MUTARE, Zimbabwe—China is pouring billions of dollars into developing Zimbabwe’s key infrastructure, but experts have expressed concern that the Zimbabwean government may not be able to repay the loans.

In April, Zimbabwe President Emmerson Mnangagwa invited the Chinese to invest in all sectors of the economy under a new comprehensive strategic partnership of cooperation.

But Beijing’s track record of enticing developing nations to become dependent on loans, in exchange for access to resources and critical infrastructure, has many worried about the influence of Chinese money in Zimbabwe.

A recent example of accepting China’s loans ending badly was in Sri Lanka, where the government had to hand over control of its main southern port, after failing to pay back $6 billion in loans granted as part of China’s One Belt, One Road initiative—Beijing’s massive investment initiative in countries throughout the world.

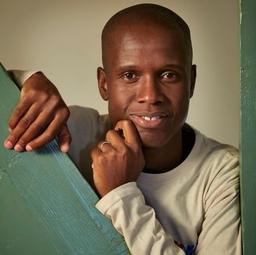

Farai Maguwu, director of the Center for Natural Resource Governance, a Zimbabwean NGO, says Zimbabwe faces great risks if it becomes beholden to China’s loans.

“If we [Zimbabwe] fail to pay back [the loans], which will likely happen, due to the mismanagement of the economy, China will demand its dues in kind: They will take land and critical institutions to recover their funds,” Maguwu said.

Maguwu added the Chinese loans and deals were negotiated without the involvement of Zimbabwe’s parliament, which is mandated by the country’s constitution to play an oversight role.

“Avoiding parliament is avoiding transparency; hence, such deals are corrupt and will enrich a cabal and deliver very little, as has become the norm in Zimbabwe,” he said. “The problem with Zimbabwe is that government officials negotiate corrupt deals for self-enrichment; hence, the projects never take off or are abandoned halfway through.”

Zimbabwe has limited choices in terms of funding for the country, which desperately needs development, says Victor Bhoroma, an expert on China–Zimbabwe relations. But with the current mechanisms and institutions, it’s not getting the best out of the China deals.

Deals

The government of Zimbabwe is courting a Chinese company, PowerChina, to construct the massive Batoka Gorge Hydro Power Station, a $5.2-billion, 2,400 MW plant along the Zambezi River.At the same time, Zimbabwe’s main airport, Robert Mugabe International Airport, is set for a major expansion under a $153-million loan facility from China.

Beijing, through the Export-Import Bank of China, has released $200 million to Sino Hydro for the expansion of the Hwange Thermal Power Station.

The Chinese also funded an expansion of the $533-million Kariba South Hydro Power Station and the construction of Zimbabwe’s new parliament building, which Mnangagwa said was a donation from the Chinese regime.

Some of the loans from China are repayable in 20 years, with interest rates of 2 percent per annum, according to Zimbabwe’s former finance minister, Patrick Chinamasa.

But Bhoroma expressed concern over the opaqueness of most of the Chinese deals.

Reservations

Linda Masarira, the spokesperson for the opposition party Movement for Democratic Change-T (MDC-T), also expressed concern about whether Zimbabwe can repay the debts.“Definitely, it can’t be a problem to get infrastructural development support, but [the problem is] Zimbabwe’s capacity to repay. That’s the elephant in the room,” Masarira told The Epoch Times.

Currently, Zimbabwe is saddled with about $300 million in arrears from previous Chinese loans.

Masarira raised concern over some of the projects financed by the Chinese, which she said were not priorities for Zimbabwe.

“Above all, are there any technology and skills transfers? Or we shall rely on Chinese forever to continue maintenance and repairs of the same infrastructure?" Masarira said.

Francis Danha, who leads a political outfit named the 1980 Freedom Movement Zimbabwe (#1980FMZ), told The Epoch Times that Zimbabwe isn’t getting much out of the Chinese deals.

Reassurances

Despite the strong reservations on projects funded by China, Mnangagwa assured the country that the government wasn’t surrendering its resources in exchange for loans from Beijing.“During the period of isolation, very few nations outside the West assisted us. Some of the notable countries which came to our assistance were China, India, Brazil, Russia … And when things are good, you don’t then forget your friends who stood with you during bad times. But you don’t sell your country because someone stood with you during bad times,” Mnangagwa was cited in the media as saying.

China has weighed in, saying its investment policies in Africa were mutually beneficial and aren’t meant to exploit the continent.

But the assurances from Mnangagwa and Beijing isn’t enough to quell Masarira’s fears.

“With low exports compared to import bills, how do we service the debt without resorting to barter trade or mortgaging our natural resources, especially diamonds and other minerals that China desperately needs for its industries?” Masarira asked.

Friends Read Free