News Analysis

When it comes to supply chains, all roads lead to China, even if the products are “made” elsewhere.

A laptop sold in the United States bearing a “Made in China” sticker is assembled in China, and many of the components are also sourced from China. That’s the easy part of tracing global supply chains, as most consumers know that the large components of many everyday products come from or are assembled in China. The part that many people don’t know, and the reason China is able to dominate global supply chains so thoroughly, is that the small things—the metals and elements that are crucial to making electronics work—are also dependent on China.

The Chinese Communist Party’s (CCP) 11th and 12th Five-Year Plans encouraged Chinese companies to invest overseas, while the regime pledged financing and support from Chinese state-owned banks. One of the goals stressed in the 12th Five-Year Plan (2011–2015) was to strengthen China’s position in metals.

The 13th Five-Year Plan, which spanned from 2016 to 2020, was dubbed a “decisive battle period” by the CCP, which sought to control the global nonferrous metal industry. This strategy is coupled with “Made in China 2025,” which seeks to dramatically expand China’s strategic industries and national defense, as well as science and technology. To this end, an action plan for China’s metals industry to achieve world power status was announced in October 2016 by the Ministry of Industry and Information Technology.

The CCP’s Five-Year Plans, Made in China 2025, as well as achieving world status in metals, all included directives for state-owned enterprises—funded by state-owned banks—to purchase and control mines in resource-rich countries around the globe.

To further ensure the country’s domination of mineral markets, Beijing imposed export restrictions on those elements that are produced in China. These restrictions have been the subject of World Trade Organization grievances that were filed by the United States and the European Union, as well as Japan and Mexico, citing unfair competition.

Several laptop brands advertise themselves as “not made in China,” although this is a bit of a mislabel because even these laptops are dependent on inputs from China. The typical laptop contains many or all of the following elements that originate from countries spread out across the world, but that are controlled by the Chinese regime: graphite, cobalt, lithium, chromium, vanadium, magnesium, antimony, and copper.

China alone supplies or controls half of the raw materials used across the world. Graphite used in rechargeable batteries is found in China, Mexico, Canada, Brazil, and Madagascar, but 69 percent of it comes from China. Cobalt originates in the Democratic Republic of Congo (DRC), where Beijing controls 35 mining companies. China controls 86 percent of the global supply of magnesium, although this element can be found in the United States, Israel, Brazil, Russia, Kazakhstan, and Turkey.

Ninety percent of the world’s lithium comes from Chile, Argentina, and Australia. Through investment in local companies, China now controls 59 percent of the global supply. And it isn’t just developing countries that are giving up their resources in exchange for Chinese cash. In Australia, China now controls 91 percent of all lithium mining, as well as 75 percent of the country’s reserves.

Two of the primary sources of vanadium are Kazakhstan and South Africa, both of which are members of China’s Belt and Road Initiative. In Kazakhstan, the China Development Bank is heavily funding the mining sector, while in South Africa, Beijing is now planning investments in vanadium mines.

Chinese companies also bought significant stakes in the largest copper mines in the DRC. In total, China owns 30 overseas copper projects in the operating stage, and an additional 38 in the exploration stage.

Zimbabwe has the world’s second-largest chromium reserve, accounting for about 12 percent of the global total. China is the world’s largest consumer of chrome and chromium, and secures its supplies by investing in extraction in countries such as Cuba and Zimbabwe. Over the past five years, China has invested billions in Zimbabwe’s metals sector, and is a major owner in one of the country’s largest chrome-mining companies, Zimbabwe Mining and Alloy Smelting Co. (ZIMASCO).

