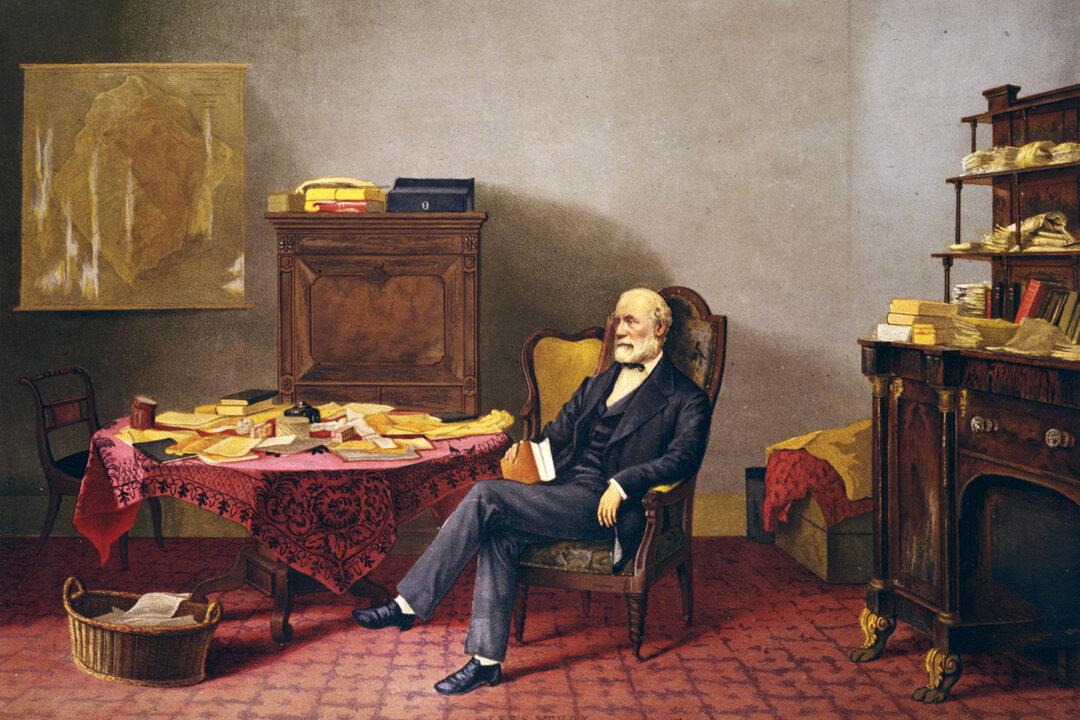

The Two Reputations of Robert E. Lee

While those in the past saw Lee’s stellar qualities, today, some cannot see that he was a man defined, like all of us, by his time.

Morality and Opera: A Traditional Message of Good Versus Evil

In this first installment of ‘A Modern Look at Opera,’ we are introduced to the strong moral messages in this classical performing art.

