Willem Middelkoop was a journalist until 2008, but he always had a good feel for financial markets.

Back in the 1990s for example, he bought as many as eight properties in Amsterdam with no money down, capitalizing on falling interest rates as well as a booming expat rental market.

Later he became interested in gold and the monetary system, correctly predicting the financial crisis of 2008 in many of his more than 5,000 appearances on Dutch television.

In the same year, he founded the Commodity Discovery Fund for high net worth clients. The fund specializes in gold and silver mining companies.

After writing “The Big Reset“ in 2013, he became intimately familiar with China and its quest to dominate the global gold market.

A Chinese language version was published and he launched the book at the Chinese International Monetary Institute, a leading monetary think tank.

The Epoch Times spoke to Middelkoop about China’s plan to accumulate gold and store it with the people, as well as their end-game for the reform of the financial system.

Epoch Times: How does China view gold?

Willem Middelkoop: The most important thing to understand about China’s gold strategy is that they see gold as a hedge against the financial system and the reserve holdings they have right now.

They still have $3.2 trillion in reserves and they understand the current dollar system is in its endgame. And they have been very vocal in their wish to hedge their dollar positions with gold.

Most of these statements never made it into the Western Hemisphere, but if you look at all the articles in China, they say they want to achieve “the highest gold reserve in the shortest possible time.”

They had quite a bit of gold in the 1920s and 1930s but most was taken away by the Japanese, after the invasion a few years before World War II.

After the war, the Kuomintang fled to Taiwan with the rest and China’s vaults were empty until the 1990s. They have a very strong wish to grow their gold reserves now.

Epoch Times: How much do you think they have now?

Mr. Middelkoop: If you want to know how much gold the Chinese have accumulated over the last 15 years, it’s not enough to look at the official gold holdings.

The central banks gold holdings are low compared to total Chinese holdings. The official reserves are shy of 1,800 tons, that’s less than 2 percent of all foreign exchange reserves.

It’s their wish to grow it to 10 percent of financial reserves, or $320 billion. Russia has over 10 percent, Europe and the United States have a much larger share. In the West, they generally have 50 percent of all reserves in gold.

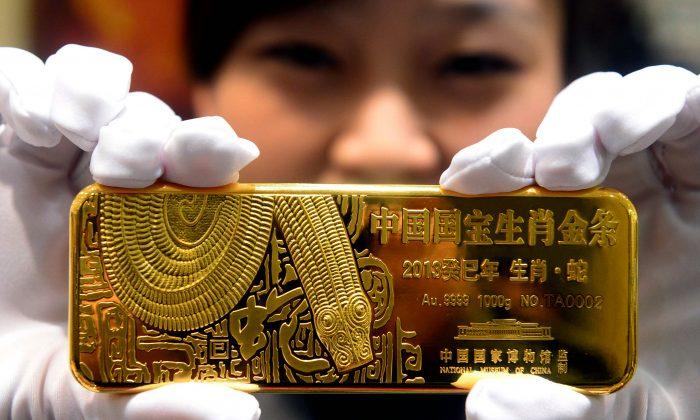

There is an official Chinese program called “storing gold with the people.” It was mentioned in an article published on the People’s Bank of China’s (PBoC) website in June last year, after they updated their official reserves.

If you look at the total gold holdings in China, the physical gold holdings are well over 10,000 tons. These reserves are stored with commercial banks, with companies, and ordinary Chinese.

At least half of it is owned by Chinese citizens. The Chinese leadership has studied financial history quite well. They know that in crisis situations, the central government can confiscate gold and hand out paper money in return. Especially in a centrally controlled country like China.

The Koreans did the same during the Asian crisis, the United States did the same in 1933 when President Roosevelt forced all Americans to hand over their gold holdings. Americans citizens weren’t allowed to buy or hold gold between 1933 and 1974.

It will be possible for the Chinese to confiscate gold when they need it, for example if they lose too much of their financial reserves defending the currency. Then they could call in the gold holdings of ordinary Chinese, but this is like a medicine, which you can use when the situation has become quite desperate.

Epoch Times: How did they accumulate so much gold without sending the price to $5,000?

Mr. Middelkoop: They don’t want to push gold prices up too high too fast, they don’t want to say openly that they use gold as a hedge against the dollar system.

So they have to pose that gold is only a small part of their reserves. They are very clever the way they play it. If they want to send gold to $3,000 per ounce, they could do so any week by bringing out a release they will convert 25 percent of their financial reserves to gold.

Epoch Times: What about the Shanghai Gold Exchange?

Mr. Middelkoop: They want to bring the pricing mechanism for gold and silver from Chicago where the Commodity Exchange [Comex] futures are traded now to Shanghai.

They have built a gold exchange in Shanghai where almost anybody can open an account to trade gold futures. One out of three transactions in Shanghai leads to a physical delivery, whereas on the Comex, only 1 in 300 paper transactions leads to a physical delivery.

