China’s soaring producer price index (PPI) and export prices are adding to inflationary pressures around the world, according to analysts.

The Chinese Communist Party’s (CCP) recent power sector reform pushes up inflation and export costs, an expert says. The rising production costs in China continue to reflect onto its downstream consumers overseas.

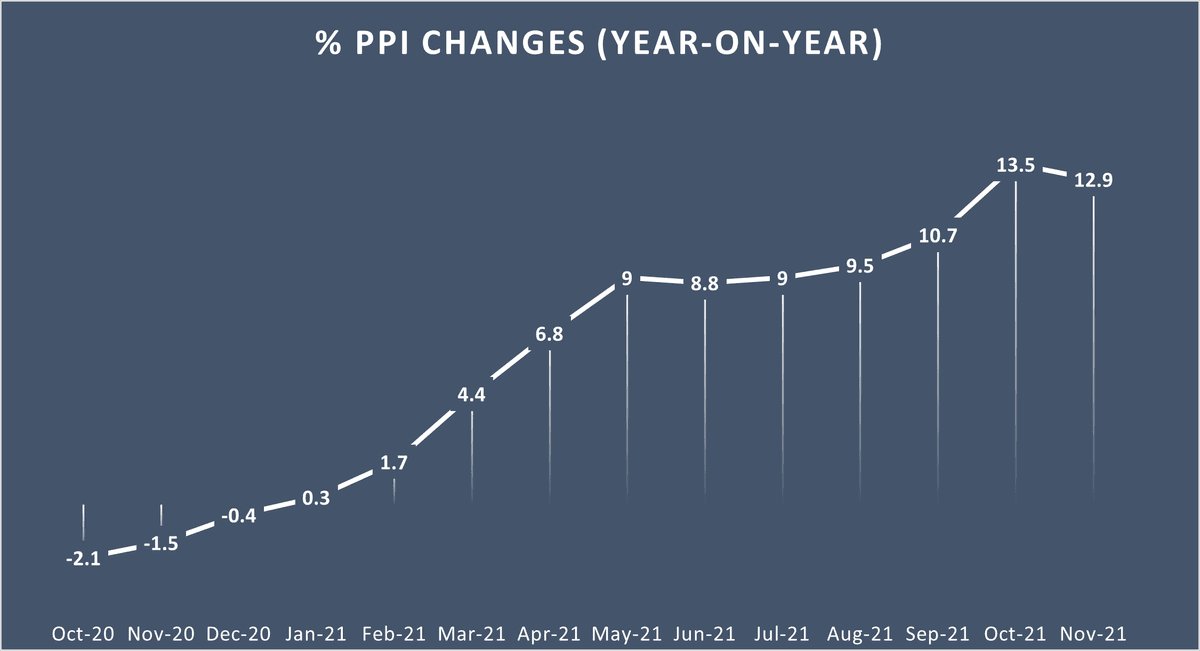

In October, China’s PPI hit the highest level since 1995, reaching a 13.5 percent increase over the same period last year.

