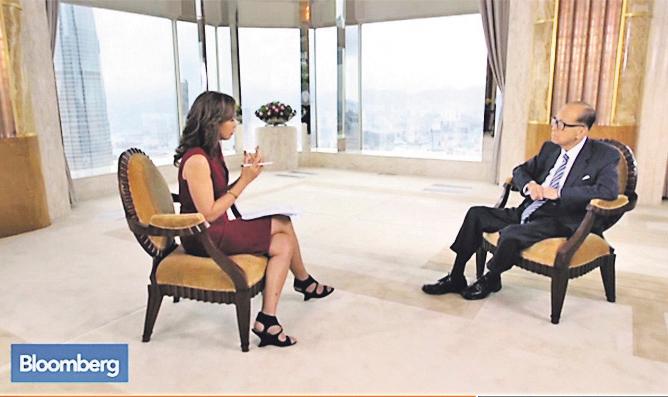

The richest man in Hong Kong, 87-year-old Li Ka-shing, said in a recent exclusive interview with Bloomberg Television that Hong Kong is now experiencing the most difficult period in two decades, and he proposed a 1 to 2 percent corporate tax increase.

That was Li Ka-shing’s first interview with international media since 2012.

During the interview, Li recommended that the government increase the current 16.5 percent corporate tax rate to narrow the wealth gap.

Li added that quite a few people earn very high salaries, up to tens of millions or even $100 million per year, and some enterprises also earn very high profits. He believes it is all right to tax them more, but the system needs to be fair.

“You mustn’t tax some people more and some people less, or else its chaos,” Li told Bloomberg. “Tax companies an extra one or two percent, and then a lot of the poor will benefit.”

However, Li said in the interview, the most important thing is no free lunch. He thinks the additional funding should be invested in education and health care, especially education.

Lack of opportunities

Referring to the Occupy Central protest, Li told Bloomberg, “This is a big problem.”

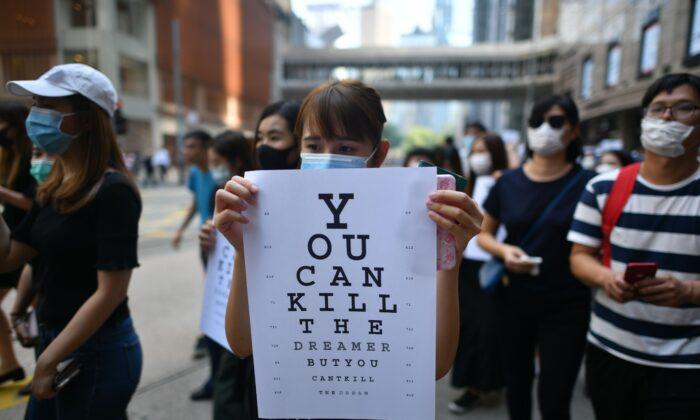

Li said in the interview that the democratic Umbrella Movement indicated the major grievances among the youth in Hong Kong.

He also said that, 80 to 90 percent of the national GDPs around the world are rising, but Hong Kong’s ordinary people and youth lack opportunities for development.

“The most important thing the government needs to think about is the options made available to the young people,” he told Bloomberg. “Especially for the young people, you have to give them opportunities and hope.”

Li’s opinion is considered to be the voice of many Hong Kong people. Senior investor Francis Leung, who is known as “the father of red chips” and is a good friend of Li’s, agreed that this is the hardest period in his 30-year career and “a moment with unclear prospects.”

Francis Leung thinks the root causes relate to the current political structure.

As the chairman of CVC Capital Partners Greater China, Leung participated in an event organised by the professional services firm Ernst & Young on June 22. When he was invited to comment on Li’s views on Hong Kong’s economy, he nodded and said “I completely agree.”

He referred to his own life, which has experienced many ups and downs, including the 1980s property slump, the Carrian Incident, bank strikes, the 1987 global stock market crash, the 1989 Tiananmen Student Movement, the 1997 financial crisis, the 2003 SARS outbreak, and the 2008 financial crisis.

“They are nothing compared to this year,” he said.

Francis Leung explained that while the crises in the past lasted for only a short time, the current situation “drags on for years.”

“No one knows when it will come to an end,” he said. He thinks the society is stuck in “pointless controversies.”

He feels sympathy for the young people who are facing issues such as lack of opportunity for development and high property prices. Leung advised youth to seize the opportunity to learn and develop rather than merely laying blame.

Leung also agreed with Li’s proposal for a corporate tax increase. Considering the economic downturn, aging population, welfare spending increase, and other issues facing Hong Kong, Leung thinks it is right and proper to tax rich people higher to achieve social balance.

He said he believes that all profitable companies will accept it.

“Paying taxes is a kind of honour,” he said.