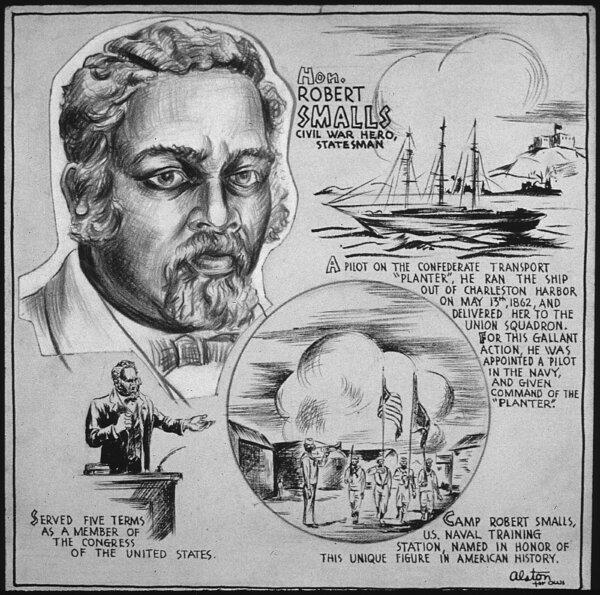

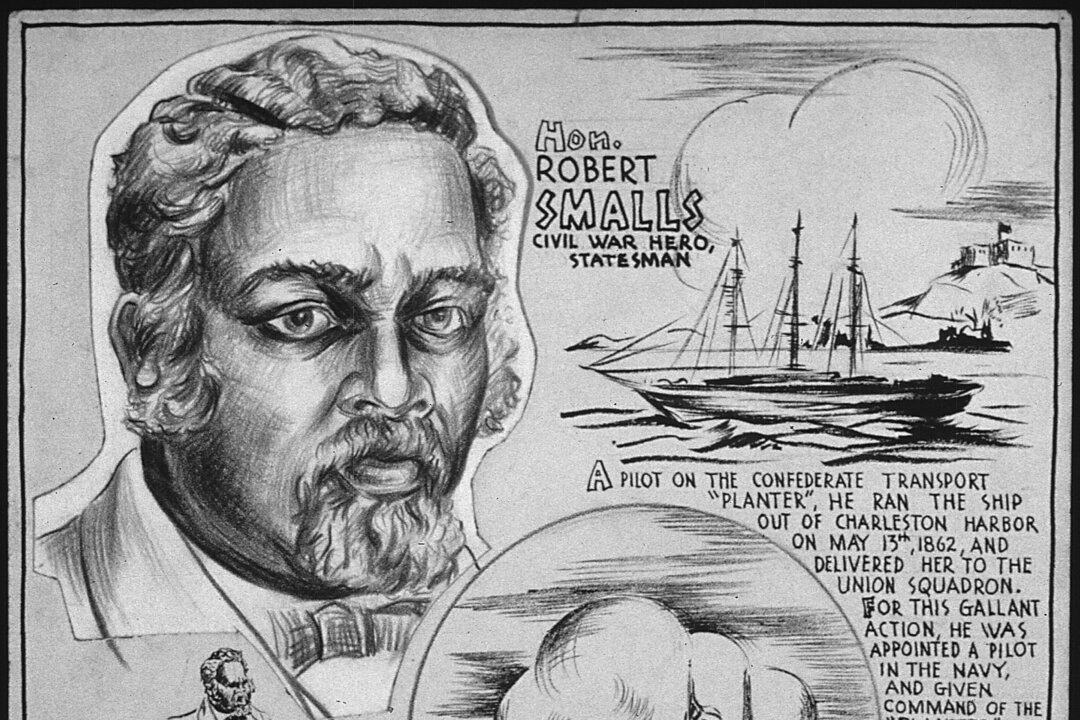

Robert Smalls: Navy Captain and Reconstruction-Era Politician

This former slave would not let anything stop him on the road to freedom.

Jedidiah Morse: Father of American Geography

In this installment of ‘Profiles in History,’ we meet a minister who possessed a keen interest in geography and a concern about Christian liberalism.

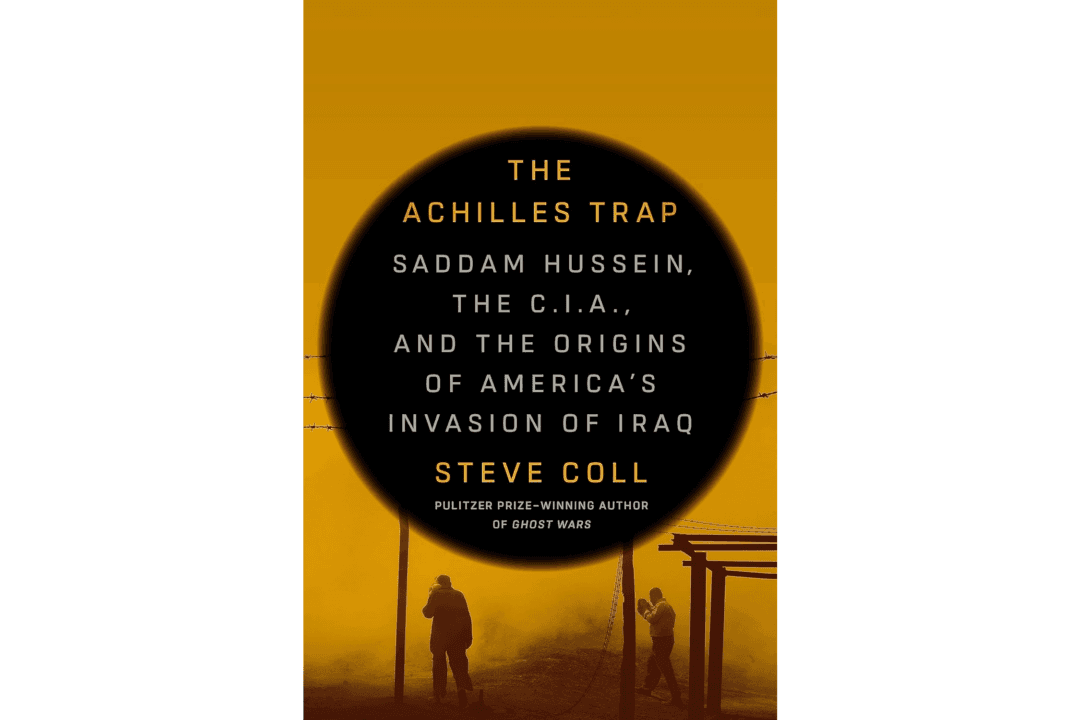

How the US–Iraq Relationship Devolved Into War

Decades of animosity swirl in Steve Coll’s ‘The Achilles Trap: Saddam Hussein, the C.I.A., and the Origins of America’s Invasion of Iraq.'

Opinion: Are You Eating Real Food? The Slippery World of Food Fraud

This empire of deceit is valued at a staggering $50 billion a year.

These Texas Airports Have Flight Cancellation Rates That Place Them Among the Highest in the Country, Study Finds

Airports across the country have made the list with New York and New Jersery placing in the top 3.

Rocky Mountaineer Train Launches Summer Season Promising Spectacular Views

Rocky Mountaineer has four routes that will take passengers through Western Canada and the American Southwest.

After 5 Years of Closure, ‘Glamping’ Back Again in Yosemite National Park

Camping hopefuls can now enter a lottery to experience three of the five available campsites.

These Texas Airports Have Flight Cancellation Rates That Place Them Among the Highest in the Country, Study Finds

Airports across the country have made the list with New York and New Jersery placing in the top 3.

![[PREMIERING 4/25, 9PM ET] Up to 5 Years in Prison for Possession of a Meme? Hermann Kelly on Ireland’s New Hate Speech Bill](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F25%2Fid5637157-240424-ATL_Hermann-Kelly_HD_TN-600x338.jpeg&w=1200&q=75)

![[LIVE 4/26 at 10:30AM ET] New Push Started for Global Digital Currencies](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F19%2Fid5633115-0426-600x338.jpg&w=1200&q=75)