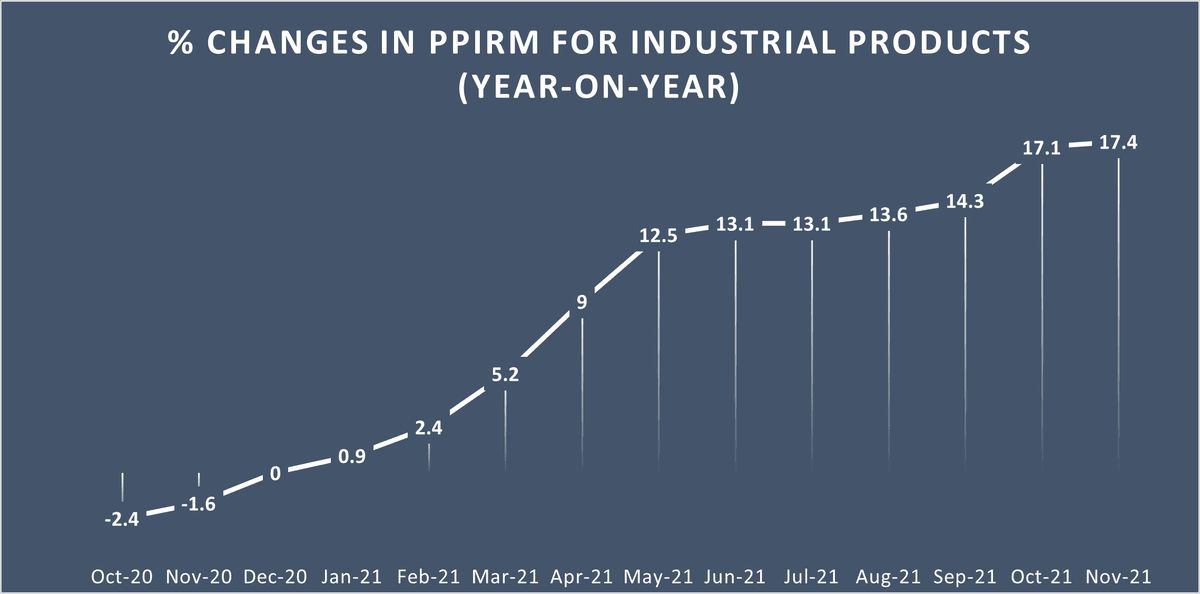

In November, its PPI rose 12.9 percent year-on-year, while its purchasing price index for raw materials, fuel & power (PPIRM) were up 17.4 percent year-on-year, another record high.

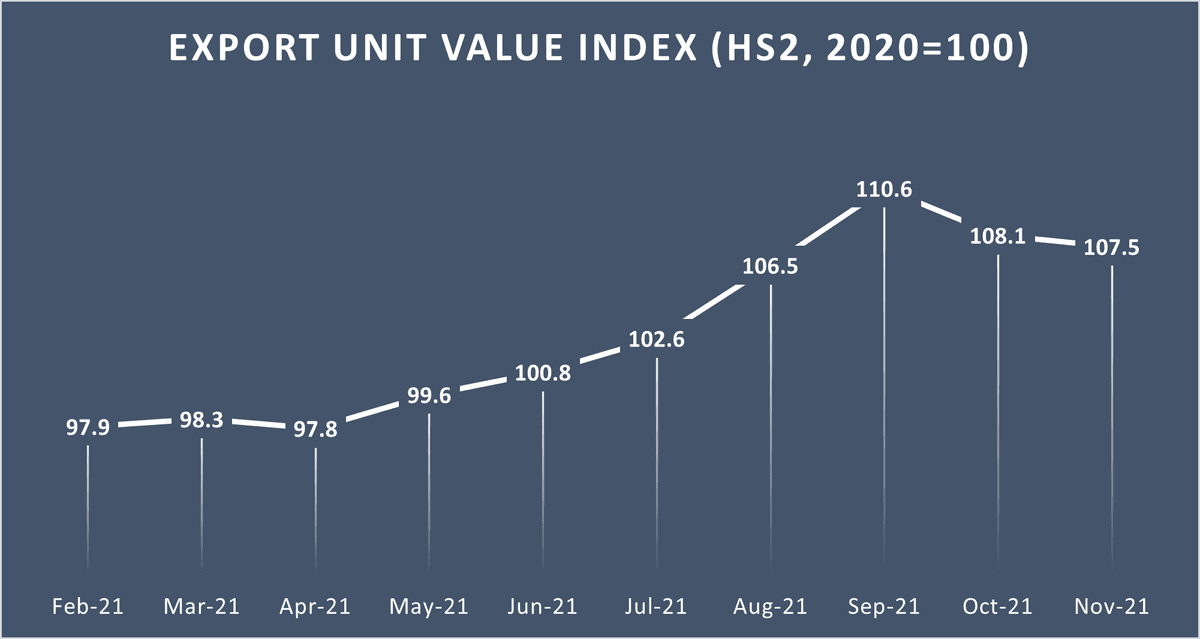

According to China’s General Administration of Customs, the export unit value index has also risen significantly in 2021. The index (HS2 Classification, 2020=100) has soared from 97.9 in February to 107.5 in November, nearly ten percentage points, with a peak in September hitting 110.6.

Price Hike on Chinese Exports Adds to US Inflation

Despite the increased U.S. tariffs on Chinese exports, China remains the largest exporter to the United States.As of November 2021, China exported approximately $528.3 billion goods to the United States, accounting for 17.2 percent of its total exports. Mechanical and electrical products account for 59 percent, the largest proportion of China exports, increased 21.2 percent year-on-year.

