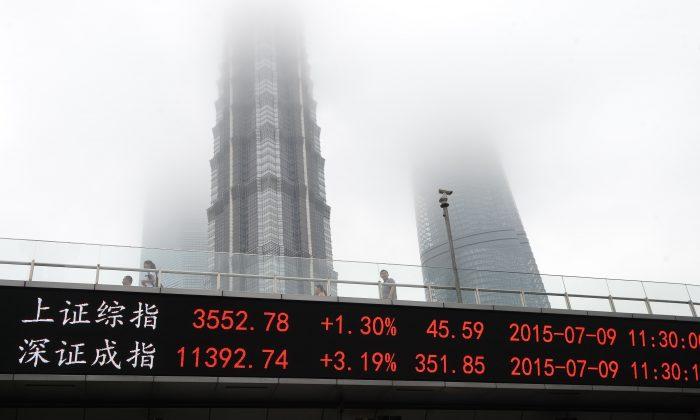

In July the Chinese stock market suffered its worst-performing month in nearly six years, as Beijing’s heavy-handed intervention to stem market losses raised more questions than answers for any investor with China exposure.

The Shanghai Composite Index fell 10 percent last week and 14 percent for the month of July, the worst one-month loss since August 2009.

But that doesn’t tell the entire story—the market has been beset by massive volatility.

A 32 percent drop between June 12 and July 8 preceded desperate measures from the Chinese Communist Party to stem the losses, including propping up margin finance firms, banning short selling, and instructing state-owned funds to purchase blocks of shares. The Shanghai Composite temporarily rallied 18 percent through July 23, but receding confidence in Beijing’s ability to manage the markets and uncertainty of future policy have resulted in elevated volatility including wild intraday swings.

Despite the selloff, Chinese stocks still look overvalued. The median price-to-earnings ratio of stocks on the Shanghai Composite is around 40, more than double the same ratio for the S&P 500 Index.

Flight from Banks

For investors, there are a few takeaways from the recent Chinese stock market gyrations. The Chinese financial sector must be avoided, especially the large banks. The banking sector faces two massive hurdles—it’s been soaking up the risk to finance the stock market bubble and at the same time being squeezed by a low interest rate environment.

China Securities Regulatory Commission (CSRC) said last week that recent efforts to bolster the stock market was partly to combat “systemic risk” of falling stock prices. But left unsaid in that announcement was its efforts were actually creating gigantic systemic risk in the banking sector.

Reuters reported July 28 that Chinese banks were trying to “get to grips with their financial exposure to the stock market.” That’s a difficult task given the number of loans Chinese banks gave to gray market firms such as smaller commercial banks, asset management companies, consumer finance firms, and trusts.

The volume of Chinese interbank lending jumped in the first half of 2015, J Capital Research Ltd. data showed. In June, total repo and reverse repo transactions reached 41 trillion yuan ($6.6 trillion), up 19 trillion yuan, or 86 percent, from January. Repos, or repurchase agreements, are essentially short-term loans between companies collateralized by securities.

There’s a lack of transparency around where the funds ultimately wound up, but the likely answer is the stock market through margin financing.

The People’s Bank of China is further squeezing banks with interest rate cuts this year putting pressure on net interest margin, or the difference between a bank’s borrowing rate and interest earned on loans.

Opportunities in Short-Term Dislocations

So far, Beijing has given assurances to maintain support of the market and prosecute short sellers and others engaging in “suspicious trading activities.” Authorities also received pledges from brokerage firms and state-controlled asset managers to keep buying stocks until the Shanghai Composite hits 4,500, which is 18 percent higher than July 31’s valuation.

Chinese authorities equate a rising market to social stability, which is one of the Communist regime’s biggest insecurities. So Beijing is likely to sacrifice long-term reform for short-term stability in the market.

Those are the known quantities. How the market—and especially retail investors—will react to these events are the unknown. For sophisticated traders, volatility and market dislocations can sometimes be of great value.

During the stock market tumble in July, a large cross-section of shares on the Shanghai Stock Exchange were halted for days, if not weeks. This created large dislocations in relative value across companies and sectors, which can be profited upon in the short term.

The recent market gyrations “have created significant dispersion of gaps between underlying fundamentals and valuations across markets,” said Robert McConnaughey, global head of research at Columbia Threadneedle Investments.

“For patient investors with the resources and skill to research and investigate these situations, there may well be exciting stock-picking opportunities through this ’sorting-out' period.”

Shades of 1929

In the long run, there’s very little upside to investing in Chinese stocks unless the Chinese Communist regime changes its policy. The financial markets have lost whatever credibility regime chief Xi Jinping had built up in the last few years attempting to diversify and reform its financial markets.

Beijing’s usual modus operandi is to prop up and bail out any major sector that doesn’t pan out. This encouragement of massive risk-taking is fueled by excessive leverage and debt at both corporations and governments.

To give the Chinese stock market a fighting chance in the long term, Beijing policymakers must completely change its policies.

“The role of the state as a regulator to protect standards and mitigate risks should not be compromised by conflicting pressures to champion rising equity prices,” wrote Yukon Huang of the Carnegie Endowment and former Beijing-based country director for China at the World Bank.

“For this to happen, the role and accountability of senior officials of regulatory agencies such as CSRC need to be clearly separated from China’s party-dominated personnel process to provide assurances that its equity markets are really markets.”

And therein lies the problem—China’s financial markets are not markets driven by supply, demand, and underlying economics. Instead of letting the market correct itself and promoting healthier growth patterns, the regime has deemed almost every corner of the country’s economy—from real estate to state-owned enterprises, from banks to the stock market—as “too big to fail.”

Guggenheim Partners chief investment officer Scott Minerd wrote last week, “If Chinese policymakers don’t alter course soon, the current Chinese equity market correction could turn into a stock market plunge similar to what happened in the United States in 1929.”

Friends Read Free