The United States and South Korea affirmed that they will build a strong and resilient supply chain and deepen cooperation in space and cyber domains, ensuring a trustworthy and value-oriented digital and technological ecosystem. The two sides committed to increasing mutual investments, including semiconductors and chips, as well as research and development cooperation in the fields of Artificial Intelligence (AI), next-generation communications networks (6G), quantum technology, biotechnology, and many others.

Hong Kong financial analyst Katherine Jiang Tianming said in an exclusive interview with The Epoch Times that the United States has been leading the decoupling of global supply chains from China. Looking back on the measures that the United States has taken in recent years, there are three parts. The resilient U.S.-South Korean supply chain is the third part of the U.S.-led global decoupling from China.

Part 1: Establishing a Decoupling Mechanism in the Regulatory and Legal Sectors

On May 15, 2019, former President Donald Trump signed an emergency executive order to secure information and communications technology and services supply chains, barring U.S. companies from using telecommunications equipment that poses a national security threat. This laid the basis for excluding Huawei Technologies Co., Ltd. (Huawei) from the U.S. telecommunications supply chain. On May 16, 2019, the U.S. Department of Commerce placed Huawei on the Entity List and issued a prohibition rule in May 2020 that any company must require licenses from the U.S. government for sales to Huawei of semiconductor products containing U.S. technology. This greatly inhibited Huawei’s ability to purchase key components such as chips in the United States.Part 2: Restructuring Supply Chains With the Strategically Important Nation—Taiwan

On May 6, the Taiwan External Trade Development Council (TAITRA) held a book launch event for “Roadmap to Resilient Supply Chains.” The preface of this book is inscribed with the names of not only TAITRA but also the American Institute in Taiwan.“This clearly signals the world that the United States and Taiwan are jointly restructuring supply chains,” said Jiang.

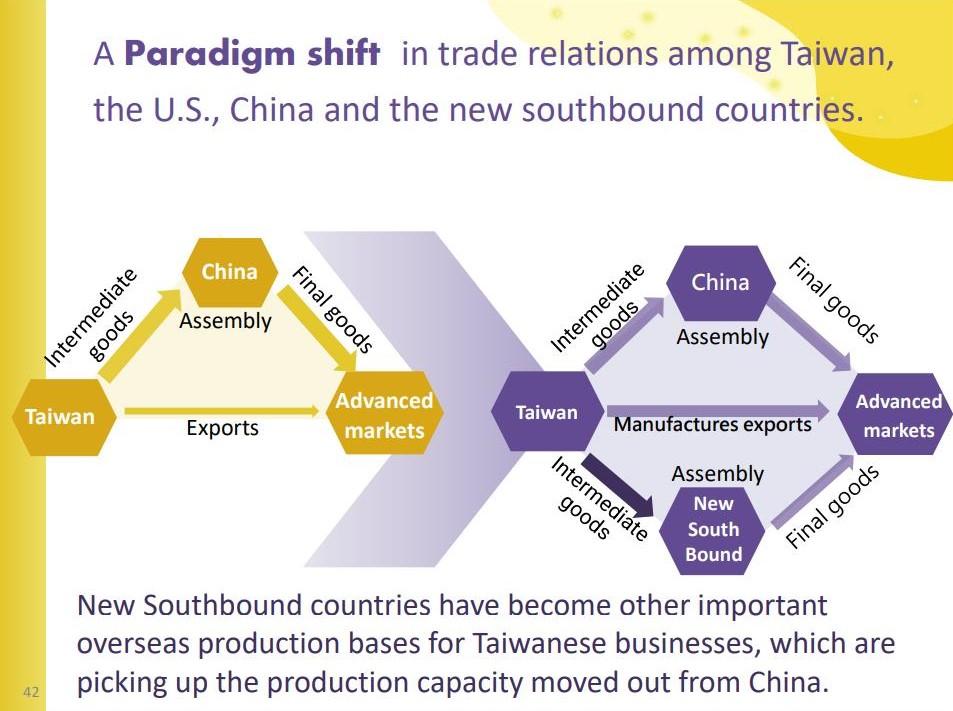

“Roadmap to Resilient Supply Chains” clearly outlines the changes in the supply chains: the former supply chain model was that Taiwan first took orders, then outsourced intermediate goods such as components to China for assembly and exported the finished products to developed countries. However, the model will change. In general industries, such as clothing and hats, the CCP economy will still play an “assembly” role in the entire industrial chain, but Southeast Asian countries will step in and share a piece of the pie.

As to the strategically important industries, the CCP will be excluded from the entire industrial chain and Taiwan will cooperate with like-minded nations in production and technology. These key industries include semiconductors, personal protective equipment (PPE), electric vehicles, etc.

Jiang stated that TSMC is like a miniature of Taiwan. Taiwan’s high-tech superiority and the global chip shortage have accentuated the global popularity of TSMC and the strategic importance of Taiwan in global supply chains. The United States has cooperated with Taiwan to restructure the supply chain, while they have also made it clear that removing the CCP from strategically important industries is the second part of decoupling the global industrial chain from the CCP.

Part 3: Strengthening Cooperation With South Korea

South Korea plays a pivotal role in global advanced technology. According to TrendForce, the South Korean company, Samsung Electronics Co., Ltd. (Samsung) is the second-largest manufacturer in the global foundry market after TSMC, and is well ahead of its global counterparts in the dynamic random-access memory (DRAM) and NAND flash memory markets. In the first quarter of 2021, Samsung held 42 percent of the DRAM market share, and SK Hynix Inc. (SK Hynix), another South Korean company, occupied 29 percent. Micron Technology, Inc. (Micron), an American company held 23 percent.The United States is forging ahead with decoupling its supply chain from the CCP. South Korea is now strengthening cooperation with the United States, and given that the latter has established decoupling mechanisms in its regulatory and legal sectors, it is likely that South Korea will also gradually decouple from the CCP.

Jiang pointed out that the decoupling of U.S. supply chains from the CCP will gradually cause an economic predicament for the CCP because there are a number of middle-end and low-end industries that are technically deficient.

Just like Huawei, its smartphone business has experienced a severe decline after two consecutive years of U.S. sanctions. Huawei, to some extent, mirrors the economic state of the CCP.

Friends Read Free