While pragmatic on the surface, some say the move indicates China’s push to end the U.S. dollar’s dominance, particularly in the Americas.

It’s a combination effect that supply chain and financial insiders say could have serious economic consequences for the United States.

“Countries such as Brazil and China are keen to reduce their reliance on U.S. dollars for trade and, if this trend is sustained, it could lead to a depreciation in the value of the U.S. dollar as a result of lower demand for it,” analyst Alex King told The Epoch Times.

King is the founder of Generation Money and the former vice president of finance in trade and working capital at Barclays Bank. He says “de-dollarization” is a theme of increasing relevance globally.

This is reflected in a sharp drop in foreign exchange reserves held in U.S. dollars, especially in Latin America. In recent months, Argentina, Brazil, and Bolivia have struggled with depleted U.S. dollar reserves.

And with major suppliers such as Brazil moving away from using the dollar, it could mean a price hike in commodities.

China’s Initiative

Price hikes on Brazilian imports to the United States could add up quickly. Agricultural imports alone total more than $3 billion annually, making Brazil the eighth-largest supplier of these commodities.Talk of ending dependency on the dollar for trade isn’t new, but the movement gained traction over the past year because of inflation and depleted U.S. foreign currency reserves. The push to end “dollarization” is especially prevalent among Brazil, Russia, India, China, and South Africa, which compose the trade bloc known as BRICS.

Both nations are suffering drastically depleted U.S. dollar reserves and local currency devaluation.

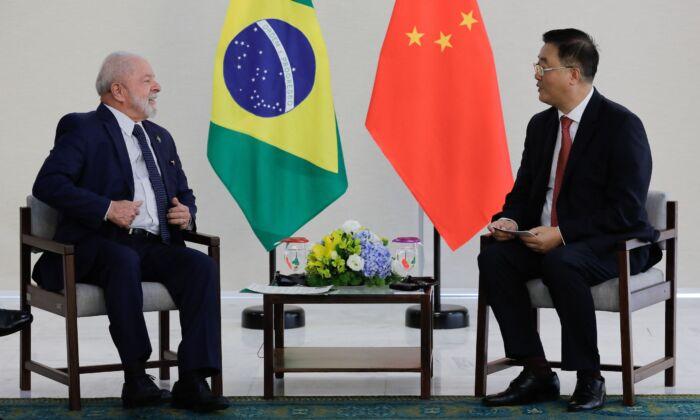

Lula’s proposal for a universal monetary system for trade was pitched as a “two birds, one stone” scenario for the economically struggling nations.

China has quietly led and supported the regional shift away from U.S. dollar transactions for eight years. In 2015, Beijing established a bank in Chile to boost yuan reserves and create a path for distribution and use throughout the region.

This year, China’s central bank signed a memorandum to establish a similar arrangement and a yuan clearing facility in Brazil to boost the currency’s viability.

Beijing has also positioned itself as the dominant trade partner and money lender in the region, giving the nation influence over the terms of its agreements. Venezuelan media outlet teleSUR claims that China has been negotiating agreements in yuan throughout Latin America since 2021.

Dollar Used Like ‘Super Weapon’

Alpeter is the founder of Izba and Capabl and has spent years in the realm of supply chain management and logistics. He said the U.S. dollar being used as the world’s reserve currency is like a “super weapon.” Though it may not be for much longer.He says a multinational desertion of the U.S. dollar would result in a sudden surplus of available currency. This could make the U.S. dollar “next to worthless and our debt undesirable.”

The economic effects of too much currency in circulation are well-documented in other countries. It fueled hyperinflation in Venezuela and Argentina for years.

Meanwhile, analysts point to the Americas as a critical proving ground for China’s aim of global dominance.

“Latin America is one of the primary areas for China’s strategy,” Miles Yu, director of the China Center, said during a Hudson Institute event.

Yu noted that Chinese Communist Party-sponsored capital investments in the region are meant to displace the influence of the IMF, the InterAmerican Development Bank, and the World Bank.

He also stressed that Latin America is the leading platform for China’s attempts to counterbalance United States’ dominance in the West.

Bottleneck Effect

The other side of the coin is China’s expanded trade and demand for Brazilian exports, which could disrupt the supply chain.“Supply chain is reactive, not proactive. With trade increasing, you’re going to see disruptions in those trade links,” Marcelo Oliveira told The Epoch Times.

Oliveira is the chief operations officer for Transship, a Chicago-based company that specializes in modern supply chain logistics.

As a Brazilian national, he says it doesn’t take much to create port congestion and logistical hang-ups in his native country.

Oliveira said the increased demand from such large economies could easily create shipping and delivery issues on the Brazilian end.

“Any paradigm shift in the supply chain, you’re going to feel it throughout ... It doesn’t take much for things to get stuck in Brazil.”

Though when it comes to China displacing the U.S. dollar in trade, Transship CEO and founder Amit Hasak thinks there is more at work than simple commerce.

“There’s a political aspect to this also,” he told The Epoch Times. ”The fact that China is going to be purchasing more products in Brazil at U.S. expense is never a good thing.”

But he also said commerce is cyclical in nature, and the United States has been in tough spots before. Hasak said the United States needs to try to match China’s offer or find other markets for commodities as needed.

“It’s basic business. It’s just commerce.”

Friends Read Free