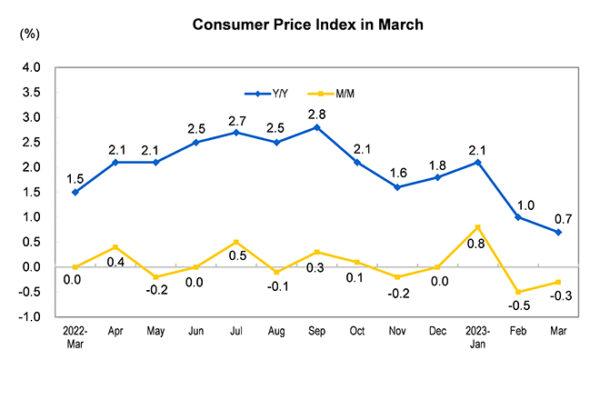

China’s consumer price index (CPI) and producer price index (PPI) data for March both fell short of expectations year-on-year. The communist regime’s economic development model is in a vicious cycle of balance-sheet recession, says an economist, and this is just the tip of the iceberg. China’s economic winter will worsen, he predicts.

Meanwhile, China’s PPI fell 2.5 percent year on year in March, an additional decrease of 1.1 percentage points, hitting its lowest level since July 2020.

Just the Tip of The Iceberg: Taiwanese Economist

Elliott Fan, a professor and vice chair of the Economics Department at National Taiwan University, believes that the economic development model of the Chinese Communist Party (CCP) is broken. The current numbers are just the tip of the iceberg, he says. In economics, the situation is known as a balance-sheet recession.“This is very similar to what happened in Japan after the bubble economy burst, which means that China is actually going down the same path,” Fan told The Epoch Times on April 12, saying China’s economic development model largely replicates the problems of Japan’s real estate bubble economy in the 1980s and 1990s.

“The core of the problem is debt issuance,” he said. “Debt is an interesting thing. It’s a very important factor in economic growth.”

“For example, if I have a company and want to develop a project, I am not likely to use my own money. I must borrow money, that is, from the bank. If the project has great development potential and makes a lot of money in the medium and long term, I will pay back the bank. This is a normal economic operation. In other words, debt is necessary to promote economic development.”

Normal economic operations are complicated, however, by corruption and government collusion, he added. “The problem of collusion between government and businesses is very serious in China. There are many privileged people who borrow money from banks, and the banks dare not refuse to lend it, but these projects are actually not profitable.”

“In the process, however, many people get benefits in various ways and split the money, [but] the projects cannot develop well, so they cannot make money. When there is more of this kind of debt, it has a negative impact.”

Good and Bad Debt

There are always good debts and bad debts in society, and a healthy economy should have a mechanism for allocating money to good debts, which will then reduce the chance of bad debts, Fan said. This is the basic environment that will allow a healthy economy to grow and develop continuously.“But China is out of that basic environment,” he said. “The problem lies in that the CCP has issued too much debt in the past, and it’s focused on real estate.”

“Why does real estate always create financial problems? Why is it always a big problem? The reason is psychological expectations.”

There are many important indicators of how society works, Fan explained, but not all have the same psychological effect. While some of them do not arouse optimistic expectations, indicators such as the stock market and financial assets can easily encourage optimism, so when they rise, people expect them to continue to rise. Those expectations frequently include the real estate market.

“In professional economic study, the biggest fear is psychological expectations,” Fan said. “Why is it troublesome when expectations develop? Because people become irrational. The various policy adjustment tools that governments can adopt are effective only when people are rational. When society as a whole becomes irrational, any policy tool becomes ineffective.”

One of the reasons for the property bubbles in Japan and China was inflated expectations, which led to an inflated bubble, according to Fan. However, the CCP authorities did not deal properly with the situation.

“Why? Because numbers look beautiful,” he said. “Before the bubble burst, it was shiny and beautiful. Everybody was making a lot of money. Weren’t they happy? Who wants to be the whistle-blower? And what happened after the bubble burst, which is what’s happening in China now, is called a balance sheet recession.”

Consequences of Balance-Sheet Recession

Fan said that in a free economy, the consequences of a bubble bursting are severe in the short term because the government does not usually intervene too much in the market. However, the Chinese market is different, since the CCP controls all sectors.“So what the CCP is doing now is preventing [companies] from going out of business, because there will be a chain of closures,” he said.

For example, if A lends B $1,000, B then has the ability to lend that $1,000 to C, and so on, and the debt can continue to cycle.

However, when that cycle is interrupted or collapses, he said, “A closure chain will follow the collapse, and the last guy will say, ‘I can’t make money. I have a loss and I can’t pay that $1,000 back.’ Then it comes back from D, C, B, A. Nobody can pay their debts.”

Fan believes that the CCP’s approach is to prevent companies from closing by using a variety of tools to extend debt maturities. The CCP’s assumption is that there will be no chain reaction as long as companies do not close down.

On the contrary, Fan said, this strategy only reduces the intensity of the problem, instead of solving it, “because debts have to be paid sooner or later, and someone has to pay them.”

“In the past, China’s economy was largely driven by a lot of debt issuance, including housing,” he said, but “that cycle has stopped now because the housing market is coming down, the economy is shrinking, and the overall economy of the whole society is going down.”

Fan noted that when debt problems arise, the first challenge an individual or a company faces is the inability to borrow money.

“In other words, his or her entire economic activity is limited,” Fan said. “The investments and activities he or she can do are limited, so investment will decrease.”

Secondly, consumption will decrease. With too much debt, both individuals and businesses cut back on spending, leading to a drop in consumption. When there is less consumption on all fronts, prices will fall.

“That is to say, amid a shrinking private demand, prices will definitely go down, so will inflation, and even deflation will occur. Once deflation occurs, it will be hard for the government to find any tools to deal with it.”

Fan said that price weakness in China is an inevitable phenomenon. The reason why balance-sheet recessions are difficult to clean up once they occur, and usually last for a long time is that they form a vicious cycle.

‘An Economic Nightmare’

Fan explained that the economic mechanism of society has a cyclical nature. China is now in a cycle of balance sheet recession, with prices, investment, and other economic factors falling. As the government adopts austerity measures due to its lack of money, everything is shrinking.“The shrinkage of one variable leads to that of another, and the cycle continues,” he said. “It’s an economic nightmare.”

“That is to say, the winter has come for the Chinese economy. It has come for a long time, and it’s going to feel colder and colder now because all the indicators are starting to move in that direction, and a cycle is slowly emerging. Once the cycle starts, it’s going to last quite a long time.”

Fan said the CCP’s numbers are dismal even if they have been “glorified.”

“Nobody knows the actual numbers,” he said, “but from all indications, it looks very bad. I think one important expectation is that these phenomena will not change in the short term.”

“The balance sheet recession is a particular recession,” he said. “It’s a very troublesome one, and it’s a very large one.”

“The volume of the CCP’s local debts and real estate bubbles [is] very large ... so large that it cannot be absorbed in a short period of time.”

Friends Read Free