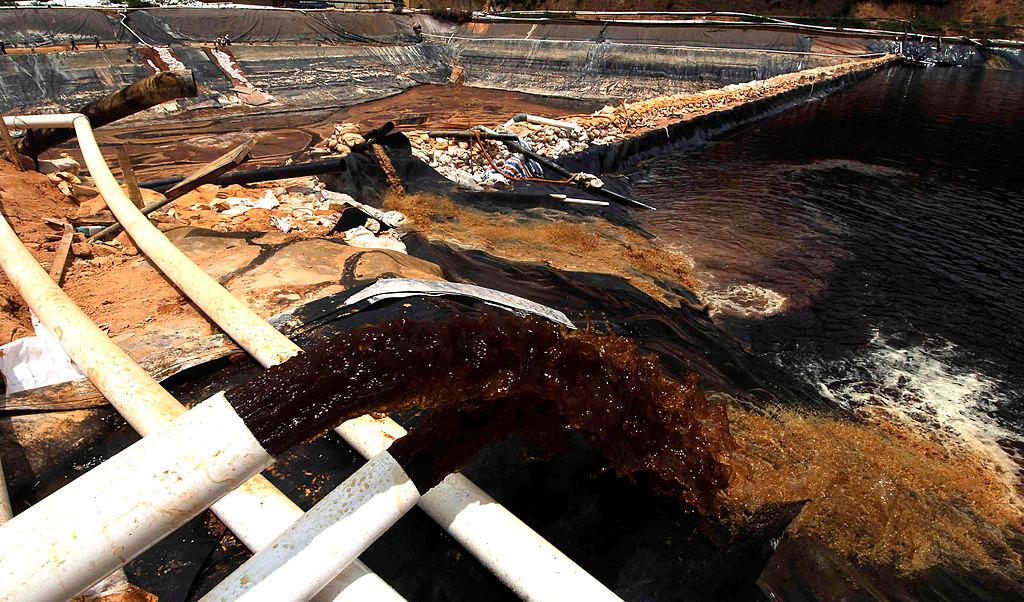

Locals describe the China–Zimbabwe relationship as exchanging mining equipment and technology for ore. This is a pattern and a strategy that China has used in resource-rich countries across the globe. Namely, that China provides construction and technological services to the local mines. In exchange, the mines agree to sell a percentage of their output to Chinese companies at an agreed-upon price. Other tools used by the CCP include mergers and acquisitions, whereby Chinese companies, many of them state-owned and funded by state-owned financial institutions, purchase a controlling interest in local mining companies.

A traditional leader in Mashonaland Central, a province in Zimbabwe, accused China of looting the country’s mineral resources. Local miners have complained that the Chinese regime exploits workers. In one incident, a Chinese manager of a mining company shot two Zimbabwean workers over a wage dispute in June last year.

China controls 90 percent of the world’s antimony supply and, until one year ago, owned 100 percent of the antimony processing plants. Once antimony is extracted from the ground, it must be processed into ingots in order to be used in the manufacture of other goods. Although antimony is found in Russia, Australia, and Tajikistan, nearly all of it is sent to China for processing. Last year, for the first time in 30 years, an antimony processing plant, called a roster, was built outside of China.

In addition to investing in other countries, the CCP is now scrambling to dominate the newer sector of undersea mining. Approval for seabed mining comes from the International Seabed Authority (ISA). Chinese companies have already filed 30 requests with the ISA for various undersea mining projects.

After conquering the seas, China plans to mine the moon. Last year, its Chang’e 5 lunar probe landed on the moon and brought back 2 kilograms of samples. U.S. space analysts suggest that China is building up its lunar research experience in order to support future moon-based mining projects. Former NASA Administrator Jim Bridenstine said he believes mining the moon will be possible in this century. Meanwhile, there’s evidence and speculation that the moon contains many critical materials.

The CCP hopes to have a manned moon landing by 2030 and to build a lunar research station. Bao Weimin, director of the Science and Technology Commission of the China Aerospace Science and Technology Corp. (CASC) has proposed creating an “Earth-Moon Special Economic Zone” by 2050.

At the rate China is expanding its control of laptop inputs, it’s likely that 20 years from now, not only will most or all of the inputs lead back to Chinese companies, but some will originate from under the sea or from the moon.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times.

Friends Read Free