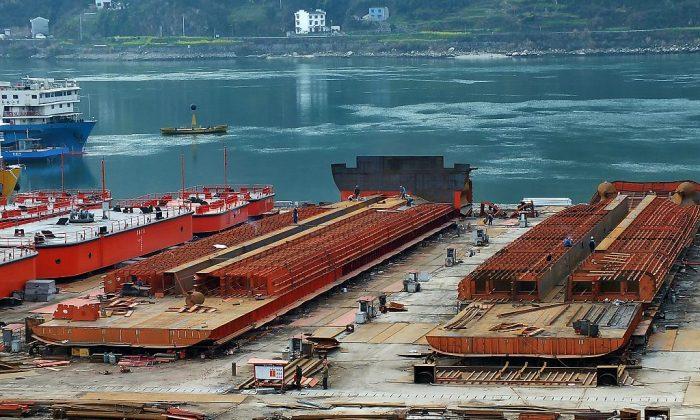

China’s shipbuilding industry has grown rapidly in recent years, becoming big enough to take on traditional shipbuilding powerhouses in South Korea and Japan. However, behind the industry’s ascent lies an important fact—despite years of heavy government subsidies, Chinese shipbuilders still lack important innovations.

In South Korea, the country’s three biggest shipbuilding companies—Hyundai Heavy Industries, Samsung Heavy Industries, and Daewoo Shipbuilding & Marine Engineering—plan to lay off over 3,000 employees in the second half of 2018 due to poor sales, according to an Aug. 13 article by South Korean newspaper JoongAng Ilbo. The large-scale layoff has very much to do with their Chinese counterparts: They have dominated the world’s shipbuilding market and pushed out competitors through heavy government support for Chinese firms.

A spokesperson for Hyundai Heavy Industries said its employees have been forced to take turns taking days off since the second half of last year. The firm also asked over 700 employees to accept early retirement packages because there hadn’t been enough work to go around.

Samsung Heavy Industries said it has already laid off 3,400 employees since 2016. The company plans to lay off another 1,000 to 2,000 because there have been fewer-than-anticipated orders. The company projected $16 billion in total orders from 2016 to 2018, but so far only received orders totaling $10 billion in value.

JoongAng Ilbo, citing statistics from the Export-Import Bank of Korea, reported that the top 10 South Korean shipbuilders received new orders for 12 vessels, or 273,000 compensated gross tonnage (CTG), for the first half of this year, a drop of 24.5 percent from the same period a year earlier.

Japanese shipbuilders are also plagued by poor business performance due to competition from Chinese shipbuilders.

Imabari Shipbuilding, Japan’s largest shipbuilder founded in 1901, announced its acquisition of another Japanese shipbuilder Minaminippon Shipbuilding in January. According to a January 15 report by Japanese newspaper Nikkei, Imabari’s acquisition was a strategic move to better challenge Chinese shipbuilders, who have grown larger in size through mergers and acquisitions under the guidance of Beijing.

Currently, China leads the world in shipbuilding. According to data by Clarkson Research Services, a British firm that provides statistics in the shipping and oil and gas industries, released in January, China became the global leader in 2017, with orders of 324 vessels totaling 7.13 million CTG, from January to November 2017.

Additionally, China secured 36.3 percent of the global shipbuilding market, followed by South Korea with about 29 percent market share.

Government Subsidies and Encouraging Mergers

South Korea and Japan were the shipbuilding powerhouses of the world, until China dominated the competition through state-run policies and hefty government subsidies for domestic shipbuilders.For years, the Chinese regime has enforced a national policy to accelerate the growth of industries important to the state’s strategic goals—such as steel, auto, and rare earth metals—by encouraging companies to consolidate. In September 2010, China’s State Council issued a recommendation to provincial and municipal governments to offer preferential tax treatment and subsidies to companies undergoing mergers or reorganization.

In March 2014, China’s State Council issued another similar suggestion to regional governments. Aside from lowering tax rates for these companies, including income tax, sales tax, and land value-added tax, local governments should speed up the review process for mergers and reorganization.

The number of independent shipyards in China has declined rapidly since 2009 in comparison to state-backed yards. According to recent data by market research firm Clarksons Research, the number of independent shipyards in China dropped from 305 to 50 from 2009 to April 2018, while state-backed yards declined from 52 to 44 in the same time period.

In March, two of China’s biggest state-run shipbuilders, China Shipbuilding Industry Corporation (CSIC) and China State Shipbuilding Corporation (CSSC), were given preliminary approval to merge together by Chinese regulators, according to Reuters.

Aside from consolidation, Chinese shipbuilders have been able to outperform shipbuilders from other countries due to heavy government subsidies from central and local authorities.

In a 2017 article, Myrto Kalouptsidi, an assistant professor of economics at Harvard University, estimated that government subsidies have lowered shipyard costs in China by roughly 13 to 20 percent in the period between 2006 and 2012.

Kalouptsidi concluded that China would see a considerable drop in market share if these government subsidies were not provided.

CSSC announced that it received 118 million yuan (about $17.2 million) in government subsidies in the first half of 2017, according to a July 2017 article on JRJ, a Chinese financial information portal.

A separate 2017 JRJ article reported that CSSC Offshore & Marine Engineering, a CSSC subsidiary based in the southern Chinese city of Guangzhou, received 87.47 million yuan ($12.7 million) in government subsidies on Sept. 15, 2017.

Technology

While Chinese shipbuilders have made significant inroads into the global market, the technology behind shipping continues to be China’s Achilles heel.An Aug. 8 online article by Li Xing, a researcher with the China Shipbuilding Industry Research Center (CSIRC), pointed out that China’s shipbuilders did not have a technological advantage over Korean or Japanese counterparts. Instead, the industry has relied on low costs to win contract orders.

To provide an example, Li pointed out that Chinese-built oil tankers in the VLCC class, meaning oil tankers with the capacity of 200,000 and 320,000 deadweight tons, could weigh up to 46,100 tons, which is about 3,500 tons, or 8 percent, heavier than similar tankers built by Daewoo in 2017.

Li explained what Daewoo could do what Chinese counterparts couldn’t: continuous optimization to the tanker’s structural design. Structural optimization could bring down the costs of building a tanker because less steel would be needed. In addition, structural optimization would also speed up the time it takes to manufacture.

China’s lack of design technology goes beyond the construction of oil tankers. In a December 2017 article published on a Chinese shipbuilding news website, Fu Xiaorong, an executive with the China-based Offshore Oil Engineering Corporation, said China still heavily relies on foreign imports for key shipbuilding technologies, such as an underwater production system for working underwater and a dynamic positioning system for precisely maneuvering ship parts.

In the same article, Chen Yingqiu, a researcher with the Chinese Society of Naval Architects and Marine Engineers, said the lack of motivation for research and development and not complying with “international standards have prevented Chinese shipbuilders from making real innovations.

Friends Read Free