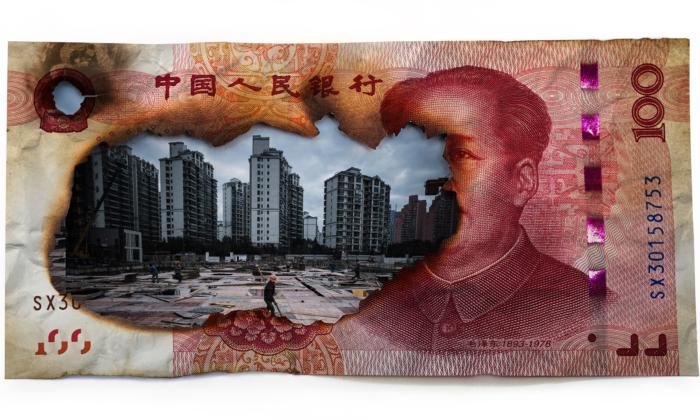

In another “first since the financial crisis” event, China’s central bank moved to cut interest rates to a record low and lowered certain bank reserve ratios.

The People’s Bank of China (PBOC) announced on its website on Friday, June 27, that it cut the one-year lending rate by 25 basis points to 4.85 percent, and decreased the deposit rate to 2 percent. It also lowered the reserve requirement ratio by half a percent for banks specializing in loans to farms and small businesses.

It was the first time the central bank cut both rates on the same day since late 2008.

The decision came after another weekly stock market rout. It’s a sign of desperation that suggests Beijing is stumbling on the tightrope of having to diffuse a stock market bubble while stimulating real economic and job growth.

Bear Market

The week prior China’s stock market suffered another collapse, capping its steepest two-week decline since December 1996. This recent plunge followed warnings issued by BlackRock Inc., UBS AG, and Credit Suisse AG over the last two months that Chinese A-shares were in a bubble.

China’s benchmark Shanghai Composite Index plunged 7.4 percent on Friday, June 26. The total drop of 19 percent since recent highs on June 12 suggests that the index is at the cusp of a full-blown bear market, typically defined as a downturn of 20 percent or more within a two-month period.

The smaller Shenzhen index and the ChiNext index, which consists mostly of high technology and startups, fell even more drastically and fully entered bear-market territory in the week ending June 26.

Frenzied selling by margin traders added fuel to the fire. Those who bought shares by borrowing from brokerages were forced to sell their holdings to cover margin calls as share prices plummeted.

‘Market Had Gone Up Too Fast’

On the one hand, the communist regime needs to keep a growing stock market alive. It instills investor confidence, builds wealth, and serves as a distraction against the sagging real economy and other social and political issues.

But the speed which the markets rose, the massive increase in margin leverage, and a hoard of newly minted day-traders have unnerved regulators.

To rein in speculation, the China Securities Regulatory Commission (CSRC) issued curbs on how much and to whom the brokerages can give margin loans. Regulators also opened up the Shanghai market to foreign investors in Hong Kong and allowed some isolated shorting.

CSRC spokesman Zhang Xiaojun said at a press conference last Friday, June 26, that the substantial correction in the short term is due to laws governing the market itself, and he expected further volatility ahead. The tone of Zhang’s comment hinted that the Chinese stock market regulator is comfortable with the recent stock market declines.

State-run business newspapers Securities Times and China Securities Journal both ran editorials suggesting that the recent bull market may be over, and that future gains will be slow.

The relative quietness from state-controlled media Xinhua News stood in contrast with earlier large stock market declines in January and May, when Xinhua was quick to step in and announce that Chinese stocks had room to run after each losing session. A lack of response implies either a newfound tolerance for stock market losses, or that authorities are at a loss on what to do next.

Between a Rock a Hard Place

The regime offered conflicting messages during the last few weeks, seemingly unsure whether it should withdraw from or inject liquidity into the banking system. Two weeks prior, the PBOC declined to roll over around 300 billion yuan ($49 billion) in short-term loans it issued to banks, according to banking sector executives who spoke with the Wall Street Journal. Its intention was to prevent banks from lending to brokerage firms who facilitated in the recent ramp up in margin debt.

But facing last week’s stock market declines, the central bank appeared to backtrack and rolled over 130 billion yuan in short-term funding to lenders. It also doubled the maturity on those loans while decreasing their interest rate.

Beijing’s dilemma arises from having to push forward contradictory policy decisions.

A major reason for the central bank’s moves on Saturday, June 27, was to decrease borrowing costs for Chinese businesses and local governments burdened by high debt loads. By lowering the benchmark rate and cutting the banks’ reserve ratios, the PBOC hopes Chinese banks would restructure local government debt and lend to small and medium-sized businesses. These actions can facilitate job growth and stimulate real economic expansion.

But the fear is that all of this easy money is fueling the stock market bubble.

“Recent monetary easing has shown little effect on stabilizing growth. There are concerns that money is flowing into the stock market instead of the real economy,” a senior economist with a well-connected Chinese think-tank told Reuters on June 16.

Despite these efforts, cost of borrowing remains high for Chinese companies already squeezed by a manufacturing downturn, property value decline, and high debt load.

With China due to release second-quarter GDP data on July 15, the central bank might be running out of options—and time.

Friends Read Free