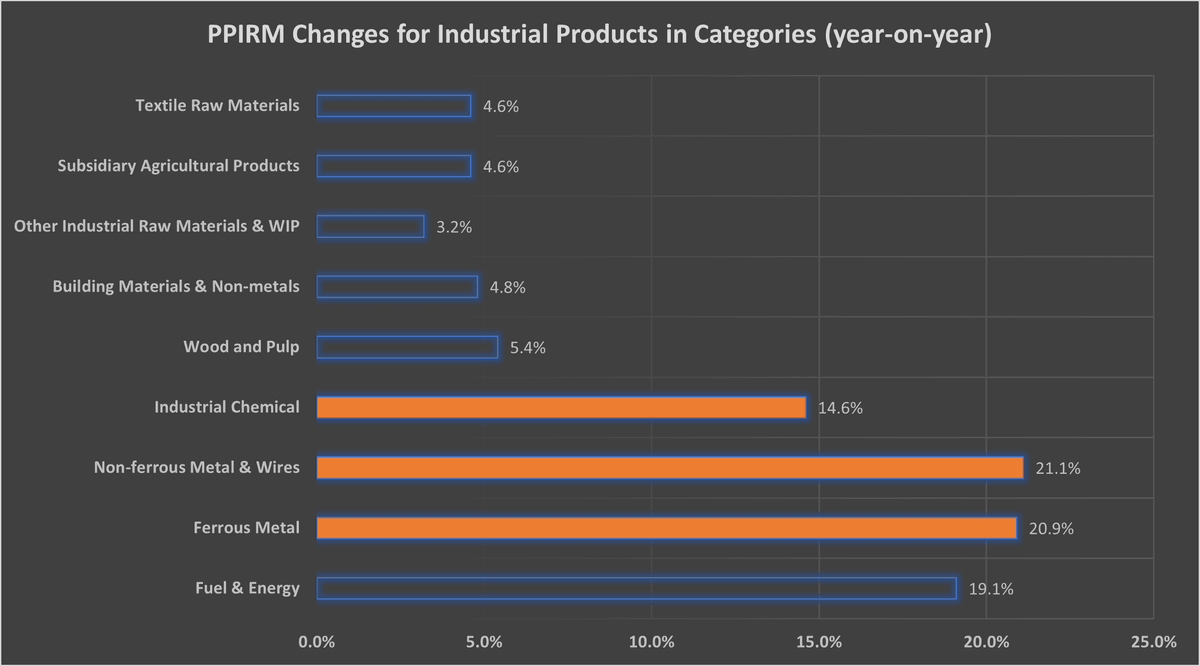

The PPIRM (purchasing price index) of ferrous metal, non-ferrous metal including wires, and industrial chemical— three types of raw materials of mechanical and electrical products—increased by 20.9 percent, 21.1 percent, and 14.6 percent, respectively, compared to the same period last year.

Jiang believes the significant increase in mechanical and electrical product exports is primarily driven by the rise in production costs and the price surge of ferrous and non-ferrous metals. The prices of raw materials will impact the prices of finished products.