So they are working on building an infrastructure in which the pricing mechanism of gold and silver and other commodities can be transferred from the West to the East.

If you look at the number of futures traded right now, in silver more futures are traded in China now than in the United States. The amount of gold traded in Shanghai is starting to compete with the Comex.

Epoch Times: The Chinese also bought some gold vaults in New York and London.

Mr. Middelkoop: The Chinese are all over gold and the Chinese are clearly preparing for the next phase in which gold will be more important.

They also introduced a gold investment fund with total assets of $16 billion. With this fund, they finance the exploration and development of new gold mining in the countries of the new Silk Road.

If you trade gold futures in the current financial system you need a settlement system, you need a settlement system for shares and bonds and you need a settlement system for physical gold.

So you need vaults in different parts of the world. By controlling the vaults, you can control the gold settlement system, which is the foundation for gold future trading, which is the pricing mechanism for gold.

The paper trading is the mechanism but it needs to be backed. That’s why you need the vault. If you don’t own the keys to the vault you don’t know your gold will be there. That’s the reason why they bought the JPMorgan vault in New York and the Deutsche Bank vault in London.

Epoch Times: What is China’s end game?

Mr. Middelkoop: I think they have a longer term plan in which gold plays a more prominent role.

They are planning for the next phase of the financial system where gold plays are a more dominant part of the system. I think the Chinese think gold prices will go much higher.

I think the Chinese are working on a plan, this is a theory worked out by James Rickards. He said there is a mutual understanding within the International Monetary Fund that when the United States, the European Union and China have the same gold holdings compared to the size of their economy, they could pool those holdings of around 30,000 tons to make the Special Drawing Rights reserve basket (SDR) gold-linked.

We know the Chinese have asked the Chatham House in London to write a report about the next phase of the monetary system. Gold was added to this study about the next phase for the monetary system, on request of the Chinese.

It’s clear that the Chinese wish to add gold to the International Monetary System, so we could end up using a gold-linked SDR in the future.

I think the Chinese have an agreement with the United States and the IMF that some of the Chinese gold holdings will stay in the United States, so it is stored in a vault which is owned by the Chinese. This is the former JP Morgan building, which is situated across the street, where the New York Fed building holds the largest gold reserves outside Fort Knox.

The Chinese seem to be happy to store part of their gold abroad, but then they want to own the vault.

Epoch Times: What would be the benefits?

Mr. Middelkoop: By bringing gold back into the system, you can increase trust in the monetary system to avoid hyperinflation. You could use the gold to create a golden foundation for the SDR.

If you revalue gold to let’s say $8,400, the balance sheets of all central banks would benefit greatly. Especially the balance sheet of the Treasury and the Fed, because the U.S. gold holdings are still valued at the historic cost price of $42.

If you revalue these gold holdings, the $11 billion currently present on the balance sheet, would grow $2.2 trillion. It’s a very easy way to clear up the messy balance sheets for central banks. To revalue gold is an easy solution to the mess.

Epoch Times: What about India, it has the largest total gold holdings of any country.

Mr. Middelkoop: In India we know there is a big gray or black market for gold because the import duties are quite high. China doesn’t have those import duties on gold.

India is still quite an isolated economy. There is not that much interconnectivity between India and other international markets.

China was a closed economic system as well but since the 1980s, they opened up and now they are a huge part of the international economy.

The Chinese became such large players in economic terms, so they are more important for the economic system.

Epoch Times: Do you think Chinese are using gold to funnel money out of the country?

Mr. Middelkoop: Chinese people are afraid of a few things. You have the corrupt officials who became rich by defrauding their country. The corrupt ones try to get abroad and get a second passport and a second home and many bought property in Canada, the U.S., or Australia. They already left with much of their financial holdings during the last 15 years.

But there are also many people who earn their wealth in a more or less proper way. These people are afraid of a large devaluation of the renminbi (yuan). So ordinary Chinese have a strong reason to bring some of their wealth outside China to avoid this risk.

But I think many Chinese understand if they buy gold in China with renminbi, they are also hedged against such a devaluation, so there is no need for normal Chinese to use gold and bring it out of the country when they made their money in an honest way.

You only want to bring gold out of the country when you don’t trust your government or you are put in jail because you illegally gained control of this money.

Epoch Times: Do you think the hedge funds are correct in betting on a devaluation of the yuan?

Mr. Middelkoop: The Chinese experienced hyperinflation in the late 1940s, so as recently as 70 years ago there was hyperinflation. Actually the Chinese Communist Party could only gain control at that time because of the monetary unrest. Monetary unrest is part of the reason the CCP controls the country.

So the Chinese leadership understands it should avoid a collapse of trust in this paper currency system at all times. That’s one of the only ways the Communist Party can lose power.

That’s why they are so scared about big moves in financial markets. They understand very well they have to control financial markets and currency markets and that’s why gold is so important to them. It’s all about staying in power.