There’s been a lot of hand wringing about the real estate market recently. And with good reason.

Home prices have been on an absolute tear for the past two years. Since the low of the pandemic, home prices have seen 13 consecutive months of increasing prices. By July 2021 they were up 20 percent from the previous year.

In an illiquid market like real estate, that’s an unsettling trend. It raises the specter of 2008 in the minds of everyone who lived through it.

But now that the Fed has gently revealed its closely held non-secret of coming interest rate increases, what’s going to happen to real estate?

Is this bubble getting ready to explode and wipe out trillions of dollars of families’ personal wealth?

Or is it even a bubble?

Mistaking Symptoms for the Disease

People mistake “price” as the only indicator of a bubble… but it’s not.It’s true, every bubble in history—from the tulip bubble all the way back in 1637 to the tech stock bubble in the 1990s to last decade’s real estate bubble—are all distinguished by extreme price levels.

But soaring prices alone, do not a bubble make.

So let’s take a look at 2008 versus today.

The crisis in 2008 was caused by banks and other mortgage lenders making bad loans. “Low-doc, no-doc” loans. “Liar loans.” They always give the bad stuff cute names.

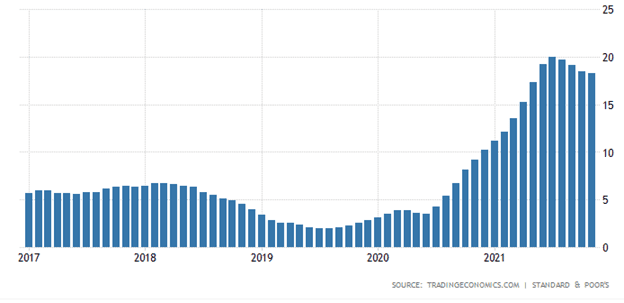

Back in the crisis, a huge number of loans were in the form of adjustable rate mortgages (ARMs). These offered the borrower a super-affordable rate for the first three to five years, and then reset to levels borrowers could never afford. At the height of the last bubble, ARMs represented nearly 60 percent of all mortgages.

Today they represent just over 4 percent.

Leading up to 2008, it was the enticement of easy money that led individuals, who had no business buying a home they couldn’t afford, flocking into the real estate market—to buy homes they couldn’t afford.

It was a nasty cycle: Demand for homes that buyers couldn’t afford kept housing prices constantly on the rise. And easy access to cheap money kept fueling that demand.

Today’s Market Is Very Different

The market still carries a little “FOMO” demand due to cheap pandemic money. But today it’s more of a supply and demand situation.The current boom started with inventory that was in relatively short supply.

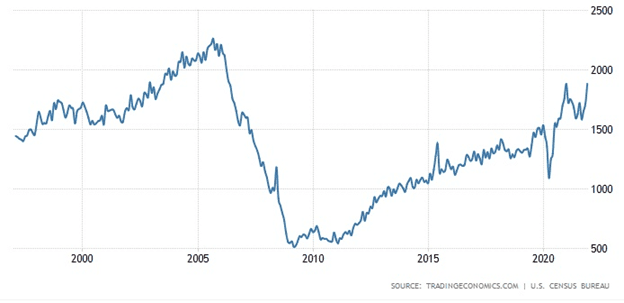

In the early 2000s, there was a building boom that fed demand and created the last bubble. The market got “overbuilt.” But as is typical when markets reach one extreme, they always snap back to the other. By the 2010s, construction practically stopped resulting in an “underbuilt” situation.

Since then, permits have been on the rise and builders’ new home inventory (aka supply) has grown substantially.

Demand, fueled by cheap money, has been outpacing supply which is what has been keeping housing prices inflated.

Prices have been rising, there’s no denying that. But I don’t believe we’re anywhere near bubble territory.

The Ebb and Flow of Real Estate

What has everyone unnerved right now is the fact that the real estate market has been acting more like a momentum stock than typical real estate. It’s like jumping on board Tesla back in 2020.The coming hike in interest rates.

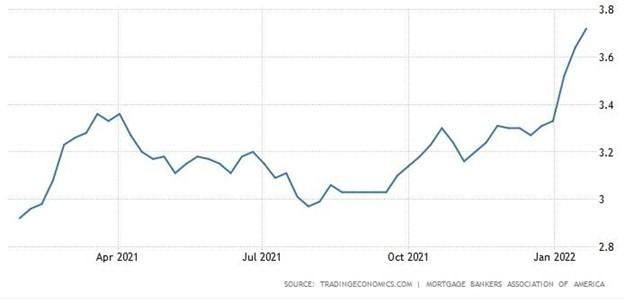

The Fed has finally announced the big non-secret everybody has been waiting to hear. We’ll look for a 25 basis point bump come March. But the mortgage market has been expecting this. Mortgage rates have been climbing since mid-2021.

Eventually the boom in building will meet with the shrinking demand and prices will slowly deflate.

So prices will normalize. Homeowners’ new bitcoin-esque wealth will slow considerably. But the risk of that wealth evaporating like it did back in 2008 is slim to none.

I’d expect housing prices to trend sideways in a 10 percent band for the next 2 years or so.

For those still looking for real estate as an investment, real estate investment trusts like the Fidelity MSCI Real Estate Index ETF or the Vanguard Real Estate Index Fund ETF are worth a look. Their prices will likely decline with the actual market, but that only means they’ll offer much better dividend yields.

Friends Read Free