China’s Power Curtailment Stokes Global Inflation

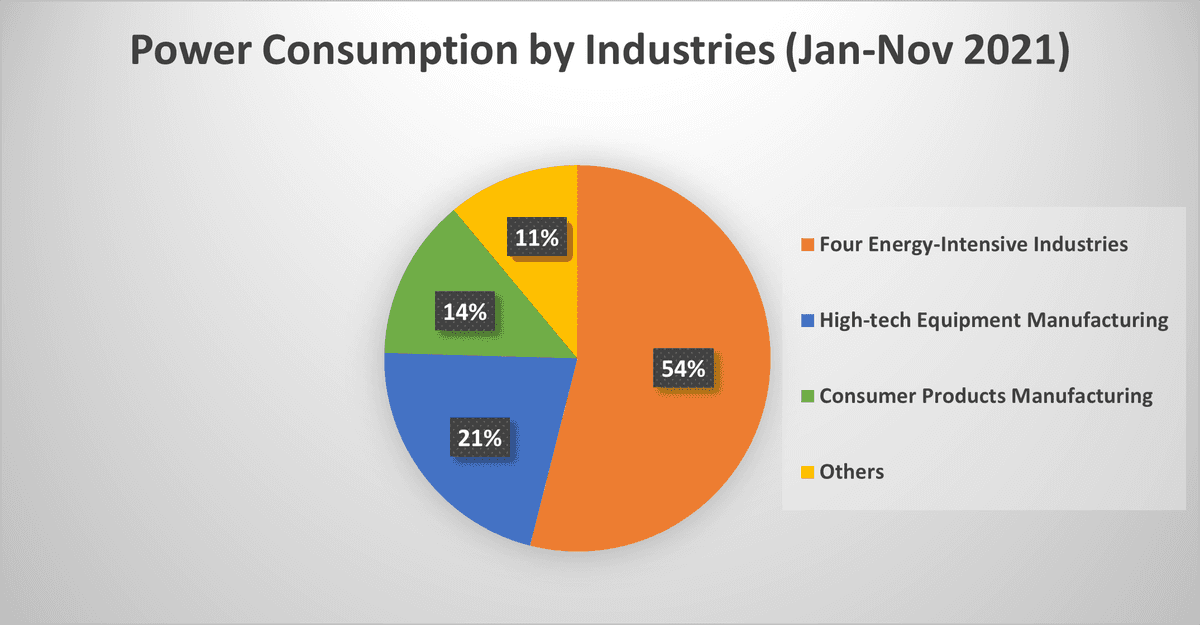

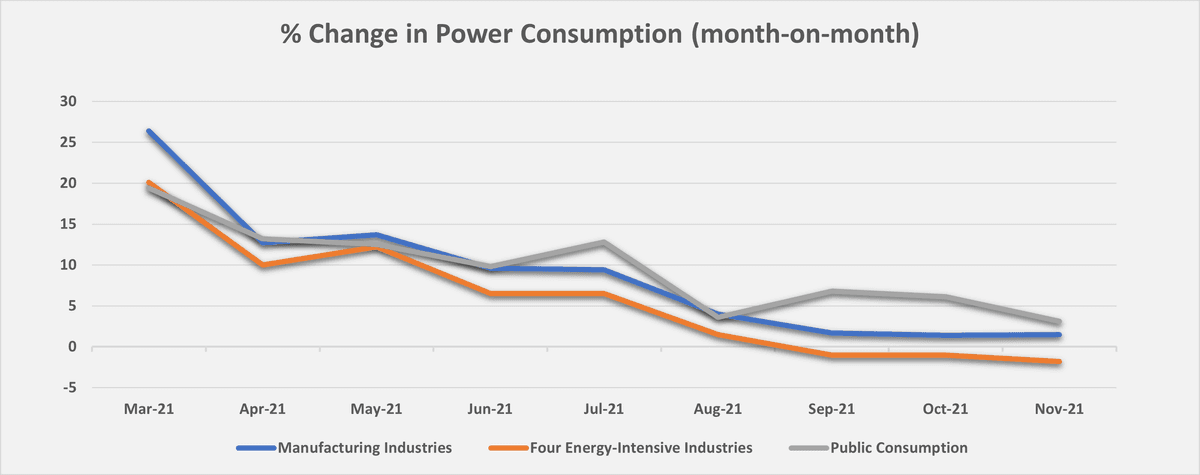

China is a major producer of ferrous and non-ferrous metals and the world’s largest producer of steel, aluminum, and refined copper. In 2020, China produced more than half of the world’s crude steel and aluminum and 39.2 percent of the world’s refined copper.Ferrous metal smelting, non-ferrous smelting, industrial chemicals, and building materials are China’s four energy-intensive industries. In 2021, due to the CCP’s power curtailment policies, the four major industries saw a declining growth in September, October, and November of 2021.

“The production of ferrous and non-ferrous materials in China greatly impacts global supply and demand and the price levels. Suppose we measure their production by their energy consumption; we can see the production activity of ferrous and non-ferrous metal smelting are both declining,” Jiang explained.

“Meanwhile, Beijing’s recent power sector reform will further increase the production costs of many industries, especially the ones that are energy-intensive,” Jiang added. “Take electrolytic aluminum as an example; electricity accounts for nearly 40 percent of its production costs. Therefore, the increase in energy prices will increase the production costs of many industries to a large extent.”

On Oct. 12, China’s National Development and Reform Commission (NDRC) increased its coal-powered electricity price cap, meaning all industrial and commercial users in China are likely to see higher electricity prices. The new cap is now a 20 percent increase instead of the original 10 percent.

In addition, energy-intensive industries are not subjected to the new price cap, meaning industries such as the ferrous and non-ferrous metal smelteries could see their electricity prices go up by more than 20 percent under the new regulation.

“The further increase in electricity and production costs for commercial and industrial enterprises in China will reflect on the prices of products. And the rise in cost will inevitably pass onto its exports and consumers overseas, further intensifying the global inflationary pressures,” Jiang added.

Friends Read Free