The so-called Global Financial Leaders’ Investment Summit was held this week. China experts know well that “contrarian theory” is needed to thoroughly understand China: What the Chinese Communist Party (CCP) or its mouthpiece emphasizes is often already lost. The same is true for the international status of Hong Kong. All sources of information suggest Hong Kong is no longer an international city. Yet the Chinese officials are asking people not to read the western news, while Hong Kong officials are asked to “tell good stories.”

Whoever is spreading fake news should be clear. Facts never lie: While elsewhere around the world, countries are accepting immigrants, Hong Kong is having a huge amount of brain drain like Ukraine’s refugees, and numerous firms and associations have announced their intention to move out of Hong Kong. These should have been mostly expected by the Chinese senior officials from the early days that they adopted hostile diplomacy toward the West. Only local (Hong Kong) officials are worrying about the local problem when seeing huge outflows emptying the economy.

Maybe the officials were too anxious about the situation that they decided to hold the “Global Financial Summit” where Hong Kong was promoted as being an international financial centre (IFC), a lower rank label than a global financial centre (GFC). To date, only New York and London belong to the GFC category. Although different parties define the nature of financial centres differently, IFC should have a certain extent of “international” features. Hong Kong was famous mainly for its stock market, but the main board has been filled with Chinese firms with shrinking foreign capital.

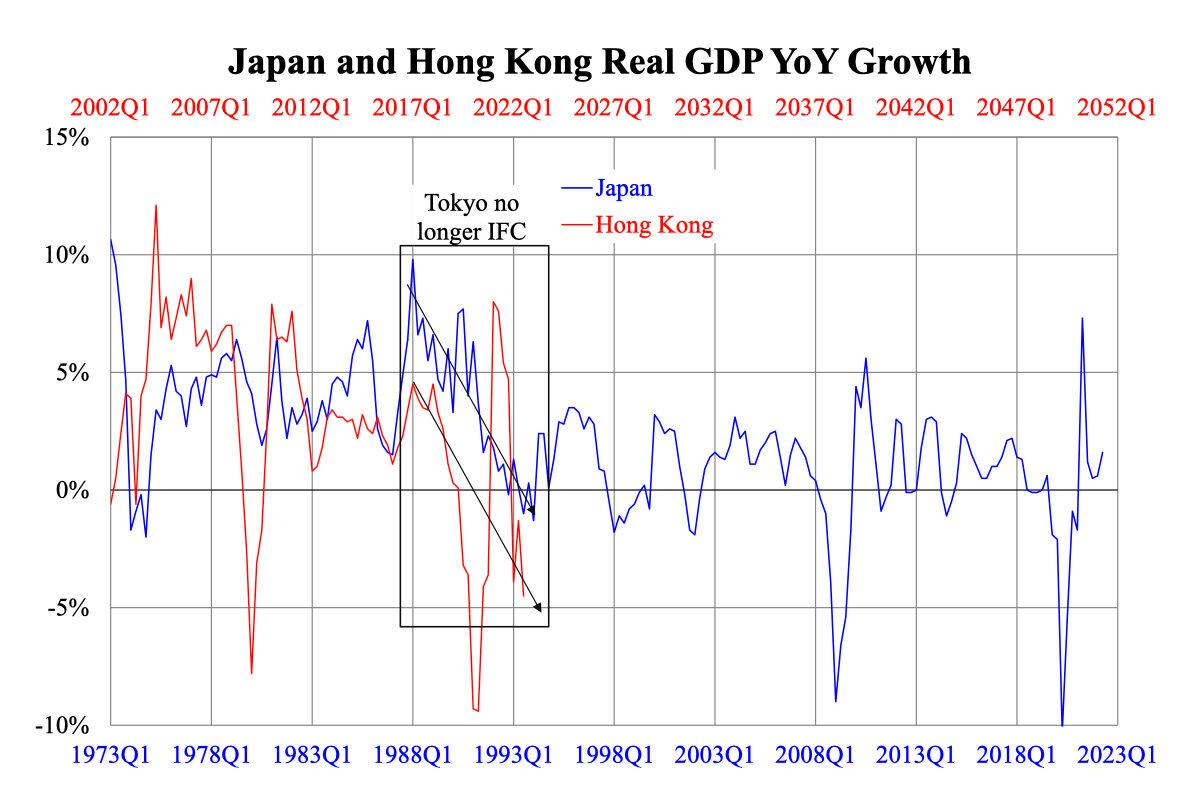

Whether a city is international is not claimed; rather, it is granted. And the international status of a city is neither gained nor lost in a day. It is the structural change that happens over a period of time where the status change spans some years. Back in the days when Tokyo’s international financial centre was overtaken by Hong Kong, the period spanned from the early 1990s to the early 2000s. Hong Kong’s international financial centre status was solidified in more or less the same decade. Likewise, for Hong Kong to lose, it might take ten years.

Since the stock market capitalization or turnover is roughly proportional to the stock market index in Hong Kong, the latter shows a good picture of how Hong Kong’s status evolved over time. There was little gain in the index in the 2010s, which was a decade of weakening status. By the 2020s, Hong Kong has been a loser beaten by most other markets. The current situation is similar to what happened in Japan in the early 1990s, which was subjected to a huge shock. In about seven years, the GDP growth dropped significantly from positive to zero.

The situation for Hong Kong is indeed even worse than Japan in those old days, as Hong Kong is probably experiencing a new normal with a negative growth trend. It is too simple and perhaps naïve to expect much from a summit. A decline is unlikely to be reversed easily.

Friends Read Free