Except for some start-up industries which need the support of tax incentives, he believes that all enterprises should be taxed at a higher rate.

Chief Executive

The interview also covered the issue of the next Chief Executive candidate. Bloomberg reported that Leung Chun-ying’s approval rating in May plunged to its lowest level recorded by the University of Hong Kong’s Public Opinion Program.

Bloomberg stated, “Some prominent local figures including lawmaker James Tien, founder of the pro-Beijing, pro-business Liberal Party, and Ricky Wong, chairman of Hong Kong Television Network Ltd., have urged finding an alternative candidate who can better bridge the city’s political divides.”

Li, who supported Henry Tang in the 2012 Chief Executive election, told Bloomberg it is “very difficult to say” who will become the next Chief Executive.

“Most importantly, this person has to understand Hong Kong and have the ability to fill Hong Kong with hope,” he added.

Commentator Lai Chak Fun believes it was quite a rare thing for Li to give a speech just before the July 1 parade. He noted that Li, as a capitalist, even proposed a higher tax rate.

“It demonstrated that Hong Kong’s current situation is very poor,” Lai said.

He thinks it lies in Hong Kong’s deep-rooted contradictions. The Chinese Communist Party intervenes in Hong Kong affairs while the SAR Government makes no contributions, he said.

In particular, since Leung took office, social grievances have been aggravated, the conflicts in local politics have been intensified, and young people cannot find a way out, Lai said.

He said it is expected that more people, especially young people, will join the parade on July 1 this year. Everyone shares a common wish to kick out Leung Chun-ying, he added.

“Even the pro-establishment camp has developed a policy of changing the Chief Executive. Surely everyone wants Leung Chun-ying to step down,” Lai said.

Analysts’ opinions

When talking about the current economic difficulties in Hong Kong, many experts mentioned the risk factors that have come from mainland China as well as Hong Kong’s gradual loss of some of its traditional strengths.

Francis Leung, the first one to help Chinese companies’ IPOs on the Hong Kong stock market, used the stock market to illustrate the mainland’s influence on Hong Kong. He said that currently more than half of Hong Kong stocks are red (owned by the Chinese government).

He said the poor performance of the Hong Kong stock market stems from an excessive amount of state-owned enterprises listed in this market.

“A lot of state-owned enterprises came from the old economic system. Decline in their profits result from their numerous problems, such as overproduction, excess inventory, excess debt, and low efficiency. How can Hong Kong shares do well?” he said.

In addition, foreign investors are not optimistic about the economy in Hong Kong and China, Leung said. He added that the range of shares in the Hong Kong stock market is limited, making it difficult to attract outstanding enterprises to be listed in the market.

Despite this, opportunities come along with risks, Francis Leung believes. He said Hong Kong people should not feel frustrated. He believes that Hong Kong’s strengths lie in its laws and decrees.

“Hong Kong’s legal system is relatively sound, and its policies are relatively stable and transparent. These three factors are very important and very critical to the financial market, giving Hong Kong an advantage over the mainland market,” Leung said.

Dong Tao, Credit Suisse’s chief regional economist for Asia, also believed that the biggest advantage of Hong Kong’s development lies in its rule of law and being hardworking.

“This is the core of Hong Kong,” he said.

He said that some of the traditional advantages of Hong Kong, such as the shipping industry, have disappeared, and tourism is slowly degrading. However, Hong Kong’s financial industry still retains its advantage.

As overseas Chinese tourists last year spent 1.2 trillion yuan outside China, Hong Kong’s tourism should have some space for development, he said. Unfortunately, in the past few months, the tourism industry saw some retrogression in attracting mainland tourists and no real progress in attracting other tourists.

Tao reminded Hong Kong people to reflect on it, “If you fail to expand your advantages, you cannot blame others,” he said.

AMAC Human Resources Consultants Limited managing director Alexa Chow believes that the high price of Hong Kong property, coupled with the lack of social resources, fuel Hong Kong’s high cost of living. However, she does not think it will reduce the interest of foreign capital coming to Hong Kong, because Hong Kong is located in a central position.

She thinks both the foreign investments coming to Hong Kong and the mainland, and the capital flowing out of China will use Hong Kong as a platform, which gives Hong Kong a unique advantage for development.

Chow said Hong Kong is a blessed land. It is magical that Hong Kong has no earthquakes and plays the important role of a financial centre in the international society.

Hong Kong has gone through twists and turns in the past, she added. Although Hong Kong’s economy has turned bad recently, everyone’s major concern is not the economic problem, but the unprecedented political disputes that are tearing apart the society. This is most disappointing to Chow.

She said that Hong Kong people helped each other get through crises in the past, but now Hong Kong people cannot unite to face the difficulties. For this, she said, the current Chief Executive “more or less should bear the blame.”

Translated by Thomas Leung. Edited by Sally Appert.

Friends Read Free